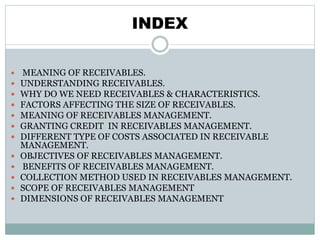

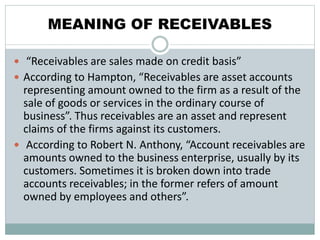

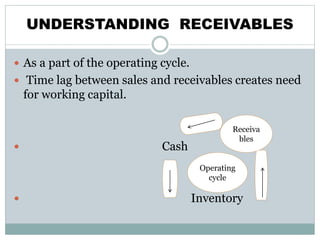

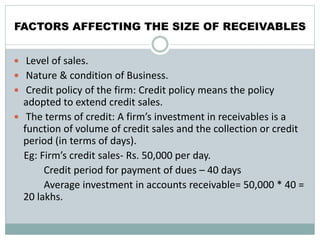

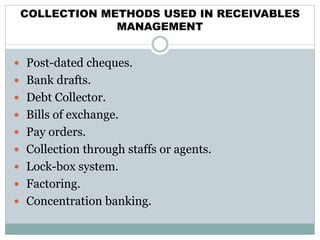

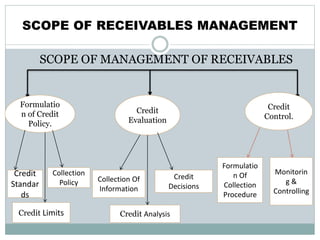

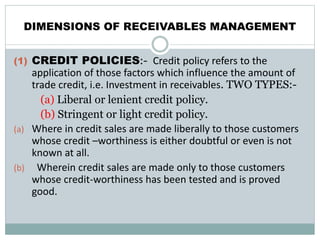

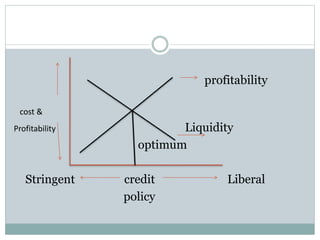

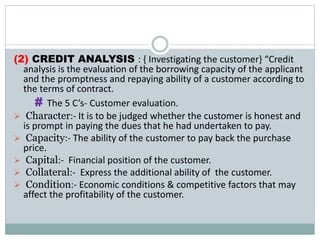

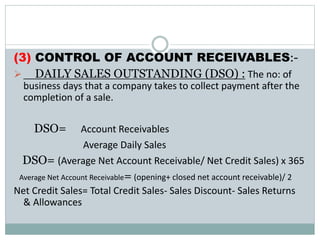

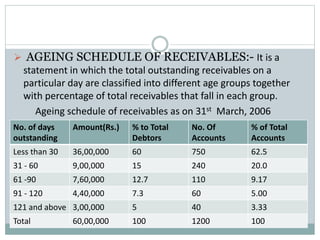

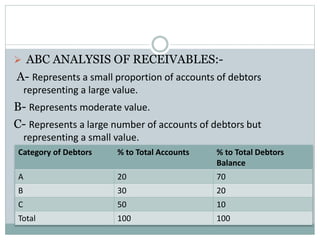

This document discusses receivables management. It begins by defining receivables as sales made on credit that represent amounts owed to a firm from customers. Effective receivables management involves establishing credit policies, evaluating customer creditworthiness, and controlling receivables. The objectives are to maximize return on investment in receivables while allowing sufficient sales growth. Key aspects covered include granting credit, costs of receivables management, collection methods, and analysis of receivables aging and customer importance.