Bajaj Auto 4QFY2010 Result Update

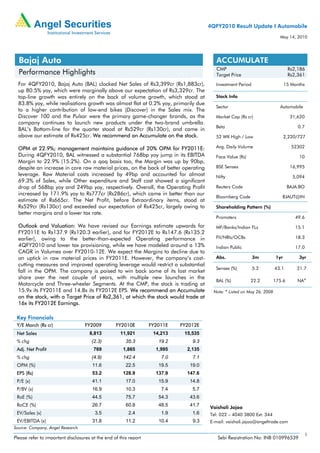

- 1. 4QFY2010 Result Update I Automobile May 14, 2010 Bajaj Auto ACCUMULATE CMP Rs2,186 Performance Highlights Target Price Rs2,361 For 4QFY2010, Bajaj Auto (BAL) clocked Net Sales of Rs3,399cr (Rs1,883cr), Investment Period 15 Months up 80.5% yoy, which were marginally above our expectation of Rs3,329cr. The top-line growth was entirely on the back of volume growth, which stood at Stock Info 83.8% yoy, while realisations growth was almost flat at 0.2% yoy, primarily due Sector Automobile to a higher contribution of low-end bikes (Discover) in the Sales mix. The Discover 100 and the Pulsar were the primary game-changer brands, as the Market Cap (Rs cr) 31,620 company continues to launch new products under the two-brand umbrella. Beta 0.7 BAL’s Bottom-line for the quarter stood at Rs529cr (Rs130cr), and came in above our estimate of Rs425cr. We recommend an Accumulate on the stock. 52 WK High / Low 2,220/727 OPM at 22.9%; management maintains guidance of 20% OPM for FY2011E: Avg. Daily Volume 52302 During 4QFY2010, BAL witnessed a substantial 768bp yoy jump in its EBITDA Face Value (Rs) 10 Margin to 22.9% (15.2%). On a qoq basis too, the Margin was up by 90bp, despite an increase in core raw material prices, on the back of better operating BSE Sensex 16,995 leverage. Raw Material costs increased by 49bp and accounted for almost Nifty 5,094 69.3% of Sales, while Other expenditure and Staff cost showed a significant drop of 568bp yoy and 249bp yoy, respectively. Overall, the Operating Profit Reuters Code BAJA.BO increased by 171.9% yoy to Rs777cr (Rs286cr), which came in better than our Bloomberg Code BJAUT@IN estimate of Rs665cr. The Net Profit, before Extraordinary items, stood at Rs529cr (Rs130cr) and exceeded our expectation of Rs425cr, largely owing to Shareholding Pattern (%) better margins and a lower tax rate. Promoters 49.6 Outlook and Valuation: We have revised our Earnings estimate upwards for MF/Banks/Indian FLs 15.1 FY2011E to Rs137.9 (Rs120.3 earlier), and for FY2012E to Rs147.6 (Rs135.2 earlier), owing to the better-than-expected Operating performance in FII/NRIs/OCBs 18.3 4QFY2010 and lower tax provisioning, while we have modeled around a 13% Indian Public 17.0 CAGR in Volumes over FY2010-12E. We expect the Margins to decline due to an uptick in raw material prices in FY2011E. However, the company’s cost- Abs. 3m 1yr 3yr cutting measures and improved operating leverage would restrict a substantial Sensex (%) 5.2 43.1 21.7 fall in the OPM. The company is poised to win back some of its lost market share over the next couple of years, with multiple new launches in the BAL (%) 22.2 175.6 NA# Motorcycle and Three-wheeler Segments. At the CMP, the stock is trading at 15.9x its FY2011E and 14.8x its FY2012E EPS. We recommend an Accumulate Note: # Listed on May 26, 2008 on the stock, with a Target Price of Rs2,361, at which the stock would trade at 16x its FY2012E Earnings. Key Financials Y/E March (Rs cr) FY2009 FY2010E FY2011E FY2012E Net Sales 8,813 11,921 14,213 15,535 % chg (2.3) 35.3 19.2 9.3 Adj. Net Profit 769 1,865 1,995 2,135 % chg (4.9) 142.4 7.0 7.1 OPM (%) 11.6 22.5 19.5 19.0 EPS (Rs) 53.2 128.9 137.9 147.6 P/E (x) 41.1 17.0 15.9 14.8 P/BV (x) 16.9 10.3 7.4 5.7 RoE (%) 44.5 75.7 54.3 43.6 RoCE (%) 26.7 60.8 48.5 41.7 Vaishali Jajoo EV/Sales (x) 3.5 2.4 1.9 1.6 Tel: 022 – 4040 3800 Ext: 344 EV/EBITDA (x) 31.8 11.2 10.4 9.3 E-mail: vaishali.jajoo@angeltrade.com Source: Company, Angel Research 1 Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539

