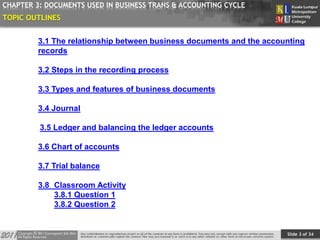

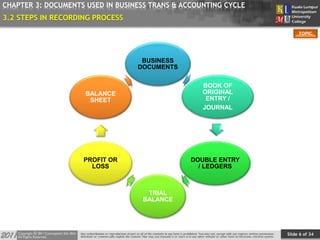

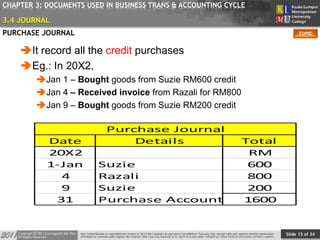

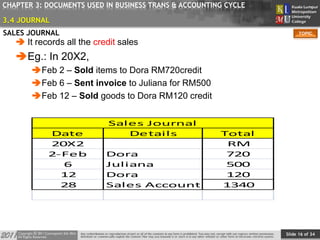

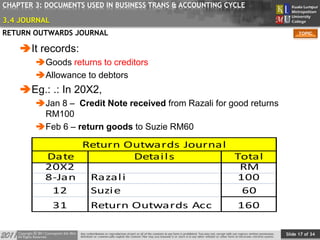

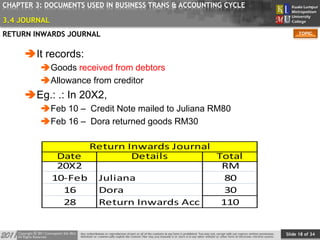

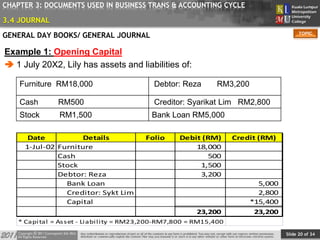

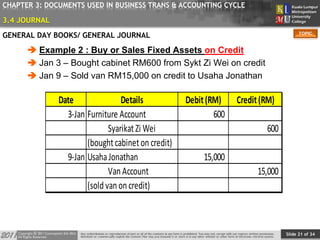

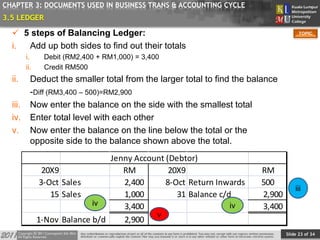

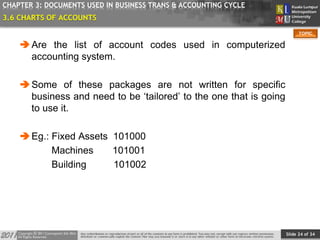

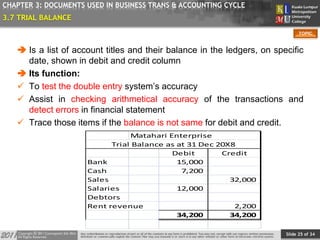

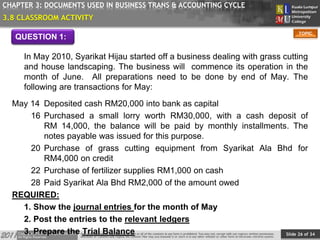

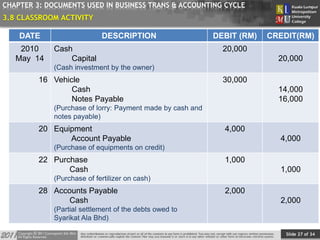

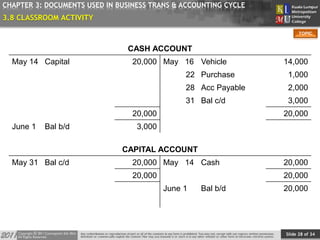

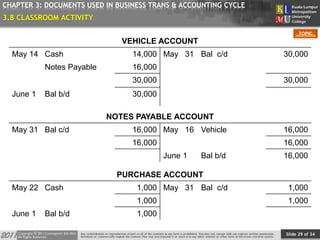

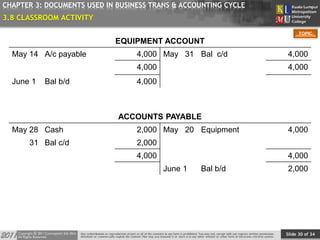

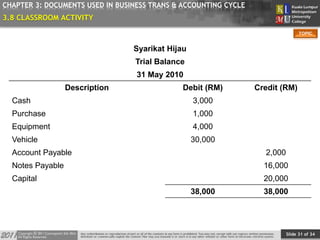

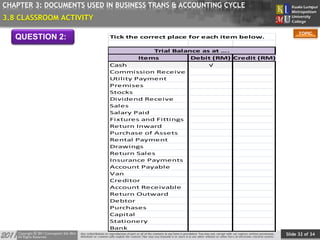

This document provides an overview of Chapter 3 which discusses documents used in business transactions and the accounting cycle. It covers the relationship between business documents and accounting records, the steps in the recording process, types of business documents like invoices and journals, the ledger and trial balance. It also includes sample journal entries, ledger accounts, and a trial balance. The chapter aims to explain how business documents are used to record transactions and flow into the accounting records through journals and ledgers.