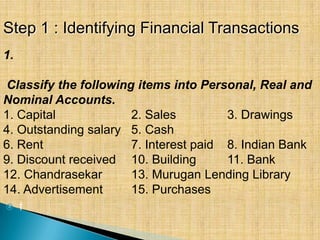

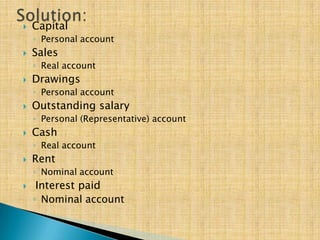

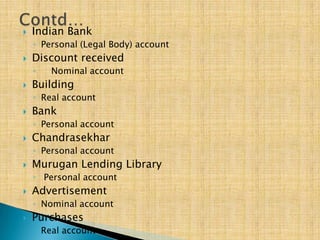

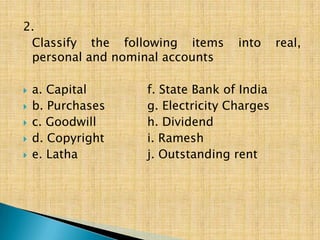

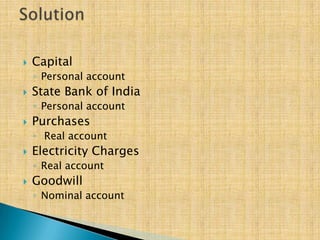

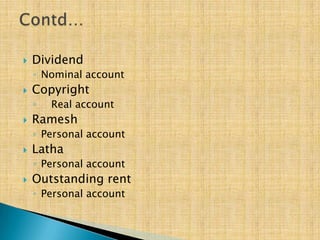

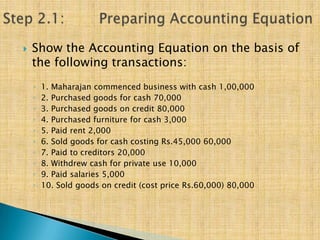

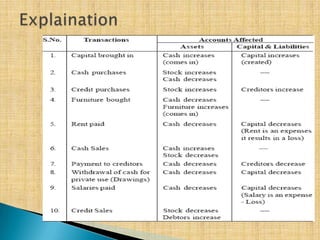

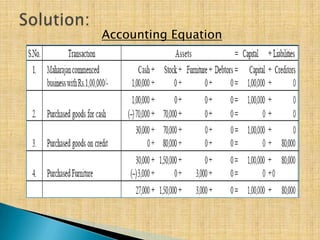

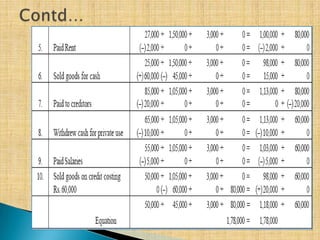

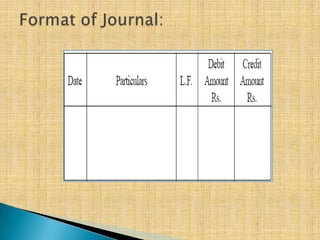

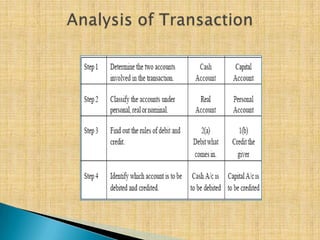

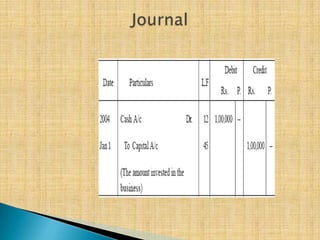

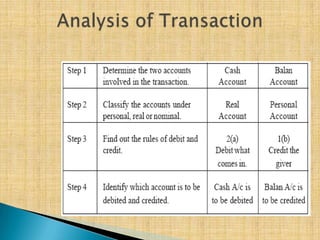

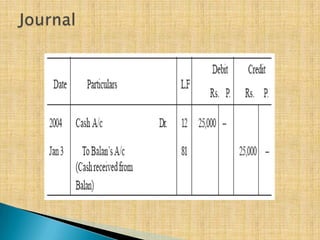

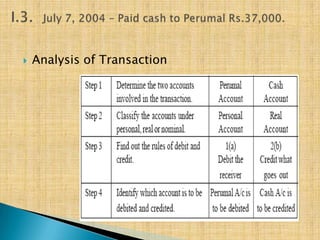

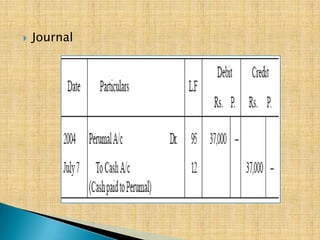

