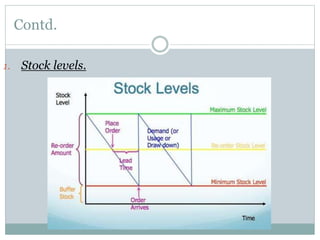

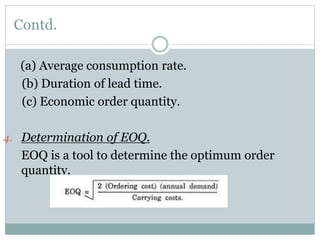

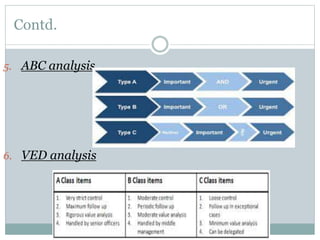

The document discusses the importance of receivables and inventory management in a business context, highlighting the costs associated with maintaining receivables and the objectives of effective management. It outlines the formation and execution of credit policies, including credit standards and collection procedures, as well as the necessity of inventory management for uninterrupted production. Additionally, it addresses the risks and costs of holding inventory and provides tools and techniques for optimizing inventory levels.