Rallis India - RU2QFY2011

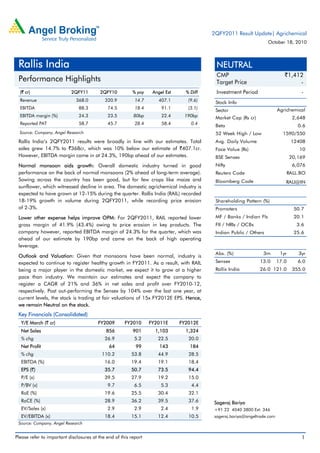

- 1. 2QFY2011 Result Update| Agrichemical October 18, 2010 Rallis India NEUTRAL CMP `1,412 Performance Highlights Target Price - (` cr) 2QFY11 2QFY10 % yoy Angel Est % Diff Investment Period - Revenue 368.0 320.9 14.7 407.1 (9.6) Stock Info EBITDA 88.3 74.5 18.4 91.1 (3.1) Agrichemical Sector EBITDA margin (%) 24.3 23.5 80bp 22.4 190bp Market Cap (Rs cr) 2,648 Reported PAT 58.7 45.7 28.4 58.4 0.4 Beta 0.6 Source: Company, Angel Research 52 Week High / Low 1590/550 Rallis India’s 2QFY2011 results were broadly in line with our estimates. Total Avg. Daily Volume 12408 sales grew 14.7% to `368cr, which was 10% below our estimate of `407.1cr. Face Value (Rs) 10 However, EBITDA margin came in at 24.3%, 190bp ahead of our estimates. BSE Sensex 20,169 Normal monsoon aids growth: Overall domestic industry turned in good Nifty 6,076 performance on the back of normal monsoons (2% ahead of long-term average). Reuters Code RALL.BO Sowing across the country has been good, but for few crops like maize and Bloomberg Code RALI@IN sunflower, which witnessed decline in area. The domestic agrichemical industry is expected to have grown at 12-15% during the quarter. Rallis India (RAIL) recorded 18-19% growth in volume during 2QFY2011, while recording price erosion Shareholding Pattern (%) of 2-3%. Promoters 50.7 Lower other expense helps improve OPM: For 2QFY2011, RAIL reported lower MF / Banks / Indian Fls 20.1 gross margin of 41.9% (43.4%) owing to price erosion in key products. The FII / NRIs / OCBs 3.6 company however, reported EBITDA margin of 24.3% for the quarter, which was Indian Public / Others 25.6 ahead of our estimate by 190bp and came on the back of high operating leverage. Abs. (%) 3m 1yr 3yr Outlook and Valuation: Given that monsoons have been normal, industry is expected to continue to register healthy growth in FY2011. As a result, with RAIL Sensex 13.0 17.0 6.0 being a major player in the domestic market, we expect it to grow at a higher Rallis India 26.0 121.0 355.0 pace than industry. We maintain our estimates and expect the company to register a CAGR of 21% and 36% in net sales and profit over FY2010-12, respectively. Post out-performing the Sensex by 104% over the last one year, at current levels, the stock is trading at fair valuations of 15x FY2012E EPS. Hence, we remain Neutral on the stock. Key Financials (Consolidated) Y/E March (` cr) FY2009 FY2010 FY2011E FY2012E Net Sales 856 901 1,103 1,324 % chg 26.9 5.2 22.5 20.0 Net Profit 64 99 143 184 % chg 110.2 53.8 44.9 28.5 EBITDA (%) 16.0 19.4 19.1 18.4 EPS (`) 35.7 50.7 73.5 94.4 P/E (x) 39.5 27.9 19.2 15.0 P/BV (x) 9.7 6.5 5.3 4.4 RoE (%) 19.6 25.5 30.4 32.1 RoCE (%) 28.9 36.2 39.5 37.6 Sageraj Bariya EV/Sales (x) 2.9 2.9 2.4 1.9 +91 22 4040 3800 Ext: 346 EV/EBITDA (x) 18.4 15.1 12.4 10.5 sageraj.bariya@angeltrade.com Source: Company, Angel Research Please refer to important disclosures at the end of this report 1

