The accounting cycle involves recording business transactions, preparing financial statements, and closing books at the end of each accounting period. It is based on key assumptions and principles including:

1) Transactions are recorded based on the accrual concept, which matches revenues to expenses in the period they are incurred regardless of when cash is received or paid.

2) Financial statements are prepared at the end of each period using the adjusted trial balance to provide an accurate picture of the company's financial position and performance.

3) The accounting equation (Assets = Liabilities + Equity) must always balance through double-entry bookkeeping, where every transaction has equal and offsetting debits and credits.

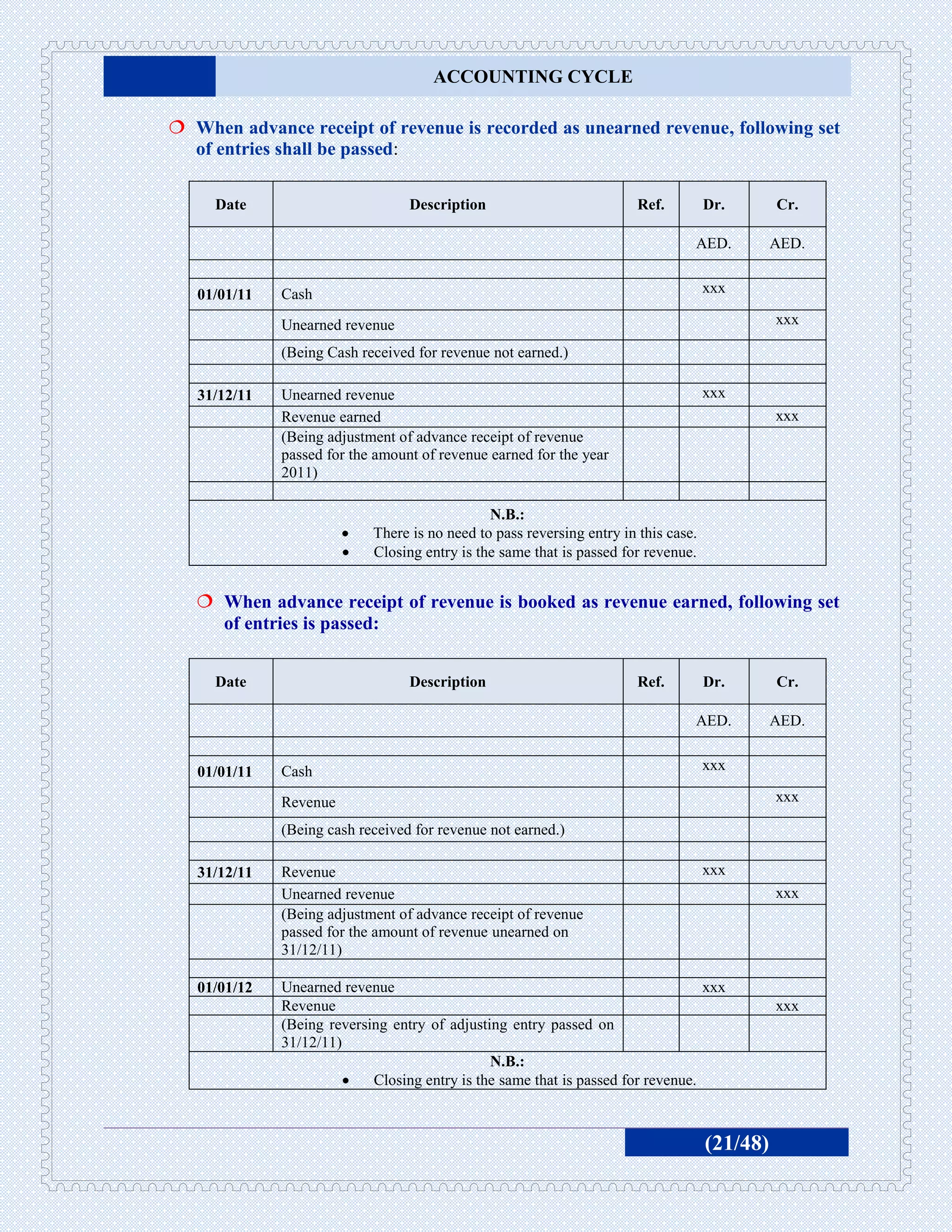

![ACCOUNTING CYCLE

Matching

For any period in which revenue is recognized, expenses incurred in obtaining that

revenue should also be recognized. For instance, sales price of merchandise is

matched with its cost on sale to third party.

Timeliness

For information generated by the accounting system to be useful for decision – making, it

must be received by the stakeholders soon after the close of the financial year. Any delay

in producing and presenting of financial statements would badly affect the decision

making capability of the company. It is because of this principle that all companies’ laws

in the world provide time frame for the production and presentation of this information.

Consistency

This principle refers to the use of the same accounting method from one reporting period

to another, so that proper evaluation could be possible over the periods of time.

Comparability

Financial reports/statements must be presented in a form that permits comparison with

other companies in the industry on equal basis. For instance, if all companies in an

industry apply IFRSs/IASs in the preparation of their financial statements, their

comparison can be made easily.

1.3 Principles of financial accounting & reporting

Disclosure

All information which would influence the assessment of the company’s health by

outsiders should be disclosed in the financial statements.

Conservatism/ Prudence

This principle can be understood from the following, ‘Record all losses when incurred

and defer all gains until they are realized’.

Separate Entity Concept

Business accounting and reporting is separate from the other personal properties and

other businesses of the owner.

Continuity/Going Concern Assumption (GCA)

The business is assumed to continue its operations for indefinite periods.

[Refer to the detail at Unit 9]

Stable Monetary Unit (SMU)

It is assumed that prices remain constant over time. Financial Statements are prepared

from historical cost rather than on current values of assets.

(8/48)](https://image.slidesharecdn.com/accountingcycle-130208083750-phpapp011-130217035216-phpapp01/75/Accounting-Cycle-9-2048.jpg)