- 2. Bajaj Auto I 4QFY2010 Result Update Exhibit 1: Financial Performance Update Y/E March (Rs cr) 4QFY10 4QFY09 % chg FY10 FY09 % chg Net Sales (include Other Op. Inc.) 3,399.5 1,883.4 80.5 11,920.9 8,813.0 35.3 Consumption of RM 2,236.7 1,241.7 80.1 7,650.6 6,089.1 25.6 (% of Sales) 65.8 65.9 64.2 69.1 Staff Costs 86.2 94.6 (8.9) 399.5 354.4 12.7 (% of Sales) 2.5 5.0 3.4 4.0 Purchases of TG 117.7 53.5 120.2 419.8 374.4 12.1 (% of Sales) 3.5 2.8 3.5 4.2 Other Expenses 181.8 207.8 (12.5) 858.5 792.9 8.3 (% of Sales) 5.3 11.0 7.2 9.0 Total Expenditure 2,622.4 1,597.6 64.1 9,328.4 7,610.7 22.6 Operating Profit 777.1 285.8 171.9 2,592.5 1,202.3 115.6 OPM 22.9 15.2 21.7 13.6 Interest (0.0) 5.2 (100.2) 6.0 21.0 (71.5) Depreciation 34.1 31.3 9.0 136.5 129.8 5.1 Other Income 42.5 22.9 85.5 122.5 111.7 9.7 PBT (excl. Extr. Items) 785.5 272.3 188.5 2,572.6 1,163.2 121.2 Extr. Income/(Expense) 49.4 82.9 - 165.0 207.1 - PBT (incl. Extr. Items) 736.2 189.3 288.8 2,407.6 956.1 151.8 (% of Sales) 21.7 10.1 20.2 10.8 Provision for Taxation 207.5 59.1 251.0 707.5 301.6 134.6 (% of PBT) 28.2 31.2 29.4 31.5 Reported PAT 528.7 130.2 306.0 1,700.1 654.5 159.8 PATM 15.6 6.9 14.3 7.4 Equity capital (cr) 144.7 144.7 101.2 101.2 EPS (Rs) 36.5 9.0 306.0 117.5 45.2 159.8 Source: Company, Angel Research Strong volume growth boosts top-line; Profit beats estimates: For 4QFY2010, Bajaj Auto (BAL) clocked Net Sales of Rs3,399cr (Rs1,883cr), up 80.5% yoy, which was marginally above our expectation of Rs3,329cr. The top-line growth was entirely on the back of volume growth, which stood at 83.8% yoy, while the realisations growth was almost flat at 0.2% yoy, primarily due to a higher contribution of low-end bikes (Discover) in the Sales mix. The Discover 100 and the Pulsar were the primary game- changer brands, as the company continues to launch new products under the two- brand umbrella. BAL’s Bottom-line for the quarter stood at Rs529cr (Rs130cr), and came in above our estimate of Rs425cr. Overall, a strong volume growth, a yoy decline in staff costs and effective operating cost management, have resulted in a substantial jump in the OPMs and the performance during the quarter. OPM at 22.9%; management maintains guidance of 20% OPM for FY2011E: During 4QFY2010, BAL witnessed a substantial 768bp yoy jump in its EBITDA Margin to 22.9% (15.2%). On a qoq basis too, the Margin was up by 90bp, despite an increase in core raw material prices, on the back of better operating leverage. Raw Material costs increased by 49bp and accounted for almost 69.3% of Sales, while Other expenditure and Staff cost showed a significant drop of 568bp yoy and 249bp yoy, respectively. Overall, the Operating Profit increased by 171.9% yoy to Rs777cr (Rs286cr), which came in better than our estimate of Rs665cr. The proposed increase in production at the Pantnagar plant, a focus on cost reductions and minimal sales promotion expenses contributed to BAL achieving better Margins. Net Profit up 306% yoy: The Net Profit, before Extraordinary items, stood at Rs529cr (Rs130cr) and exceeded our expectation of Rs425cr. BAL announced VRS for 2,331 workmen at its Akurdi plant, and decided to recognise expenditure amounting to Rs337cr over an appropriate period; for 4QFY2010, the company recognised Rs45.8cr. After deducting the Exceptional items amounting to Rs49.4cr (Rs82.9.cr), the Bottom-line grew by 306% yoy to Rs529cr (Rs130cr). The tax rate has declined by 304bp yoy, due to higher production at Uttarakhand. May 14, 2010 2