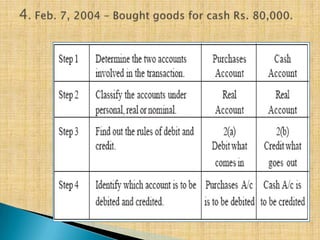

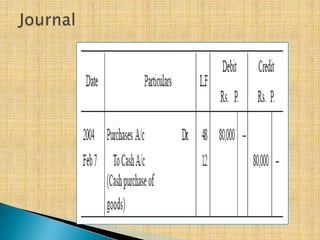

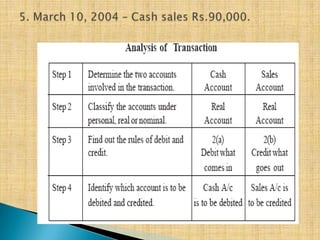

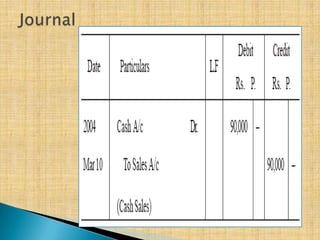

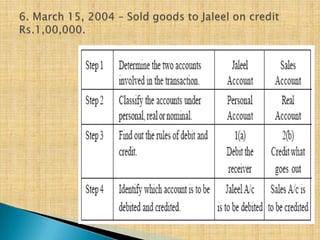

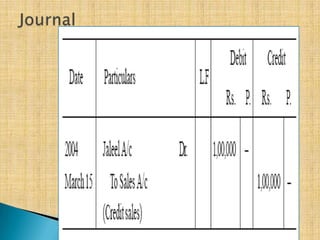

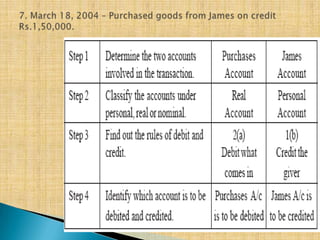

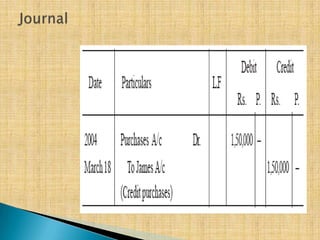

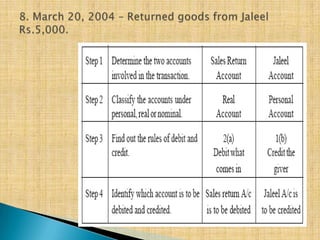

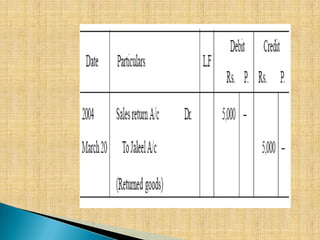

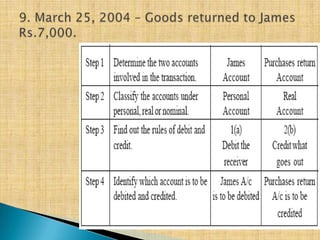

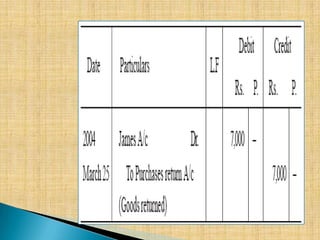

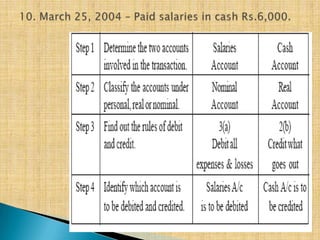

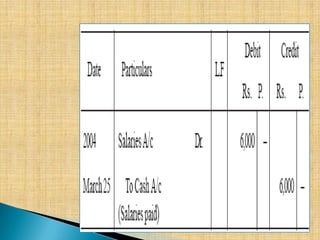

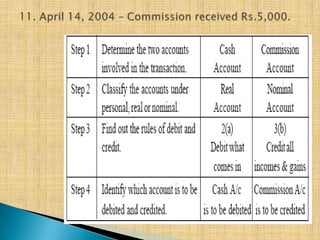

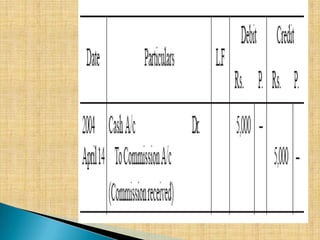

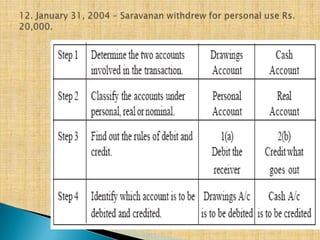

