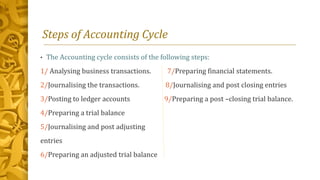

The accounting cycle consists of 9 key steps: (1) analyzing transactions, (2) journalizing transactions, (3) posting to ledger accounts, (4) preparing a trial balance, (5) journalizing and posting adjusting entries, (6) preparing an adjusted trial balance, (7) preparing financial statements, (8) journalizing and posting closing entries, and (9) preparing a post-closing trial balance. The purpose of the accounting cycle is to ensure all financial activities of a business are recorded and reported accurately through a series of processes that track money coming in and going out. Errors can occur if transactions are incorrectly recorded or posted, leading to an unbalanced trial balance that requires adjustment.