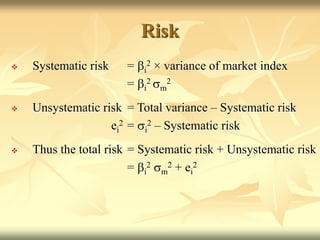

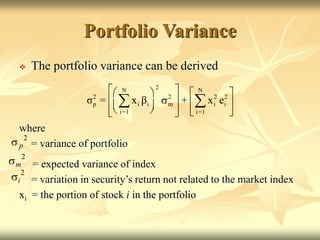

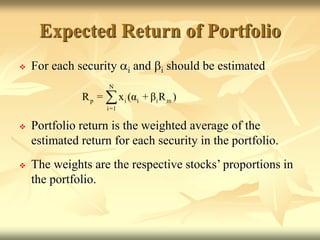

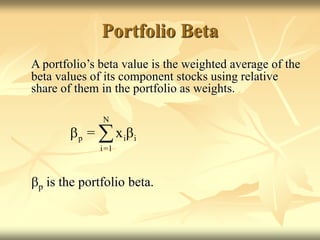

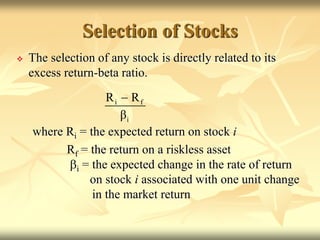

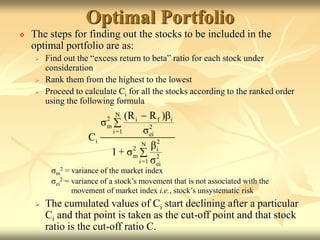

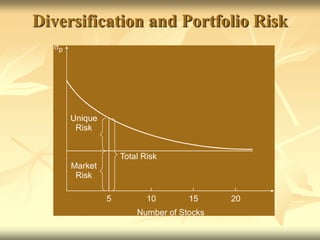

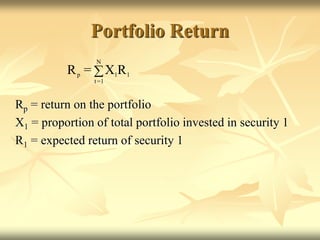

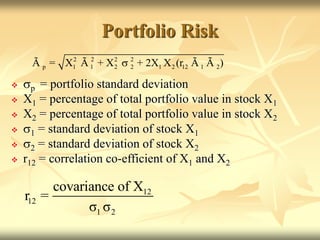

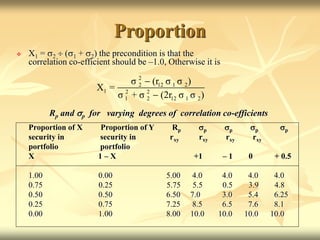

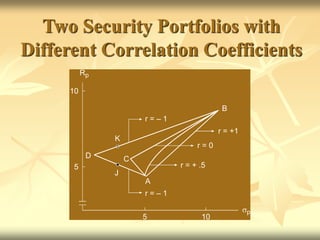

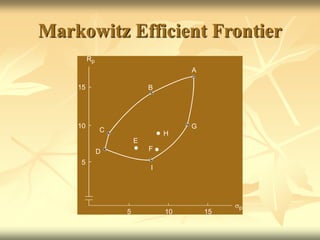

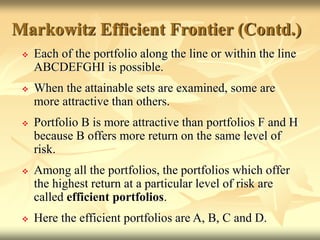

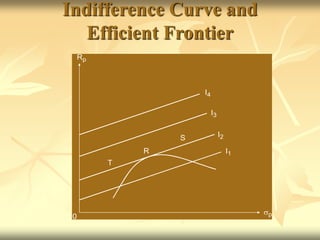

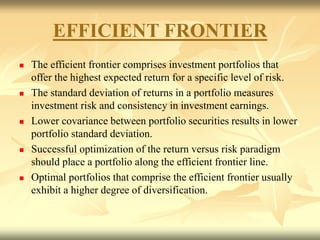

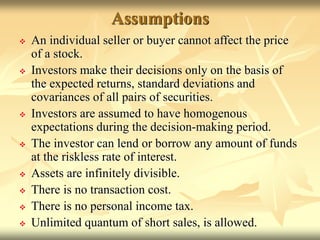

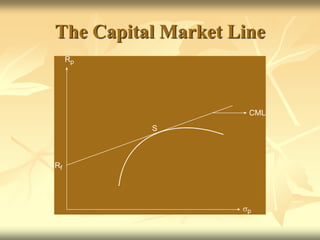

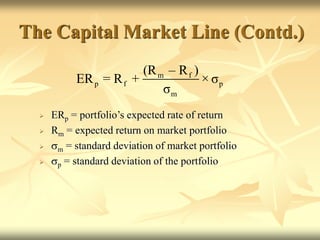

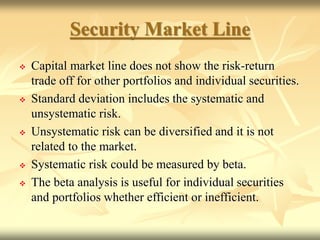

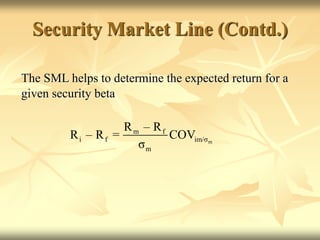

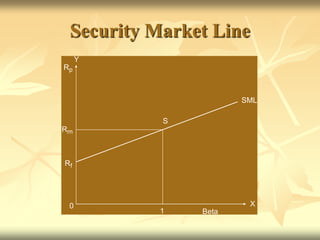

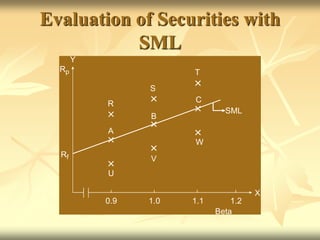

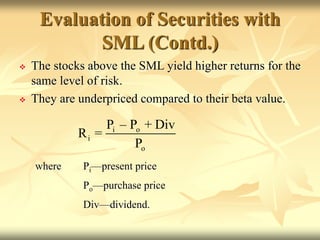

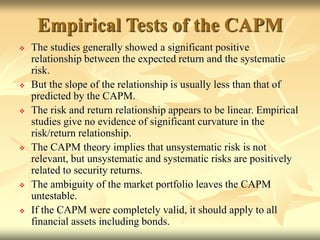

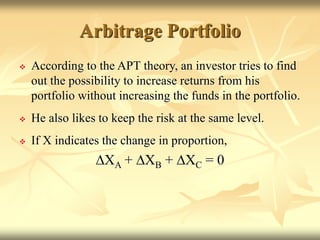

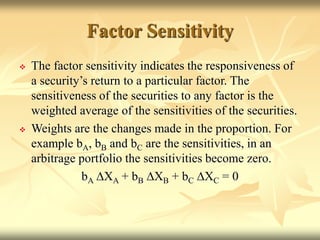

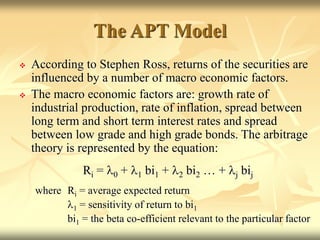

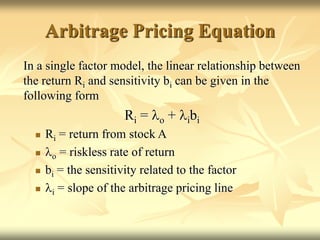

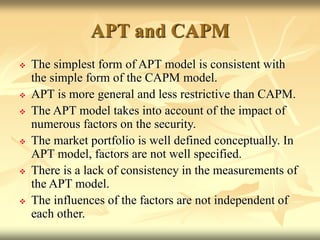