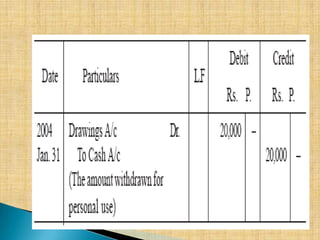

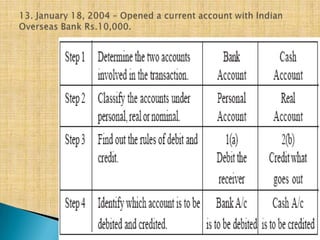

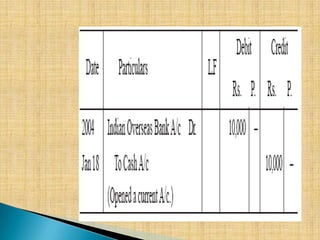

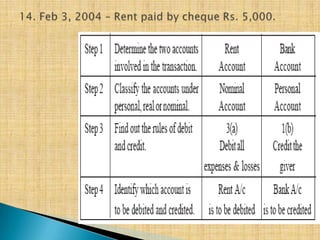

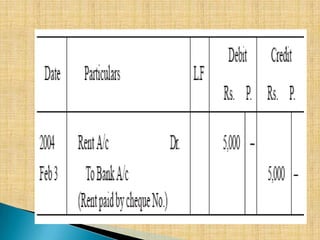

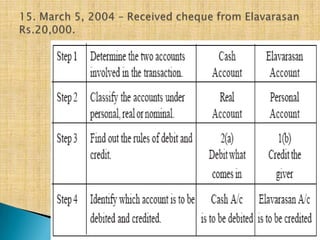

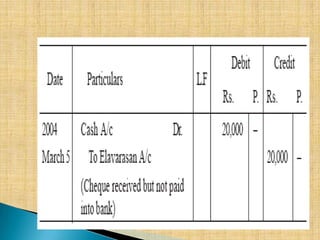

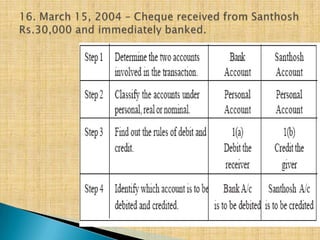

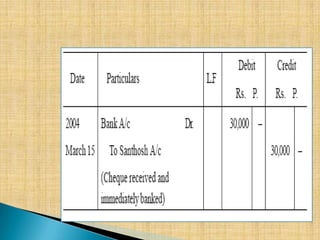

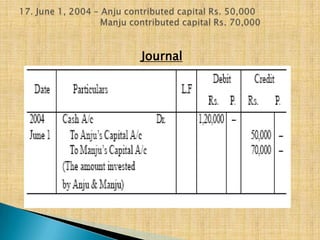

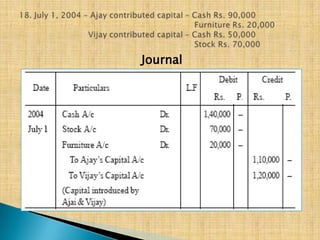

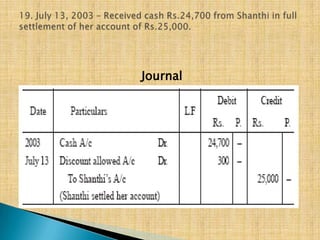

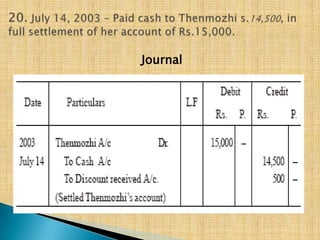

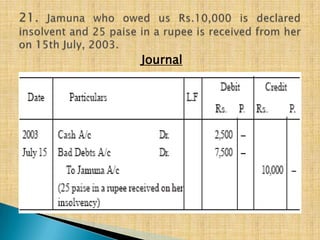

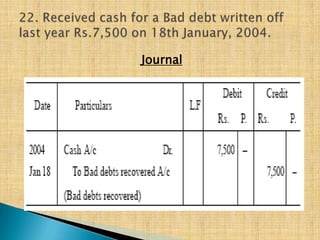

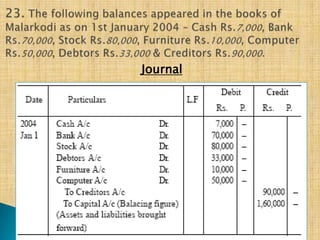

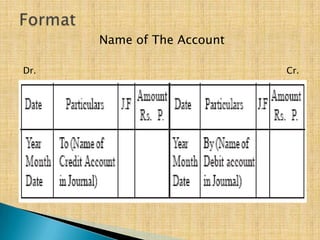

