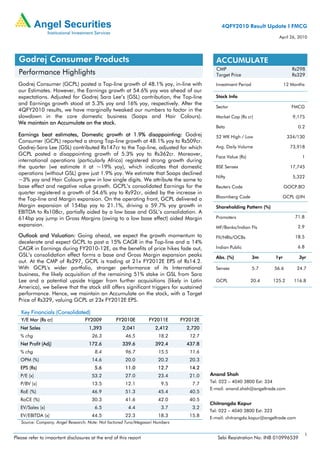

Godrej Consumer Products reported strong revenue growth of 48.1% for the fourth quarter, driven primarily by the consolidation of Godrej Sara Lee. However, excluding this contribution, domestic growth was a disappointing 5.3%. Earnings growth of 54.6% was boosted by margin expansion but adjusted earnings grew only 16% excluding Godrej Sara Lee. While international operations grew robustly, growth in the core domestic business of soaps and hair colors slowed. The brokerage maintains an 'Accumulate' rating based on Godrej's wider portfolio and potential for acquisitions but expects growth to moderate going forward.