- 3. Bajaj Auto I 4QFY2010 Result Update Conference Call – Key Highlights Volume guidance: The Management has guided for robust growth in total volumes during FY2011E, with expected sales of around 3.6-4mn units in FY2011E (2.85mn units in FY2010). This growth will primarily be on the back of robust volumes clocked by the three brands across segments: Discover, Pulsar (Two-Wheelers) and RE (Three-Wheelers). The two-wheeler segment is expected to grow by around 40% yoy in the Motorcycle segment in FY2011E, with the Three-Wheeler segment following at a yoy growth of around 18% yoy. This growth is expected to continue due to a slew of new launches under its primary brands in the next couple of quarters. Moreover, the company is also optimistic about export volumes, and is poised to achieve its target of 1.1mn vehicles for FY2011E. Additionally, it has guided for robust sales expected at a CAGR of 18%-20% over the next 2-3 years in the key markets of Africa, South-East Asia, Latin America and Sri-Lanka, with forays expected in other emerging markets. The BAL management believes that the elevated growth rates for the two wheeler industry in FY2010 at 24% were partially aided by the pent up demand of the previous years, and that growth rates will moderate in FY2011E to the trend levels of 12-14%. Exhibit 2: Motorcycle Segment volumes Units % Market Share (RHS) Volume (LHS) 800,000 100 700,000 80 600,000 60 500,000 40 400,000 20 300,000 0 200,000 (20) 100,000 (40) 0 (60) 1QFY2007 2QFY2007 3QFY2007 4QFY2007 1QFY2008 2QFY2008 3QFY2008 4QFY2008 1QFY2009 2QFY2009 3QFY2009 4QFY2009 1QFY2010 2QFY2010 3QFY2010 4QFY2010 Source: SIAM, Angel Research Exhibit 3: Three-Wheeler Segment volumes Units Market Share (RHS) Volume (LHS) % 100,000 80 90,000 60 80,000 40 70,000 20 60,000 0 50,000 (20) 40,000 (40) 30,000 (60) 1QFY2007 2QFY2007 3QFY2007 4QFY2007 1QFY2008 2QFY2008 3QFY2008 4QFY2008 1QFY2009 2QFY2009 3QFY2009 4QFY2009 1QFY2010 2QFY2010 3QFY2010 4QFY2010 Source: SIAM, Angel Research May 14, 2010 3

- 4. Bajaj Auto I 4QFY2010 Result Update Target to achieve 34% market share in FY2011E: BAL maintained its market leadership in the 125cc-plus category, with a market share of around 46.7%. Its market share in the domestic Motorcycle Segment declined to around 21.9% in FY2009, which has improved to 24.3% in FY2010. The management believes that the full effect of new launches in 4QFY2010 helped the company to regain its market share. It expects to further increase its market share in the motorcycle segment to 34-35% in FY2011E. Operating Margins expected to be at around 20%: The company recorded robust margins in 4QFY2010 at 22.9%, higher on a qoq basis. The company had given a guidance of maintaining a healthy Margin level, at around 20% in FY2011, despite relatively higher Raw material costs, primarily on the back of cost-cutting efforts adopted at the operating level and better