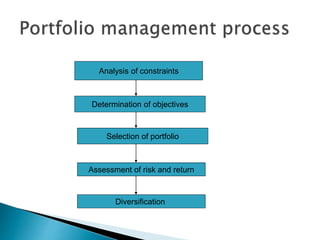

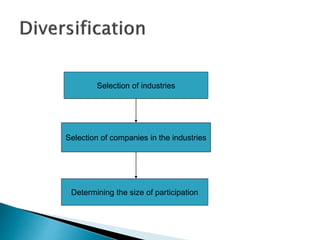

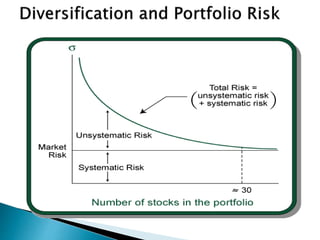

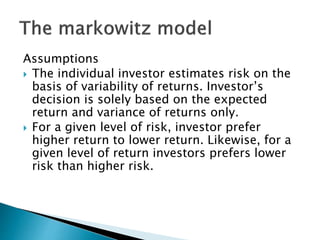

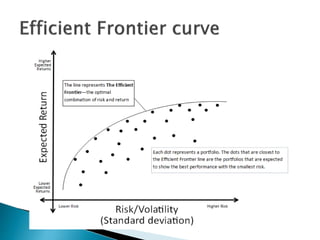

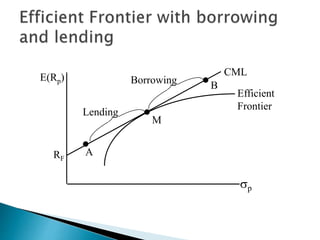

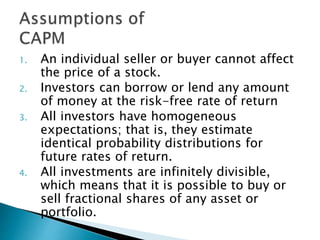

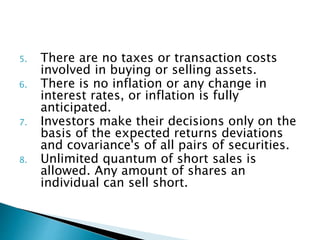

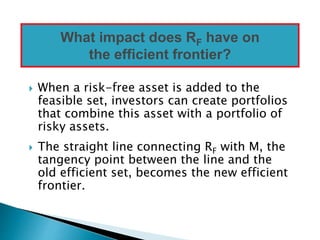

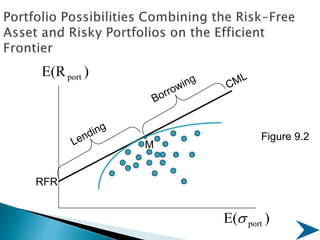

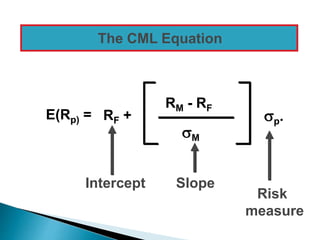

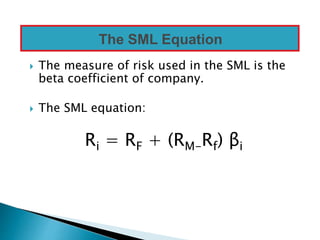

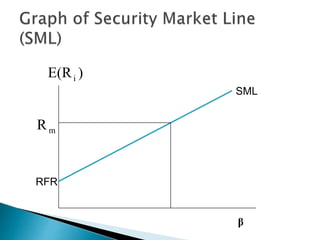

The document discusses portfolio management and the capital asset pricing model (CAPM). It covers key aspects of portfolio construction including diversification, risk and return analysis, and asset selection. It also explains key concepts of the CAPM such as the security market line (SML), capital market line (CML), beta, and the relationship between risk and expected return. The assumptions and limitations of the CAPM are also outlined.