This document provides an overview of portfolio theory and several asset pricing models, including:

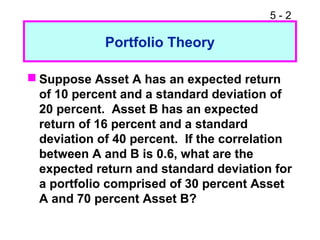

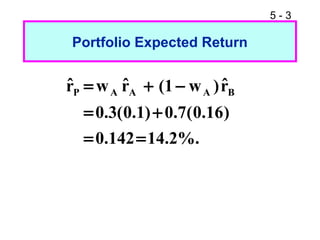

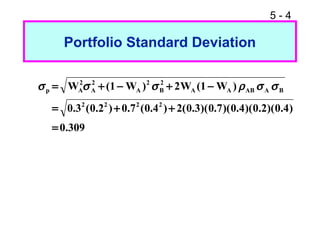

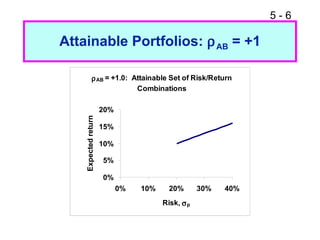

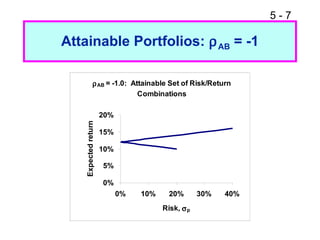

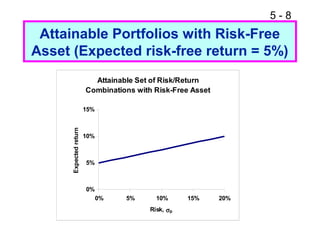

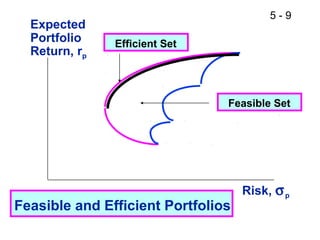

- Portfolio theory concepts such as the efficient frontier and capital market line

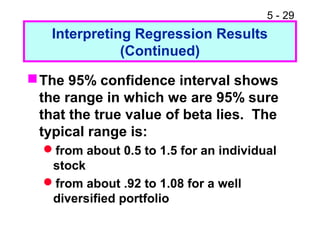

- The Capital Asset Pricing Model (CAPM) and its assumptions, including how betas are calculated

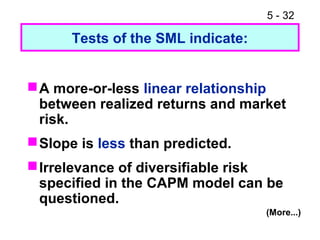

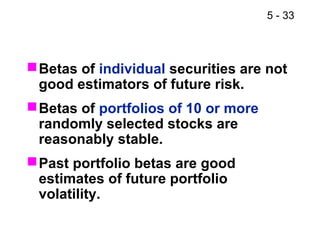

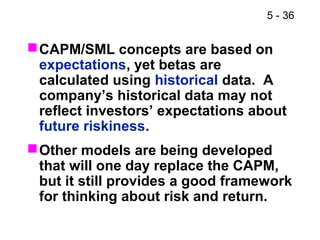

- Criticisms of the CAPM and problems testing it empirically

- The Arbitrage Pricing Theory as an alternative multi-factor model

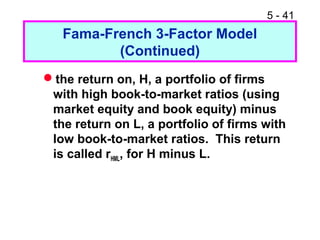

- The Fama-French three-factor model as another improvement over the single-factor CAPM