realisations in Exports, all of which it has realised in FY2010. Going ahead, the management has guided to maintain its margin above the 20% level for the next couple of quarters, despite an uptrend seen in input cost prices in the recent months. Also, the management is sanguine about maintaining the 18-20% margin range for FY2011E, on the back of better operating leverage on higher volumes, which is expected to offset the hike in raw material costs, to a certain extent. Further, a higher volume off-take from the Pantnagar plant (60,000 per month currently) will have a positive effect on the NPM. The management expects the production at the Pantnagar plant to increase to 70,000 per month in the June 2010 quarter, and to 1,20,000 per month in the later part of FY2011E. Capacity Expansion: Bajaj Auto has guided for capex of Rs250cr in FY2011E. It is scaling up production at its Uttarakhand plant to 1.2m units (from 0.6m units in FY2010). The company will incrementally produce the Discover range and the Pulsar 135cc bikes from there. The management also pointed that the capex over FY2012E would be determined by the roll out plans for the small car. Currency hedges: The company has hedged its entire FY2011E export exposure at Rs46.5/US$. May 14, 2010 4

- 5. Bajaj Auto I 4QFY2010 Result Update Outlook and Valuation Overall, Two-wheeler sales improved in FY2010, owing to the various measures adopted by the government and positive developments on the macro-economic front. We believe that although the substantial ownership base of Two-wheelers results in reduced headroom for higher double-digit growth rates, the increased dependence on replacement demand is expected to sustain volumes. Moreover, the rural markets are expected to register better growth on account of the new demand arising from the relevant rural population, which is expected to help Two-wheeler companies in maintaining their growth momentum, registering an 8-9% CAGR in Volumes over the next few years. In the case of BAL, we have revised our Earnings estimate upwards for FY2011E to Rs137.9 (Rs120.3 earlier), and for FY2012E to Rs147.6 (Rs135.2 earlier), owing to its better-than-expected Operating performance in 4QFY2010 and lower tax provisioning, while we have modeled around a 13% CAGR in Volumes over FY2010-12E. We expect the Margins to decline on an uptick in raw material prices in FY2011E. However, the company’s cost-cutting measures and improved operating leverage would restrict a substantial fall in the OPM. The company is poised to win back some of its lost market share over the next couple of years, with multiple new launches in the Motorcycle and Three-wheeler Segments. At the CMP, the stock is trading at 15.9x its FY2011E and 14.8x its FY2012E EPS. We recommend an Accumulate on the stock, with a Target Price of Rs2,361, at which the stock would trade at 16x its FY2012E Earnings. Exhibit 4: One year forward P/E 60.0 50.0 40.0 30.0 20.0 10.0 - Aug-02 Aug-03 Aug-04 Aug-05 Aug-06 Aug-07 Aug-08 Aug-09 Dec-02 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Apr-02 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Absolute P/E 3 year Average P/E Source: C-line, Angel Research Exhibit 5: BAL - Premium/Discount to Sensex P/E 250% 200% 150% 100% 50% 0% -50% -100% Apr-02 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Aug-02 Aug-03 Aug-04 Aug-05 Aug-06 Aug-07 Aug-08 Aug-09 Dec-02 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Absolute Premium 3 year Average Premium Source: C-line, Angel Research May 14, 2010 5

