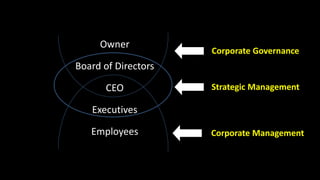

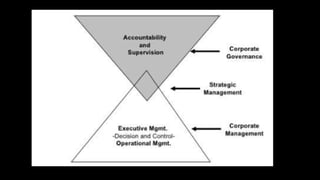

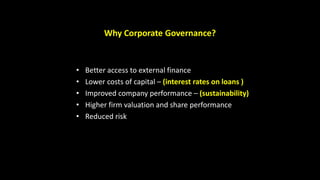

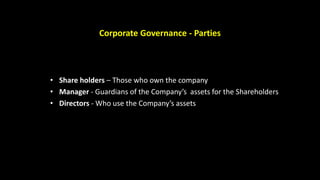

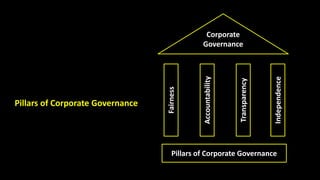

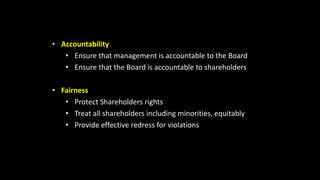

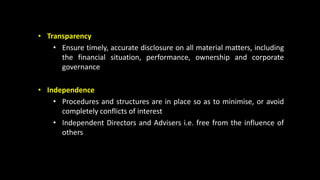

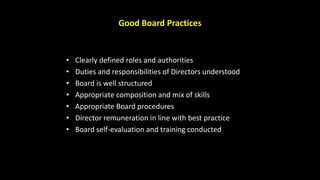

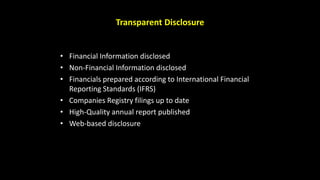

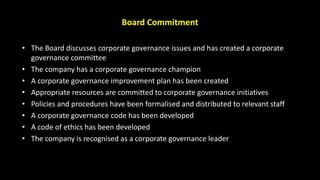

This document discusses corporate governance, providing definitions, parties involved, pillars, and elements. Corporate governance refers to how corporations are directed and managed, and involves relationships between management, the board of directors, shareholders, and other stakeholders. It aims to balance goals for individuals, society, and the economy. Key pillars include fairness, accountability, transparency, and independence. Key parties are shareholders, management, and directors. Elements that comprise good corporate governance include well-defined shareholder rights, board commitment, a strong control environment, transparent disclosure, and good board practices.