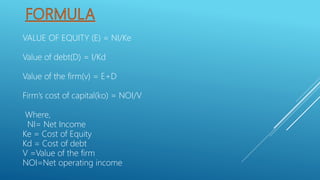

This document discusses the net income approach to capital structure. It states that according to this approach, the value of a firm is based on the net income available to equity shareholders after paying interest on debt. It provides an example showing how the value of equity, debt, and the firm change as debt levels increase from 0% to 5% to 9% of the total capital. The weighted average cost of capital decreases and the total firm value increases as debt levels and leverage rise. However, the assumptions of the approach do not always hold in reality.