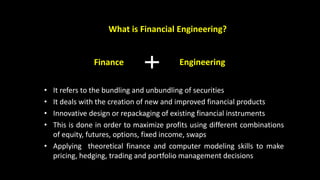

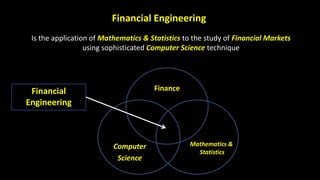

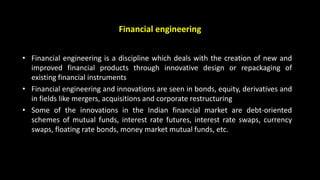

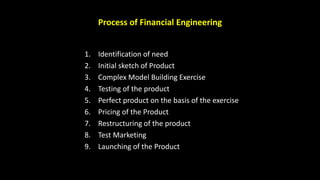

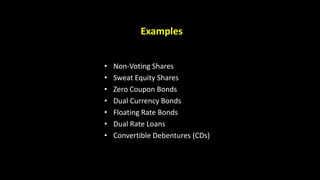

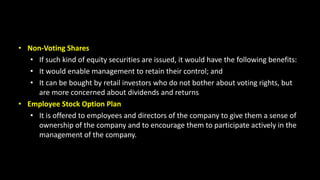

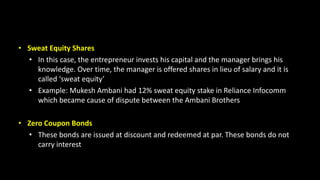

Financial engineering is the application of mathematics, statistics, and computer science to study financial markets and develop innovative financial products. It involves bundling and unbundling securities to maximize profits. Some innovations in India include debt-oriented mutual fund schemes, interest rate futures, interest rate swaps, and floating rate bonds. The process of financial engineering includes identifying client needs, developing product models, testing products, pricing, and launching products. Examples of engineered products are non-voting shares, sweat equity shares, zero-coupon bonds, and dual currency bonds.