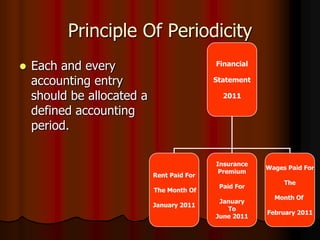

Generally Accepted Accounting Principles (GAAP) are essential rules for preparing and presenting financial statements, ensuring accuracy and comparability across companies. These principles enable long-term financial decision-making and maintain credibility with third parties like creditors and shareholders. Key principles include historical cost, prudence, full disclosure, consistency, revenue recognition, and periodicity, all contributing to transparent and reliable financial reporting.