The document discusses capital asset pricing theory and arbitrage pricing theory. It summarizes the CAPM model and its assumptions, including that an asset's required rate of return is linearly related to its beta value. It also discusses the security market line and empirical tests of CAPM. The document then summarizes arbitrage pricing theory, including its assumptions and the arbitrage pricing equation. It notes that APT is more general than CAPM but lacks consistency in measurements. Finally, it summarizes the Sharpe index model and Markowitz portfolio theory, including calculations for portfolio return, risk, proportions and the efficient frontier.

![Need for Sharpe Model

In Markowitz model a number of co-variances have

to be estimated.

If a financial institution buys 150 stocks, it has to

estimate 11,175 i.e., (N2 – N)/2 correlation

co-efficients.

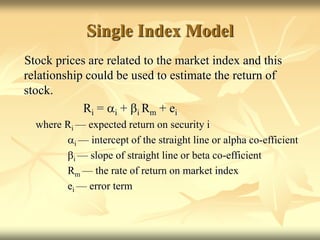

Sharpe assumed that the return of a security is

linearly related to a single index like the market

index.

It needs 3N + 2 bits of information compared to

[N(N + 3)/2] bits of information needed in the

Markowitz analysis.](https://image.slidesharecdn.com/capmcml-220623093542-e417a86e/85/CAPM-CML-ppt-25-320.jpg)