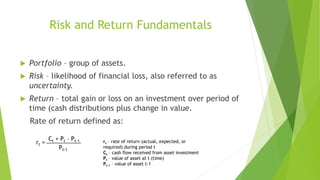

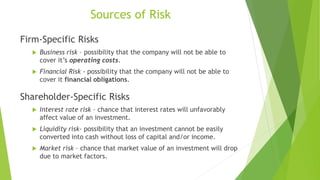

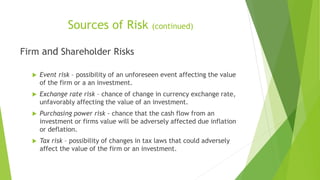

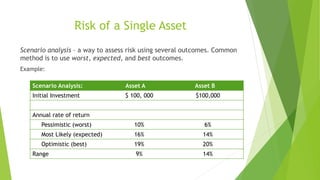

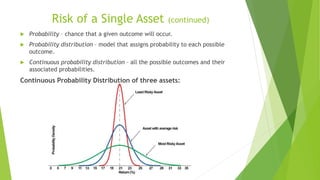

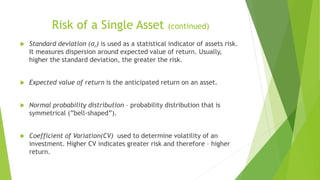

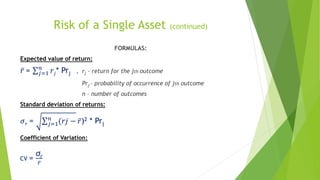

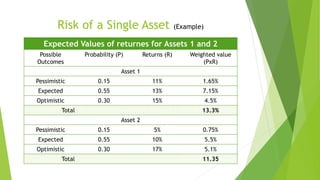

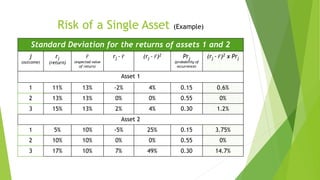

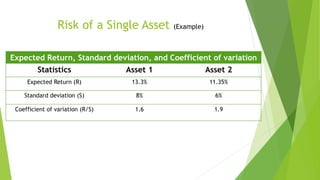

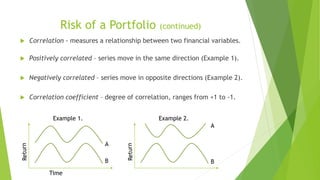

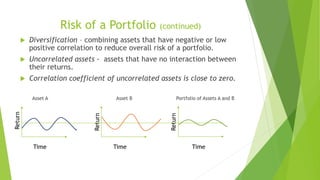

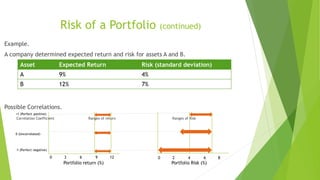

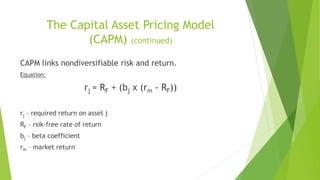

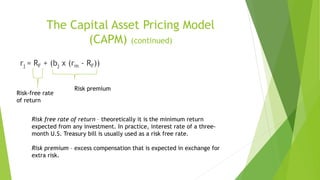

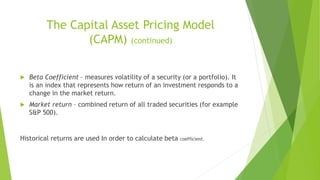

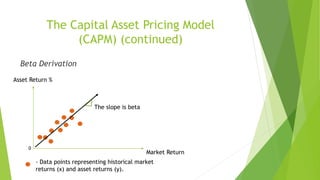

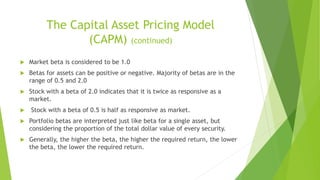

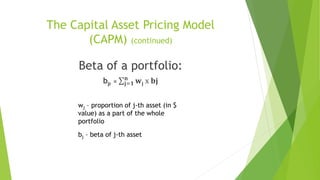

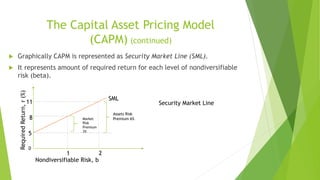

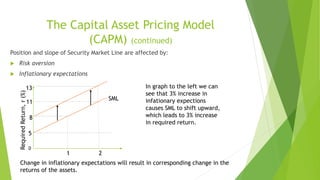

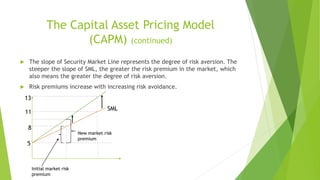

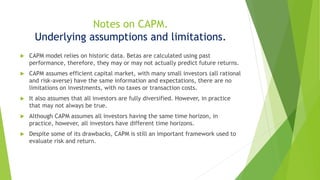

The document provides an overview of risk and return principles in managerial finance, detailing various types of risks including firm-specific and shareholder-specific risks, and introducing key concepts such as portfolio return, the Capital Asset Pricing Model (CAPM), and volatility measures. It emphasizes the importance of diversification and correlation in managing portfolio risk, as well as explaining how expected returns are impacted by risk preferences and market factors. Additionally, it highlights limitations of the CAPM model and its reliance on historical data for predicting future returns.