- 2. Rallis India | 2QFY2011 Result Update Exhibit 1: Quarterly Performance Y/E March (` cr) 2QFY11 2QFY10 % chg 1HFY11 1HFY10 % chg Net Revenues 368 321 14.7 571 487 17.1 Raw material cost 211 179 17.8 333 280 18.8 Gross Profit 157 142 10.8 238 207 14.9 Gross margin 43 44 42 42 Employee Expenses 18 16 37 33 as % of sales 5 5 6 7 Other expenditure 50 52 90 80 as % of sales 14 16 16 16 Total Expenditure 280 246 460 393 Operating Profit 88 75 18.4 111 94 17.9 OPM (%) 24.3 23.5 19.8 19.6 Depreciation 4 4 8 8 EBIT 84 70 103 86 EBIT (%) 23 22 18 18 Other income 1 1 3 2 Interest 0 1 -1 1 PBT (excl of Ext items) 85 71 20.7 107 88 22.1 Ext items 0 2 0 4 PBT (incl of Ext items) 85 69 107 84 Tax 27 23 34 28 Reported PAT 59 46 28.4 74 55 33.4 Adj PAT 59 48 74 60 Report EPS (`) 30.1 23.4 28.4 37.7 28.3 33.4 Adj EPS (`) 30.1 24.7 21.9 37.7 30.6 23.3 Source: Company, Angel Research Sales growth below estimates RAIL posted top-line growth of 14.7% to `368cr, which was marginally below our estimate of `407cr. Top-line was driven by the company’s robust performance in the domestic market (18% volume growth) that witnessed strong demand for pesticides along with revival in exports. The company launched three new products under its domestic segment during the quarter. However, overall domestic industry lost some sales due to the continuous rains it resulted in lower spraying by the farmers. October 18, 2010 2

- 3. Rallis India | 2QFY2011 Result Update Exhibit 2: Total Revenue performance 400 22 25 320 20 14 15 13 15 240 ( `cr) 10 (%) 160 5 80 0 (3) 0 (5) 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 Total Revenue % YoY Source: Company, Angel Research Lower other expense helps improve OPM For 2QFY2011, RAIL reported lower gross margin of 41.9% (43.4%) owing to price erosion in key products. The company however, reported EBITDA margin of 24.3% for the quarter, which was ahead of our estimate by 190bp and came on the back of high operating leverage. Exhibit 3: Margin trend Exhibit 4: Other expense declines 50 43 45 42 42 60 21 25 38 20 40 50 20 16 40 14 14 30 15 (%) (`cr) (%) 30 20 24 10 24 21 21 20 10 5 10 12 0 0 0 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 Gross margin EBITDA Other exp Other exp as % of sales Source: Company, Angel Research Source: Company, Angel Research Earnings growth in line with estimates Reported PAT for the quarter came in line with our estimates registering 28.4% yoy growth to `59cr (`46cr) on the back of higher EBITDA margins. October 18, 2010 3

- 4. Rallis India | 2QFY2011 Result Update Exhibit 5: PAT trend 70 160 59 60 46 120 50 40 (` cr) 80 (%) 30 24 25 20 15 40 10 0 0 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 PAT % YoY Source: Company, Angel Research Management meet - Key takeaways Overall domestic industry turned in good performance on the back of normal monsoons (2% ahead of long-term average). Sowing across the country has been good, but for few crops like maize and sunflower, which witnessed decline in area. The domestic agrichemical industry is expected to have grown at 12-15% during the quarter. RAIL recorded 18-19% growth in volume during 2QFY2011, while recording price erosion of 2-3%. Domestic formulation sales crossed the `100cr mark in September 2010 aided by launch of three products: (a) Tarak - a post emergence herbicide for rice/paddy, (b) Ralligold -a plant growth nutrient for crops like cotton, groundnut, paddy, vegetables, soybean and pulses and (c) Toran – an insecticide for cotton. The Dahej plant commenced trail run operation; commercial production would begin by end of 3QFY2011. Given the company’s healthy cash flows and robust cash position (~`150cr), management stated that it would look around for suitable acquisition in agri- related business. RAIL is evaluating entry into the complex fertiliser business, where Tata Chemical’s (TCL) is currently undertaking test marketing through its Babaral plant. If TCL emerges successful, RAIL plans to set up a similar plant and market the products in the southern and western parts of India; North and eastern regions are being catered to by TCL. October 18, 2010 4