- 6. Bajaj Auto I 4QFY2010 Result Update Profit & Loss Statement (Rs cr) Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E Gross sales 10,639 9,690 9,050 12,118 15,126 16,832 Less: Excise duty 1,321.7 1,029.5 610.1 609.7 1,285.7 1,683.2 Net Sales 9,317 8,660 8,440 11,508 13,840 15,149 Other operating income 227.5 358.5 373.4 412.5 373.2 386.5 Total operating income 9,545 9,019 8,813 11,921 14,213 15,535 % chg - (5.5) (2.3) 35.3 19.2 9.3 Total Expenditure 8,146 7,855 7,831 9,328 11,515 12,664 Net Raw Materials 6,893 6,618 6,466 8,070 9,965 10,983 Other Mfg costs 249.1 216.4 192.2 - 207.6 227.2 Personnel 340.1 444.0 537.7 399.5 470.6 499.9 Other 663.7 576.8 635.2 858.5 871.9 954.4 EBITDA 1,399 1,164 982 2,592 2,698 2,871 % chg - (16.8) (15.7) 164.0 4.1 6.4 (% of Net Sales) 15.0 13.4 11.6 22.5 19.5 19.0 Depreciation& Amortisation 190.3 174.0 129.8 136.5 154.2 168.3 EBIT 1,209 990 852 2,456 2,544 2,703 % chg - (18.1) (14.0) 188.3 3.6 6.2 (% of Net Sales) 13.0 11.4 10.1 21.3 18.4 17.8 Interest & other Charges 5.3 5.2 21.0 6.0 19.6 19.6 Other Income 524.2 148.7 122.2 122.5 171.0 183.4 (% of PBT) 27.9 13.8 14.6 5.1 6.3 6.4 Recurring PBT 1,728 1,134 953 2,573 2,696 2,866 % chg - (34.4) (15.9) 169.9 4.8 6.3 Extraordinary (Expense)/Inc. 150.6 (52.8) (114.8) (165.0) - - PBT 1,878 1,081 838 2,408 2,696 2,866 Tax 489.6 378.0 298.7 707.5 700.8 730.9 (% of PBT) 26.1 35.0 35.6 29.4 26.0 25.5 PAT (reported) 1,238 756 655 1,700 1,995 2,135 ADJ. PAT 1,087 809 769 1,865 1,995 2,135 % chg - (25.6) (4.9) 142.4 7.0 7.1 (% of Net Sales) 11.7 9.3 9.1 16.2 14.4 14.1 Basic EPS (Rs) 107.5 55.9 53.2 128.9 137.9 147.6 Fully Diluted EPS (Rs) 107.5 55.9 53.2 128.9 137.9 147.6 % chg - (48.0) (4.9) 142.4 7.0 7.1 May 14, 2010 6

- 7. Bajaj Auto I 4QFY2010 Result Update Balance Sheet (Rs cr) Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E SOURCES OF FUNDS Equity Share Capital 101.2 144.7 144.7 144.7 144.7 144.7 Preference Capital - - - - - - Reserves& Surplus 5,433 1,443 1,725 2,916 4,149 5,367 Shareholders Funds 5,534 1,588 1,870 3,060 4,293 5,512 Total Loans 1,625.4 1,334.3 1,570.0 1,570 1,570 1,570 Deferred Tax Liability 74.2 11.0 4.2 4.2 4.2 4.2 Total Liabilities 7,234 2,933 3,444 4,634 5,867 7,086 APPLICATION OF FUNDS Gross Block 3,179 2,984 3,334 3,596 3,954 4,208 Less: Acc. Depreciation 1,922 1,726 1,808 1,944 2,099 2,267 Net Block 1,256 1,258 1,526 1,652 1,856 1,941 Capital Work-in-Progress 26.9 34.7 22.1 36.0 39.5 42.1 Goodwill - - - - - - Investments 6,448 1,857 1,809 3,244 4,401 5,669 Current Assets 3,819 1,650 2,325 3,522 3,796 4,008 Cash 83.5 56.1 136.9 909.1 672.9 758.6 Loans & Advances 2,896 969 1,491 1,726 2,076 2,121 Other 840 625 697 887 1,048 1,129 Current liabilities 4,333 1,877 2,438 3,820 4,225 4,574 Net Current Assets (514.1) (227.6) (112.3) (298) (428.4) (566.0) Mis. Exp. not written off 17.5 10.5 199.6 - - - Total Assets 7,234 2,933 3,444 4,634 5,867 7,086 Cash Flow (Rs cr) Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E Profit before tax 1,878 1,081 838 2,408 2,696 2,866 Depreciation 190.3 174.0 129.8 136.5 154.2 168.3 Change in Working Capital 6.8 (203.6) 144.6 (176.0) 176.3 108.3 Less: Other income 903.9 193.2 403 (1,094) 458 134.7 Direct taxes paid 489.6 378.0 298.7 707.5 700.8 730.9 Cash Flow from Operations 681.7 480.2 411 2,754.9 1,867 2,277.3 (Inc.)