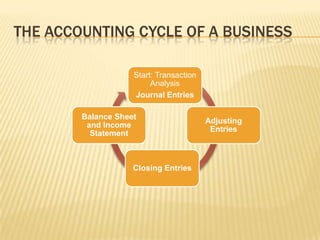

The accounting cycle involves recording business transactions in a journal throughout the month. At month-end, adjusting entries are made to properly allocate revenues and expenses to the correct period. Closing entries are then made to zero out temporary accounts and prepare the financial statements for the period, including the income statement and balance sheet. This process repeats at the start of each new accounting period.