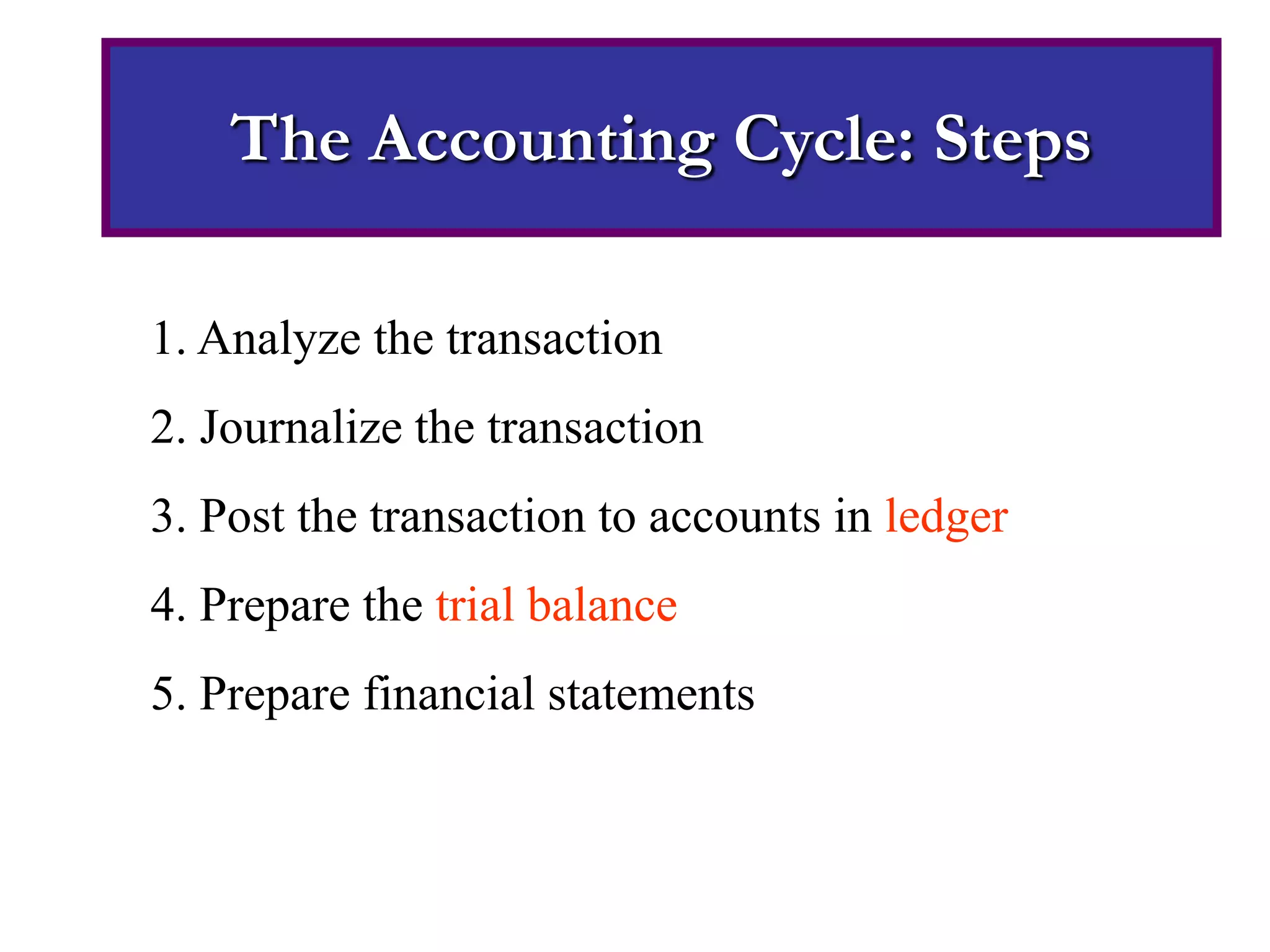

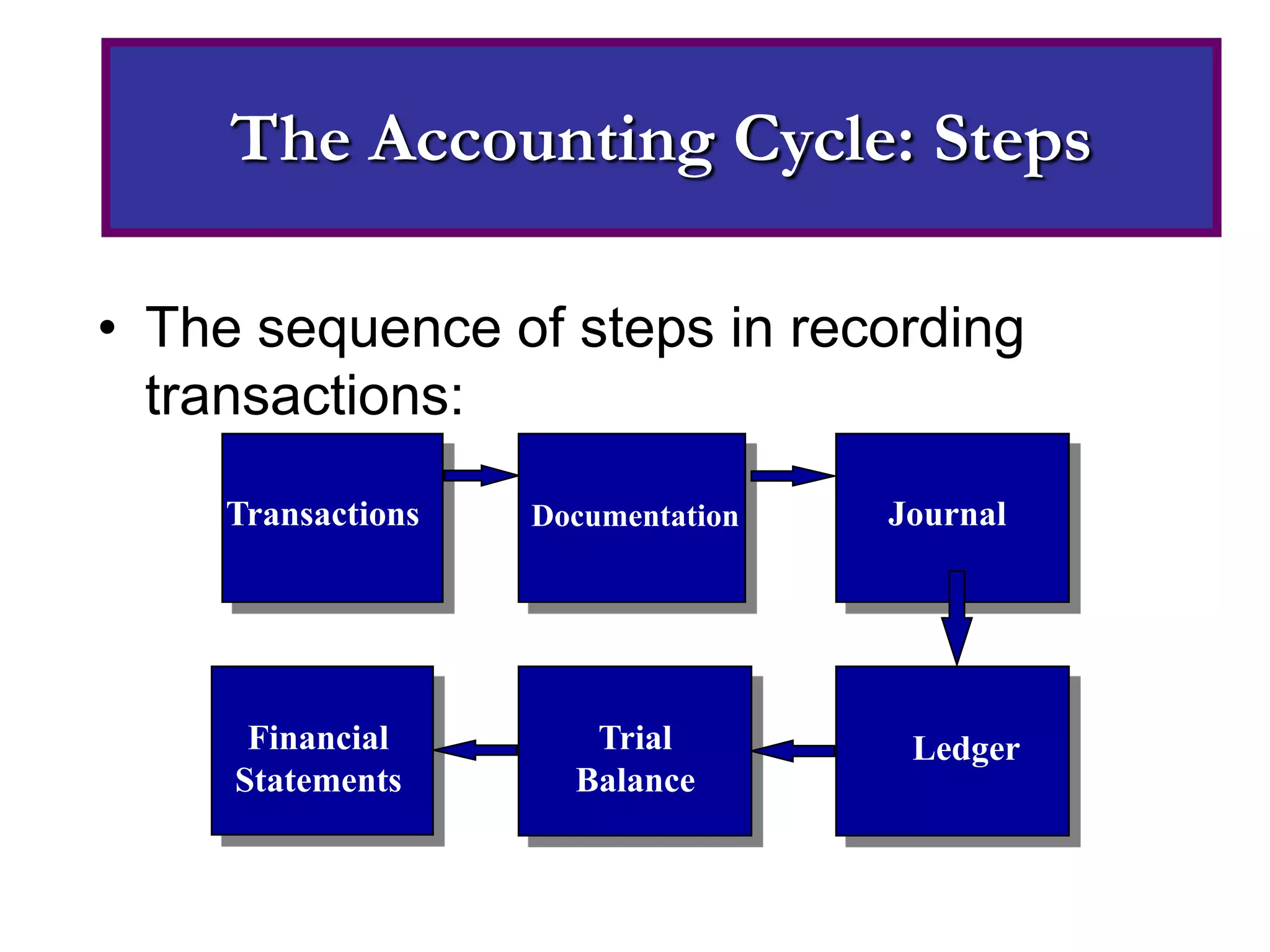

The accounting cycle refers to the complete sequence of accounting procedures that are repeated during each accounting period. It begins with recording transactions and ends with preparing financial statements. The key steps in the accounting cycle are: 1) analyzing transactions, 2) journalizing transactions, 3) posting to ledger accounts, 4) preparing a trial balance, and 5) preparing financial statements.