/Dec. in Fixed Assets (287.1) 186.6 (337.1) (276) (361.5) (256.2) (Inc.)/Dec. in Investments (590.6) - 48.6 (1,435.6) (1,156.4) (1,268.3) (Inc.)/Dec. in loans and advances (93.7) (95.3) (141.4) 813.4 (366.4) 30.4 Other income 524.2 148.7 122.2 122.5 171.0 183.4 Cash Flow from Investing (447.1) 240.0 (307.7) (776) (1,713) (1,310.8) Issue of Equity - 43.5 - - - - Inc./(Dec.) in loans 158.3 (291.1) 235.7 - - - Dividend Paid (Incl. Tax) 461.5 473.5 338.6 372.4 677.1 761.7 Others (853.0) (973.5) (597.2) (1,579.0) (1,067.5) (1,642.6) Cash Flow from Financing (233.3) (747.6) (23.0) (1,207) (390.4) (880.8) Inc./(Dec.) in Cash 1.4 (27.4) 80.8 772.2 (236.2) 85.7 Opening Cash balances 82.1 83.5 56.1 136.9 909.1 672.9 Closing Cash balances 83.5 56.1 136.9 909.1 672.9 758.6 May 14, 2010 7

- 8. Bajaj Auto I 4QFY2010 Result Update Key Ratios Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E Valuation Ratio (x) P/E (on FDEPS) 20.3 39.1 41.1 17.0 15.9 14.8 P/CEPS 15.5 34.0 40.3 15.8 14.7 13.7 P/BV 4.0 19.9 16.9 10.3 7.4 5.7 Dividend yield (%) 1.8 0.9 1.0 1.8 2.1 2.3 EV/Sales 2.5 3.2 3.5 2.4 1.9 1.6 EV/EBITDA 19.1 26.7 31.8 11.2 10.4 9.3 EV / Total Assets 3.7 10.6 9.1 6.3 4.8 3.8 Per Share Data (Rs) EPS (Basic) 107.5 55.9 53.2 128.9 137.9 147.6 EPS (fully diluted) 107.5 55.9 53.2 128.9 137.9 147.6 Cash EPS 141.2 64.3 54.2 138.3 148.5 159.2 DPS 40.0 20.0 22.0 40.0 45.0 50.0 Book Value 547.0 109.7 129.2 211.5 296.7 381.0 Dupont Analysis EBIT margin 13.0 11.4 10.1 21.3 18.4 17.8 Tax retention ratio 0.7 0.7 0.6 0.7 0.7 0.7 Asset turnover (x) 1.4 1.8 2.9 3.4 3.2 2.7 ROIC (Post-tax) 13.7 13.4 18.5 51.1 43.4 35.8 Cost of Debt (Post Tax) - - - - - - Leverage (x) - - - - - - Operating ROE 13.7 13.4 18.5 51.1 43.4 35.8 Returns (%) ROCE (Pre-tax) 17.8 19.5 26.7 60.8 48.5 41.7 Angel ROIC (Pre-tax) 16.9 34.4 25.8 65.9 49.0 42.7 ROE 21.1 22.7 44.5 75.7 54.3 43.6 Turnover ratios (x) Asset Turnover (Gross Block) 3.1 2.9 2.8 3.4 3.8 3.8 Inventory / Sales (days) 11.4 13.9 14.9 12.1 12.3 12.7 Receivables (days) 16.3 17.0 13.7 14.6 14.3 14.0 Payables (days) 53.4 53.6 48.8 39.4 38.0 41.1 WC cycle (ex-cash) (days) (22.9) (17.8) (11.0) (22.3) (29.6) (28.5) Solvency ratios (x) Net debt to equity (0.9) (0.4) (0.2) (0.8) (0.8) (0.9) Net debt to EBITDA (3.5) (0.5) (0.4) (1.0) (1.3) (1.7) Interest Coverage (EBIT / Int.) 226.3 191.9 40.6 410.7 129.6 137.7 May 14, 2010 8

- 9. Bajaj Auto I 4QFY2010 Result Update Research Team Tel: 022-4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Securities Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, and is for general guidance only. Angel Securities Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Securities Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Securities Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Securities Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Disclosure of Interest Statement Bajaj Auto 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies’ Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below Rs 1 lakh for Angel and its Group companies Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel : (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 May 14, 2010 9