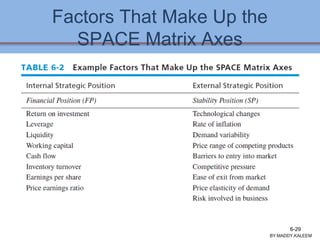

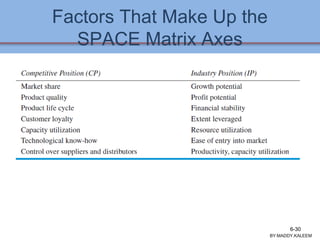

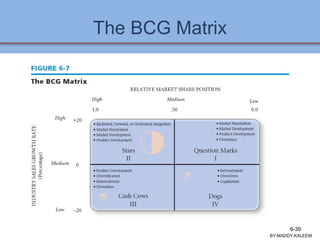

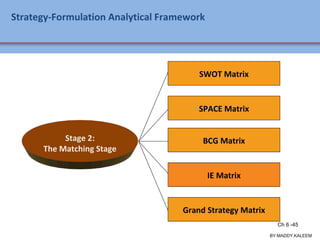

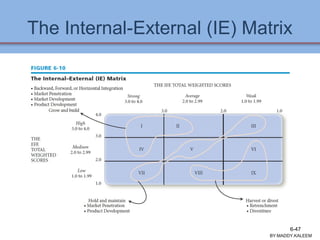

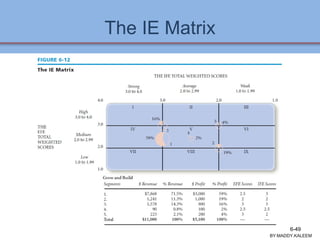

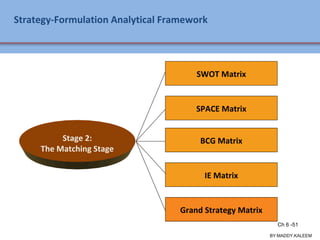

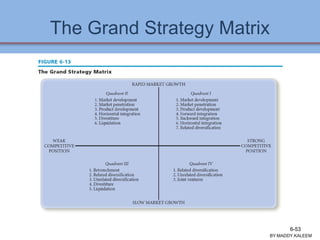

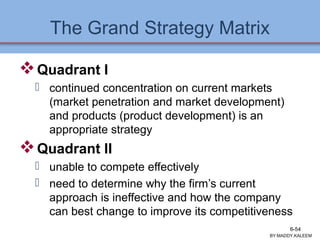

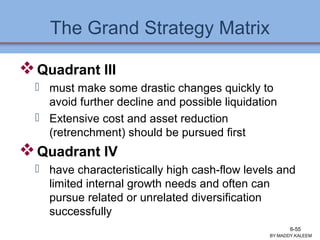

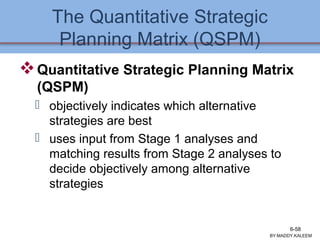

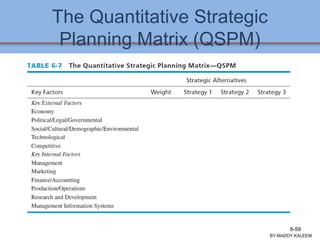

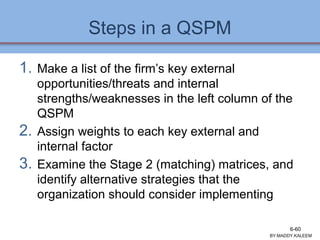

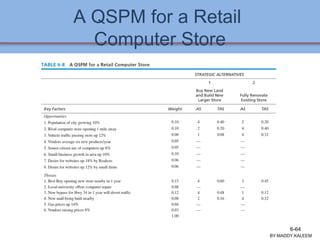

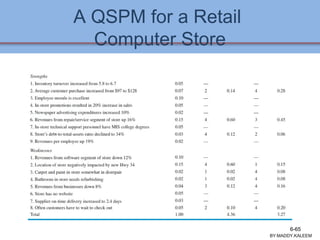

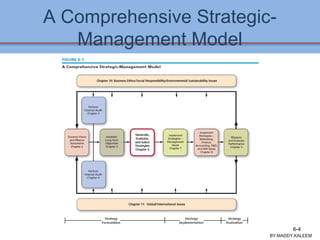

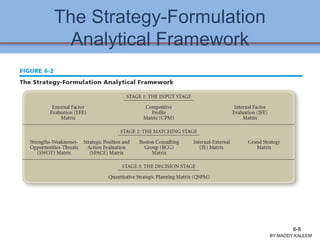

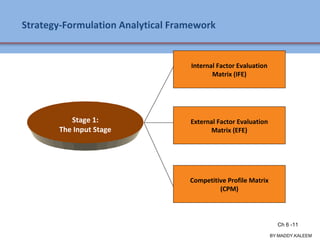

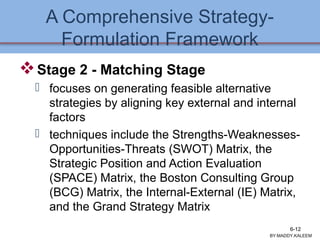

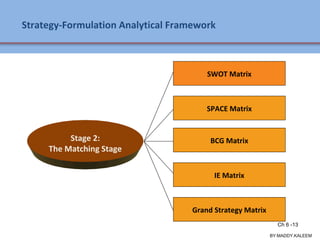

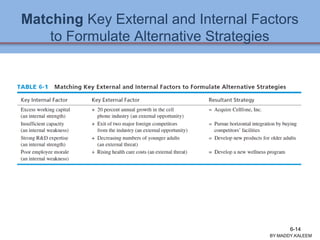

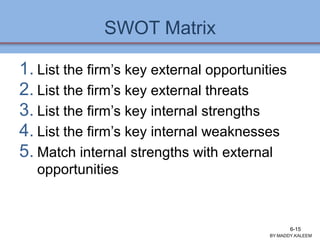

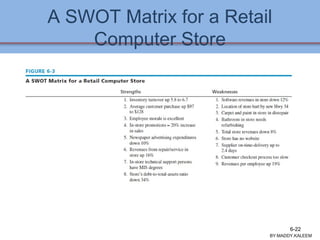

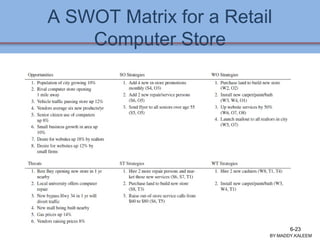

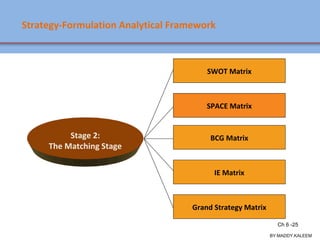

The document discusses strategic analysis and choice, providing a three-stage framework for choosing among alternative strategies. It describes various analytical tools that can be used in each stage: the input stage uses SWOT, IFE, and CPM matrices; the matching stage uses SWOT, SPACE, BCG, IE, and grand strategy matrices; and the decision stage uses the QSPM matrix. The tools help generate alternative strategies, evaluate them objectively, and select the most attractive strategies to pursue.

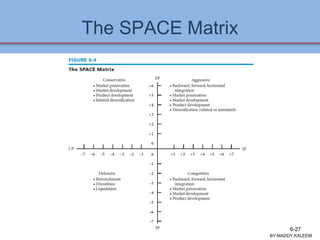

![The Strategic Position and Action

Evaluation (SPACE) Matrix

Two internal dimensions (financial

position [FP] and competitive position

[CP])

Two external dimensions (stability

position [SP] and industry position [IP])

Most important determinants of an

organization’s overall strategic position

BY:MADDY.KALEEM

6-28](https://image.slidesharecdn.com/chapter06-strategyanalysisandchoice-180718193109/85/Strategic-Management-Concepts-Cases-Chapter-06-28-320.jpg)