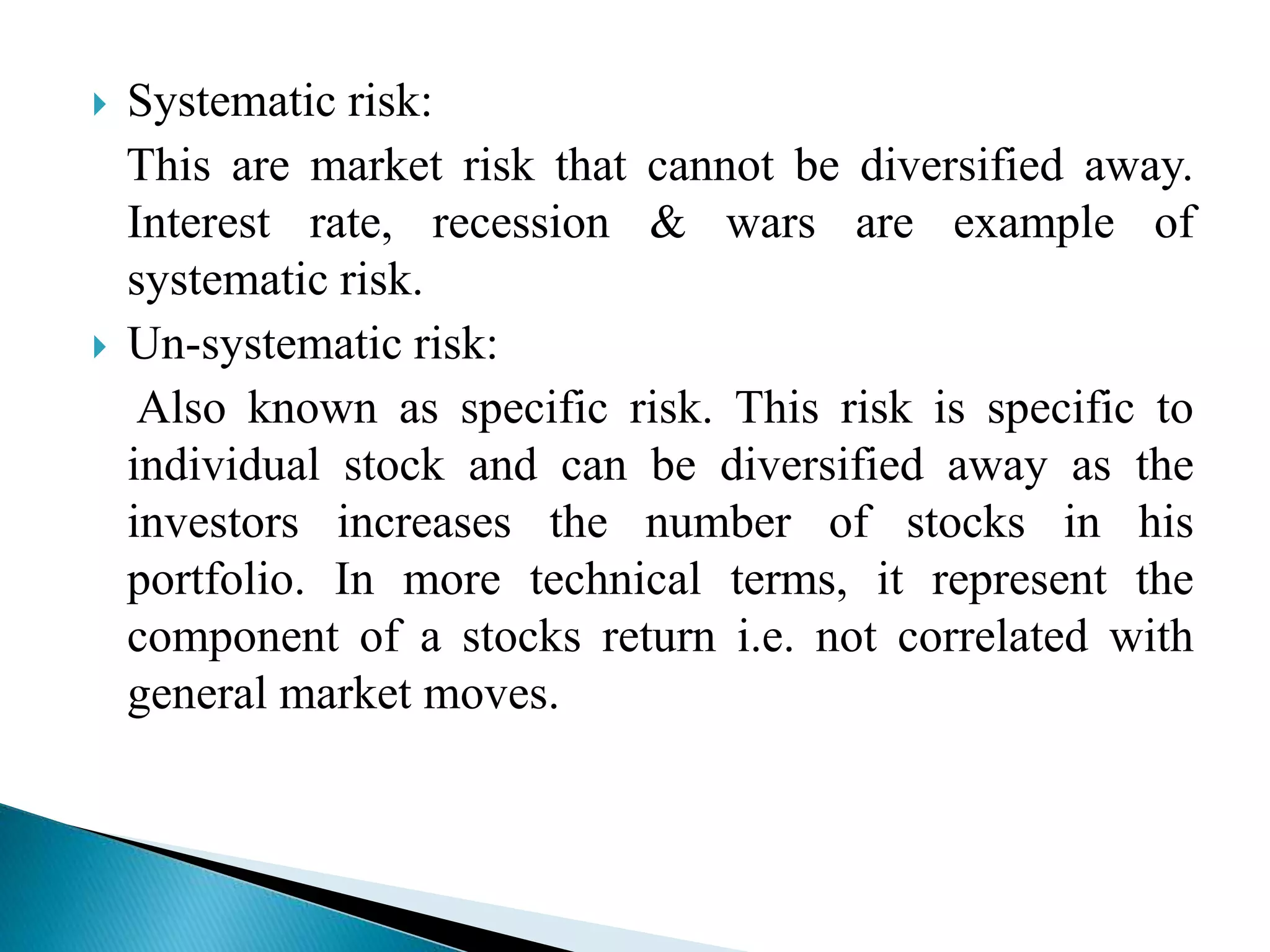

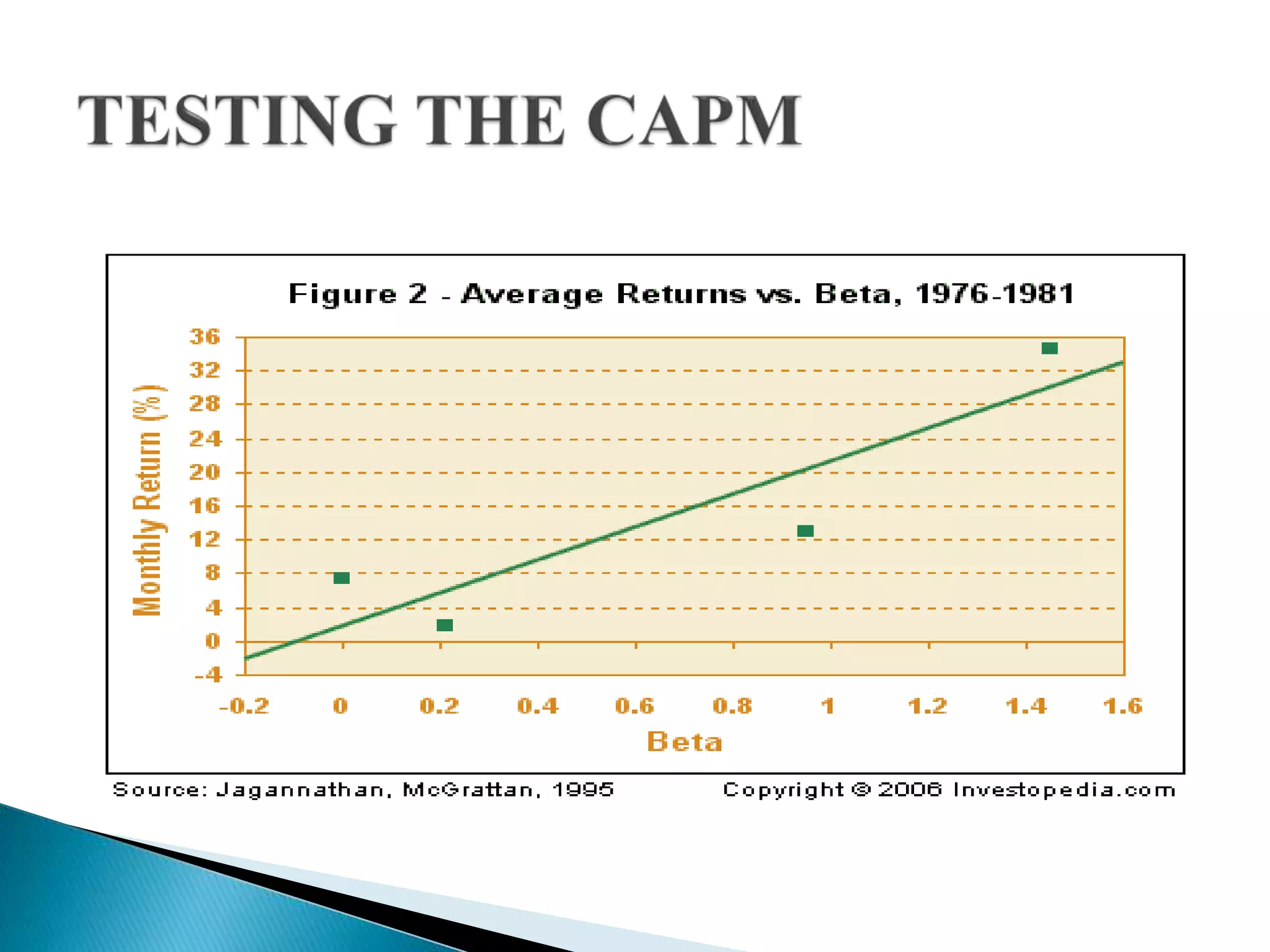

This document contains information about 6 students including their names and roll numbers. It also discusses concepts related to portfolio management such as determining strengths, weaknesses, opportunities, and threats to maximize returns given a risk appetite. Some benefits of project portfolio management are also listed such as higher returns, lower risks, and increased throughput. Key questions and steps for diversification and project management are outlined. Modern portfolio theory and the capital asset pricing model are also summarized.