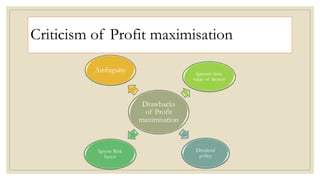

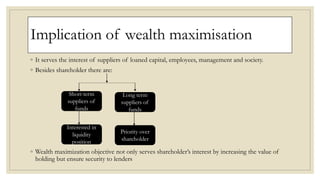

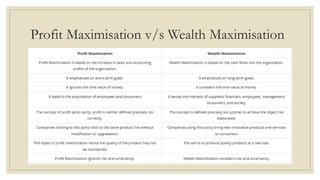

Manpreet Kaur discusses the differences between profit maximization and wealth maximization as objectives for financial management. [1] Profit maximization aims to increase earnings and is a short-term approach, but it can exploit workers and consumers. [2] Wealth maximization seeks to increase long-term shareholder value by maximizing the current stock price, balancing the interests of various stakeholders. [3] While both have drawbacks, wealth maximization is generally considered a more appropriate objective as it considers the time value of money and risk over the long run.