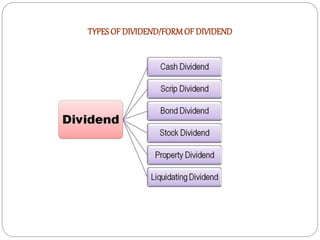

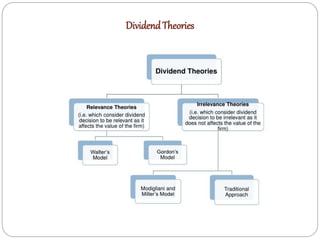

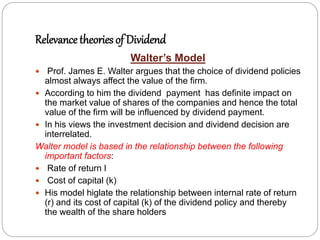

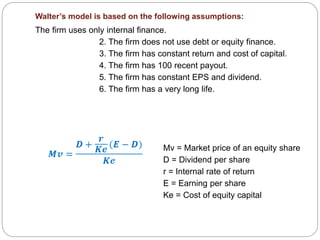

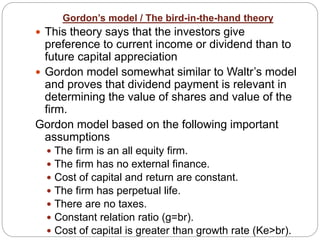

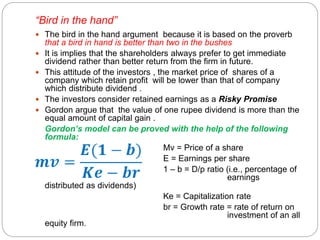

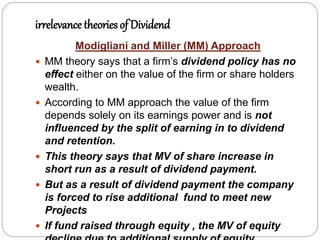

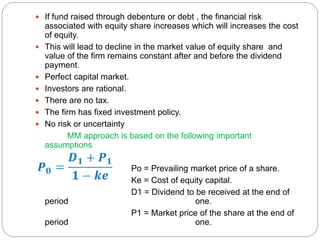

This document discusses dividend decision and policy. It defines dividends as profits distributed to shareholders from company earnings. There are several types of dividends including cash, stock, scrip, and bond dividends. Factors that influence a company's dividend policy include future growth needs, business cycles, the age and industry of the company, and shareholder preferences. Dividend theories also impact policy, such as Walter's model stating dividends influence firm value, and the MM irrelevance theory stating dividends do not impact value or shareholder wealth. Overall the document provides an overview of dividends, factors in determining policy, and influential theoretical frameworks.