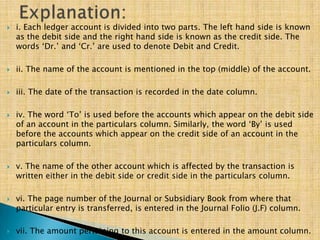

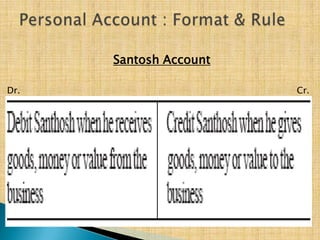

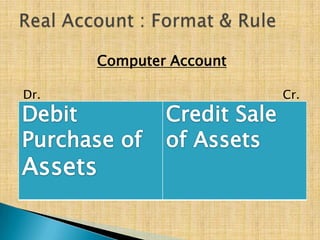

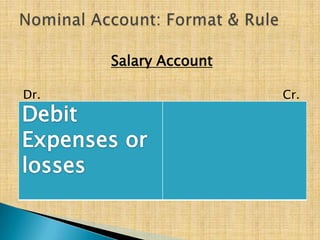

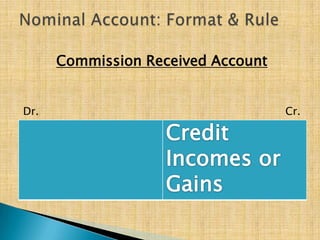

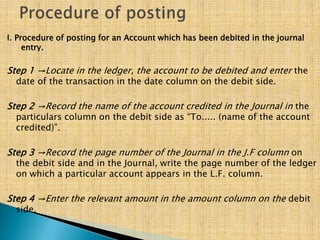

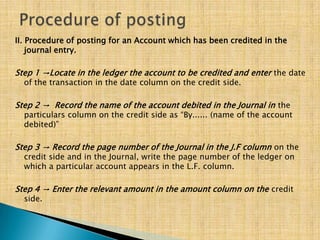

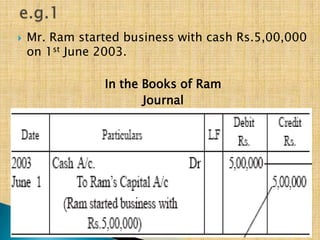

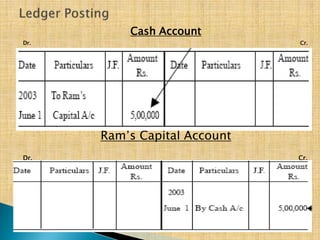

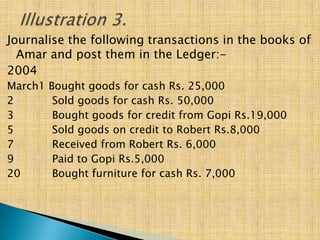

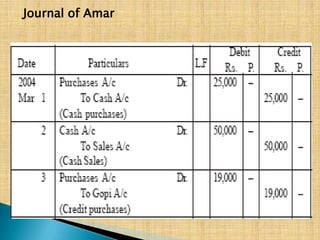

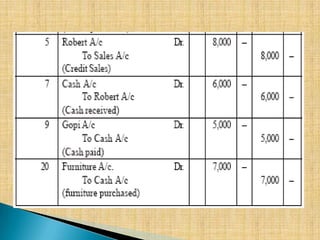

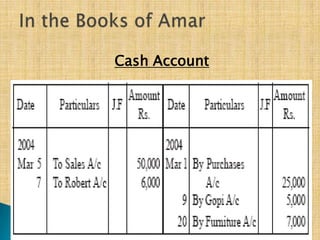

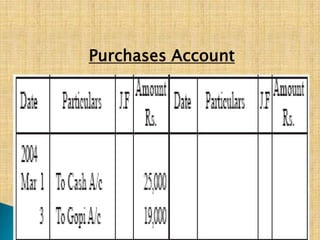

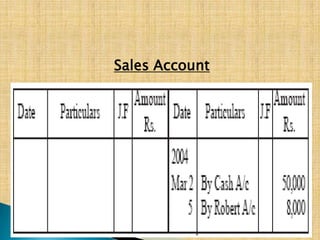

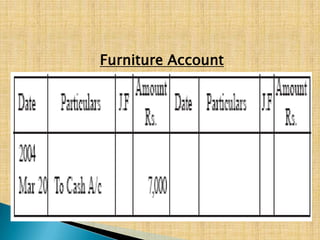

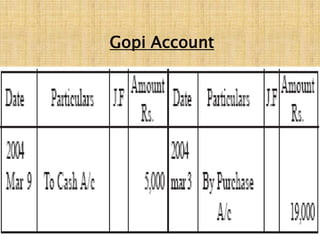

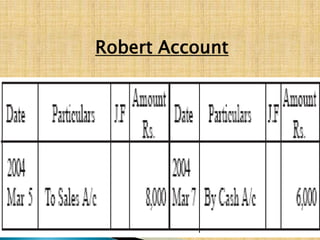

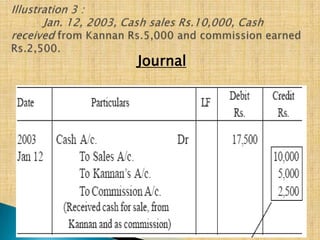

The document discusses the accounting cycle and provides examples of classifying accounts, journalizing transactions, preparing ledger accounts, and posting journal entries to the ledger. It begins by classifying various accounts as personal, real, or nominal. Examples are then provided of journalizing transactions and posting the journal entries to update the appropriate ledger accounts. The key steps in journalizing, preparing ledger accounts, and posting entries from the journal to the ledger are outlined. Compound or combined journal entries involving multiple debits and/or credits are also introduced.