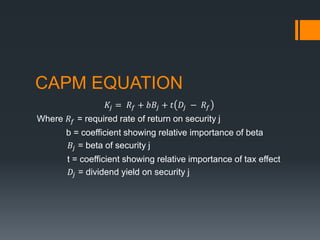

The document provides an overview of the Capital Asset Pricing Model (CAPM). It defines key terms like the capital allocation line, capital market line, security market line, beta, and expected return. The capital allocation line shows the risk-return tradeoff for efficient portfolios. The capital market line depicts the risk-return relationship for efficient portfolios available to investors. The security market line is a graphic representation of CAPM that describes the market price of risk. CAPM holds that the expected return of an asset is determined by its beta, or non-diversifiable risk. It assumes investors will hold an efficient portfolio consisting of a risk-free asset and the market portfolio.

![CAPITAL ALLOCATION LINE

Capital allocation line shows the reward to variability ratio in

terms of additional beta

Let us denote a risk-free portfolio by F, a risky portfolio by M,

and a complete portfolio formed by combining them as C.

Further w is the fraction of the overall portfolio invested in M,

and the remaining (= 1-w) in F. The expected return of

complete portfolio may be calculated as

E(𝑟𝑐) = 𝑟𝑓 + w [ E(𝑟 𝑚) − 𝑟𝑓]](https://image.slidesharecdn.com/capitalassetpricingmodelcapm-170219154918/85/Capital-asset-pricing-model-CAPM-2-320.jpg)