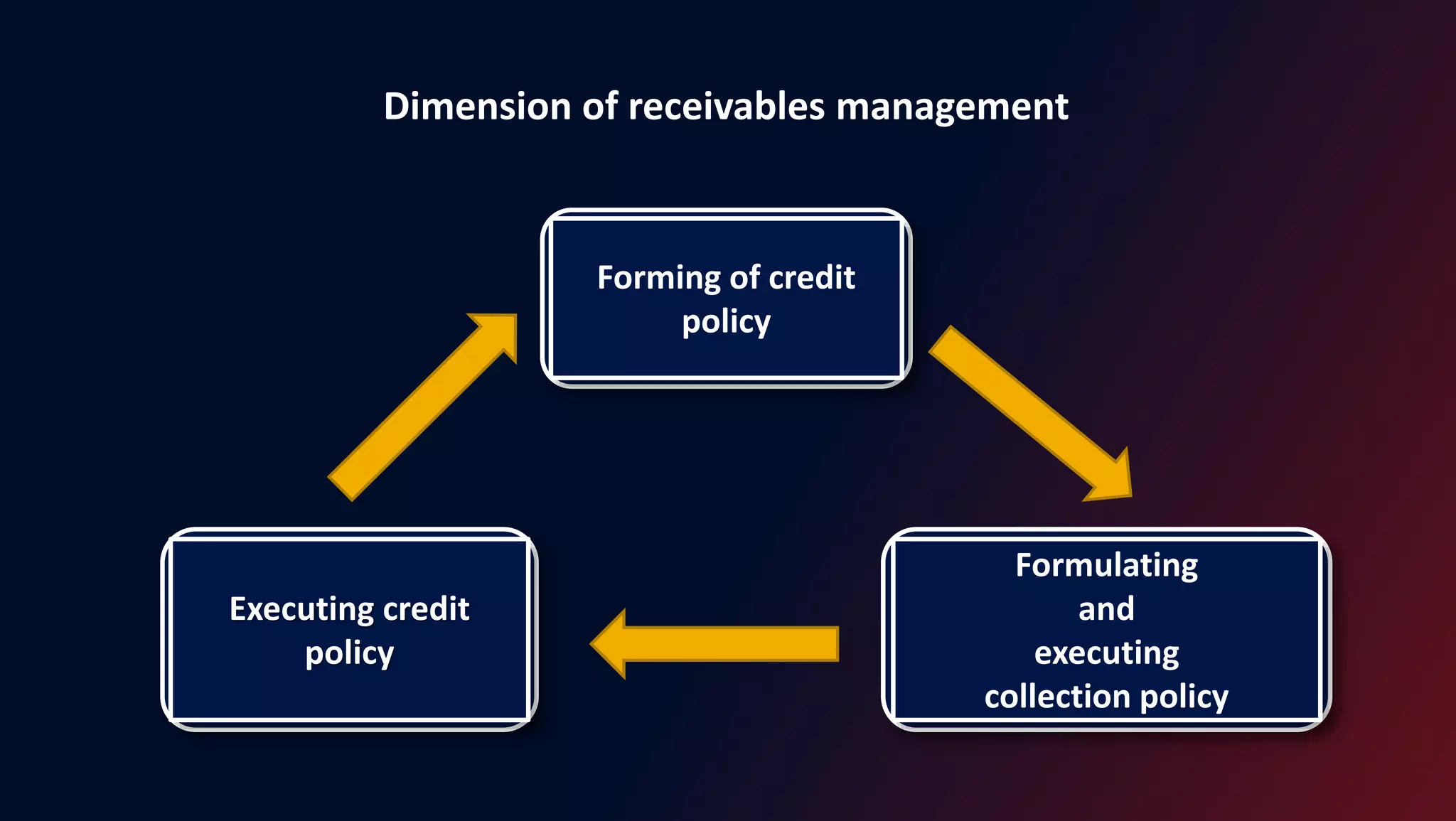

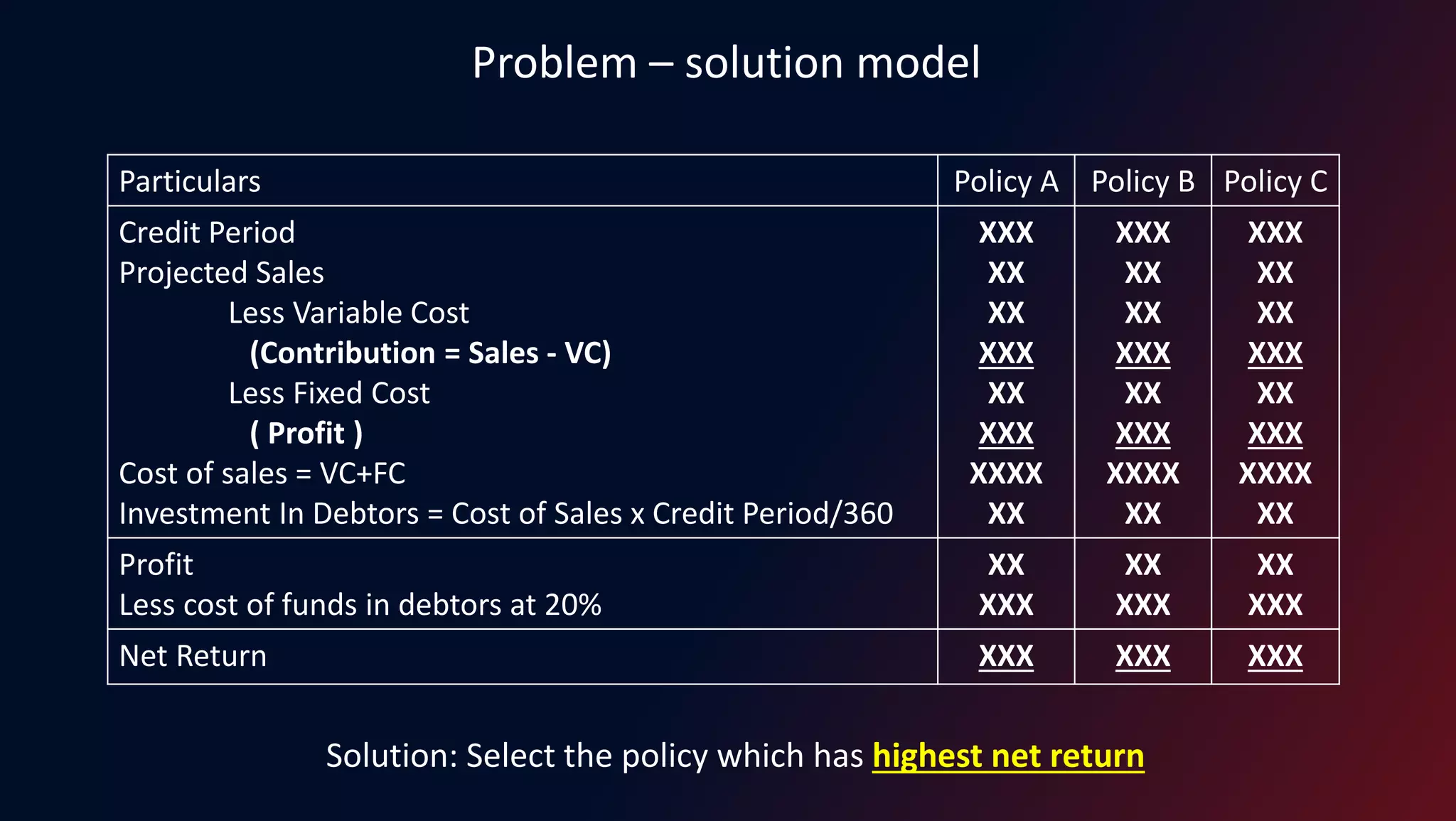

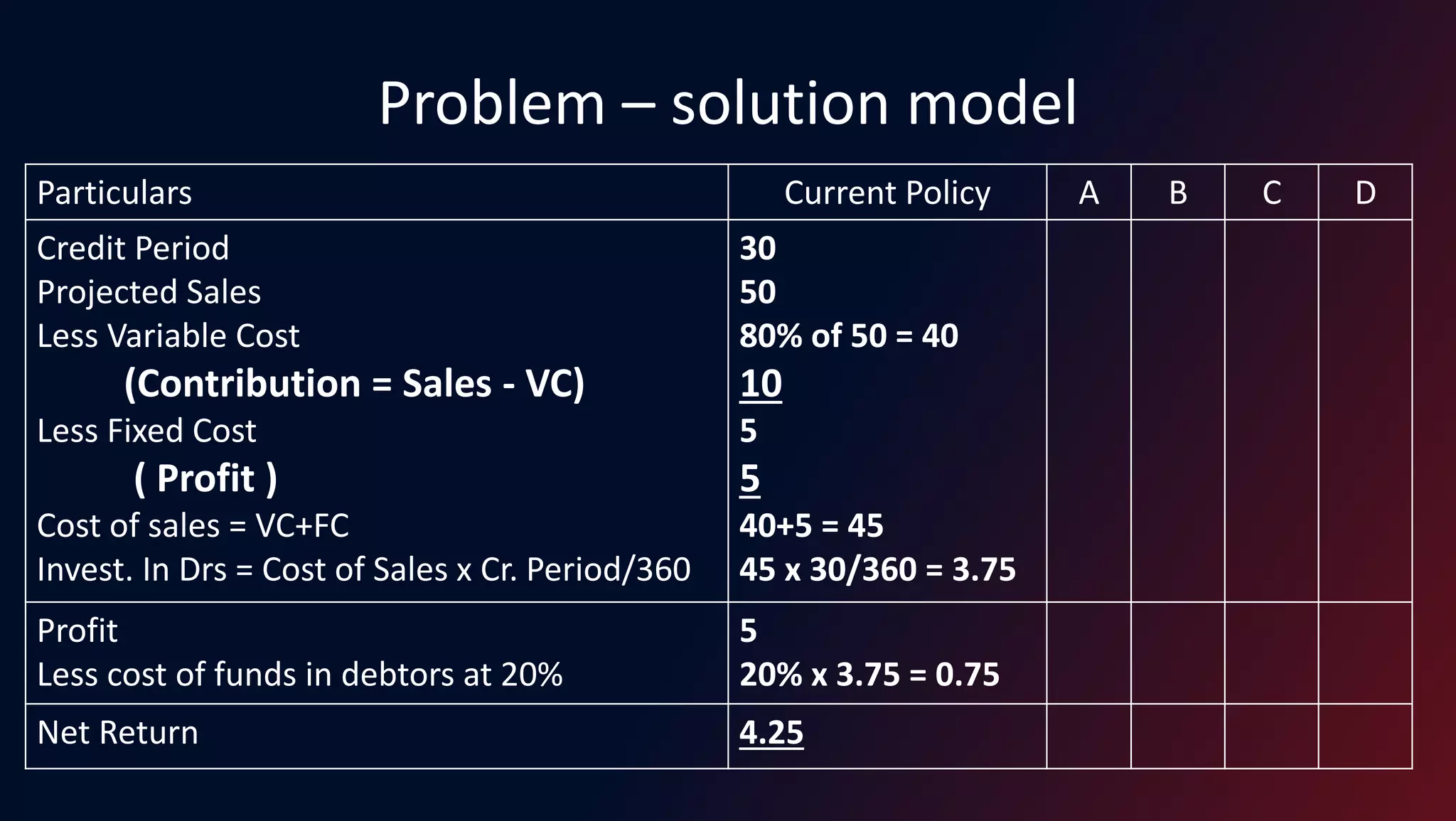

This document discusses receivables (accounts receivable) management. It defines receivables as amounts owed to a firm for goods or services sold. Maintaining the right level of receivables is important to meet competition and increase sales and profits, but it also incurs costs like financing, administration, collection, and bad debts. The document outlines factors that influence the size of receivables like credit terms, collection efforts, and customer habits. It describes the key aspects of receivables management including forming credit policies, executing those policies, and formulating and executing collection policies.