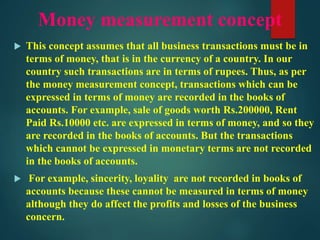

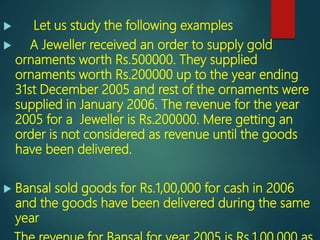

This document discusses key accounting concepts and conventions. It explains concepts like business entity, money measurement, going concern, accounting period, cost, dual aspect, matching, realization and accrual. It also covers conventions like consistency, full disclosure, materiality and conservatism. The concepts and conventions establish the fundamental assumptions and guidelines for preparing financial statements according to standard accounting principles.