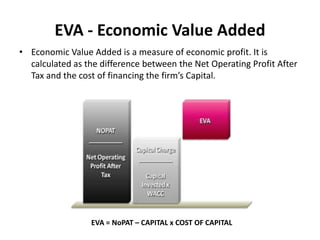

EVA is a measure of economic profit calculated as net operating profit after tax minus the cost of financing the firm's capital. To derive NOPAT, sales minus variable costs equals contribution, minus fixed costs equals EBITDA, minus depreciation/amortization and tax equals NOPAT. EVA is used to measure a firm's economic value created over the required return of investors, and is determined to pay incentives and bonuses. Key benefits of EVA include measuring value creation, managing decisions to link to value creation, and motivating managers with incentive plans tied to shareholder value. Adjustments help translate financial statements to an economic framework for EVA calculation.