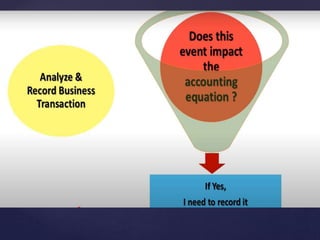

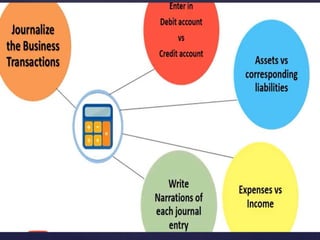

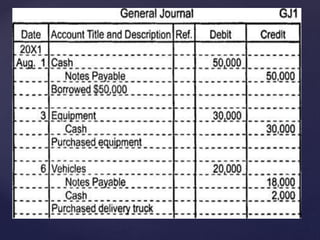

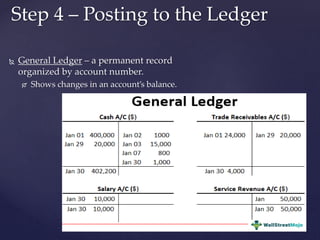

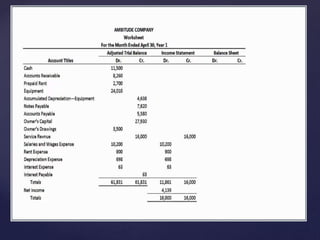

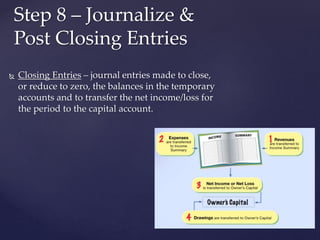

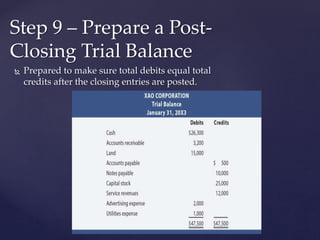

The accounting cycle is a series of nine steps that are regularly repeated to record a company's financial transactions. The steps include collecting source documents, analyzing transactions, recording transactions in a journal, posting to the general ledger, preparing a trial balance, preparing a worksheet, creating financial statements, journalizing and posting closing entries, and preparing a post-closing trial balance. The accounting cycle ensures all financial records are complete and accurate.