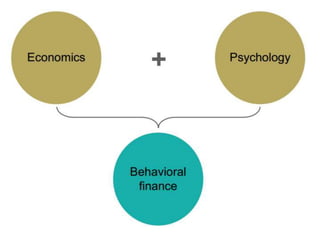

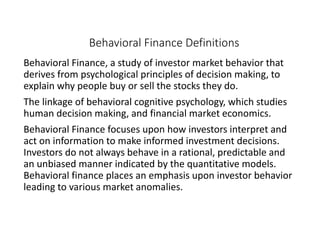

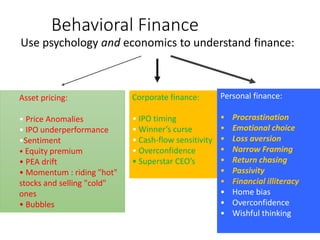

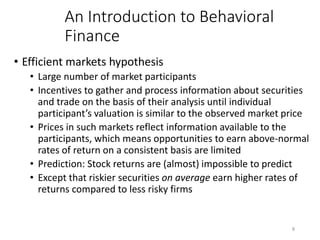

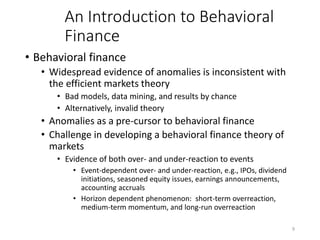

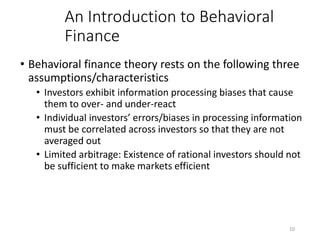

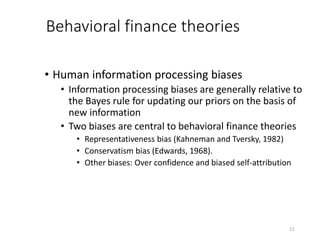

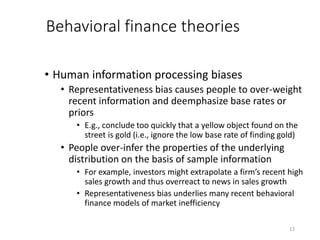

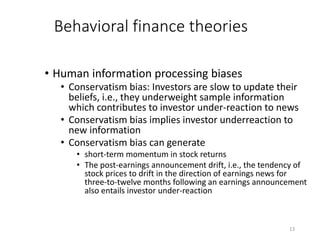

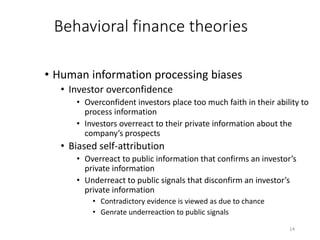

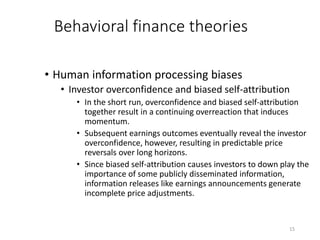

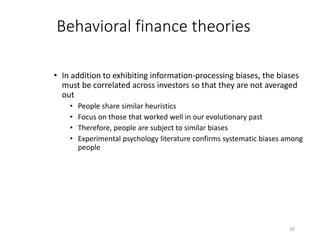

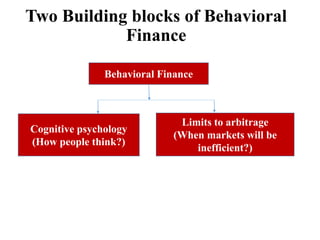

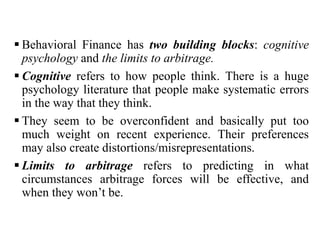

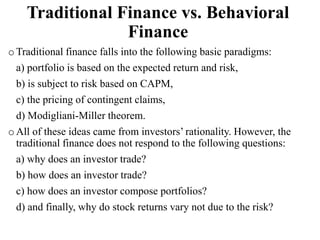

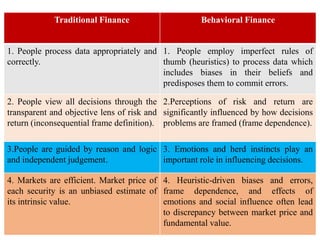

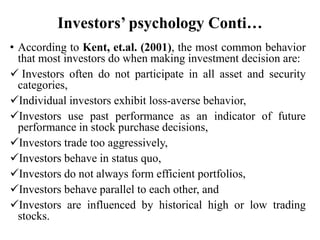

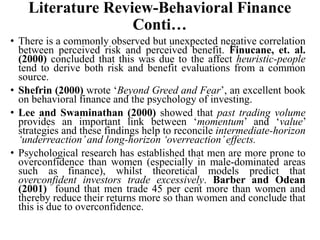

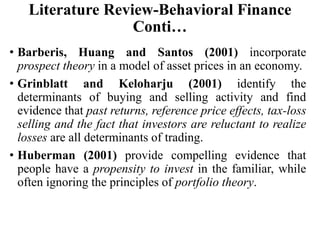

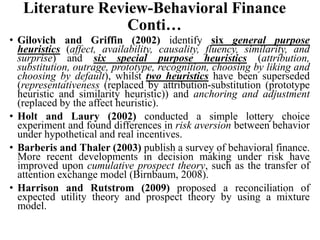

Investors do not always behave rationally as assumed by traditional finance theories. Behavioral finance incorporates insights from psychology to understand how investor behavior actually departs from rational decision making. Some key insights from behavioral finance include that investors exhibit cognitive biases like overconfidence and framing effects. They are also influenced by emotions. While traditional theories assume markets are efficient, behavioral finance suggests market inefficiencies can persist due to limits to arbitrage from factors like information and trading costs. Understanding actual investor psychology is important for behavioral finance in explaining anomalies compared to models of rational decision making.