- 5. Rallis India | 2QFY2011 Result Update Investment Arguments Set to seize rising opportunities in the domestic pesticides market: India's overall pesticides consumption is one of the lowest in the world, and we believe that RAIL is well-placed to seize this opportunity on the back of its wide distribution network, strong brands and robust new product pipeline. According to industry estimates, the unorganised market accounts for another 50% of the industry. Nonetheless, we believe that RAIL is in a position to wrest market share as well as charge a premium for its products. Exports to register steady growth: Closing down of capacity in China before the Olympics 2008 and MNCs diversifying their base to India had resulted in the company’s exports spiking 80% in FY2009 to `295cr. The scenario has however changed post the Olympics and many closed capacities have come on stream and commodities prices have strong corrected due to which export decline by 35% in FY2010. Against this backdrop, we estimate RAIL to post a CAGR of 40% in exports over FY2010-12E. Contract manufacturing to be next growth driver: RAIL plans to focus on CM for Exports and selectively target and supply to the top players. To facilitate the same, the company is setting up a new plant at Dahej. Overall, RAIL targets to achieve cumulative Revenues of `1,000cr over the next five years from this segment alone. Outlook and Valuation Given that monsoons have been normal, industry is expected to continue to register healthy growth in FY2011. As a result, with RAIL being a major player in the domestic market, we expect it to grow at a higher pace than industry. We maintain our estimates and expect the company to register a CAGR of 21% and 36% in net sales and profit over FY2010-12, respectively. Post out-performing the Sensex by 104% over the last one year, at current levels, the stock is trading at fair valuations of 15x FY2012E EPS. Hence, we remain Neutral on the stock. Exhibit 6: Key Assumptions FY11E FY12E Comment Domestic Growth (%) 18.0 15.0 Robust volume growth on account of normal monsoon Export Growth (%) 46.0 35.0 Revival in exports, lower inventory in LAT-AM markets Total Revenue Growth (%) 22.8 20.0 Gross Margin (%) 39.7 38.8 Higher penetration to see marginal reduction in prices EBITDA Margin 19.1 18.4 Higher contribution from low-margin contract manufacturing business Tax rate (%) 32.2 23.4 Lower rate due to SEZ benefit Source: Company, Angel Research October 18, 2010 5

- 6. Rallis India | 2QFY2011 Result Update Exhibit 7: Peer Valuation Company Reco Mcap CMP TP Upside P/E EV/Sales EV/EBITDA RoE (%) CAGR (%) (` cr) (`) (`) (%) FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E Sales PAT Rallis Neutral 2,753 1,412 - - 19.2 15.0 2.4 1.9 12.4 10.5 30.4 32.1 21.3 36.5 Bayer CropScience Neutral 4,081 1,033 - - 23.9 20.0 2.0 1.7 15.9 13.5 26.9 25.7 15.3 22.8 United Phosphorus Buy 8,706 188 228 21 13.3 10.7 1.6 1.4 7.8 6.5 19.3 19.9 8.8 21.7 Nagarjuna Agrichem NA 322 216 - - 9.6 5.4 0.6 0.5 4.5 2.8 15.5 23.7 9.3 0.1 Source: Company, Bloomberg, Angel Research Exhibit 8: One-year forward P/E band 1,800 1,600 1,400 Share price (`) 1,200 1,000 800 600 400 200 - Oct-07 Oct-08 Oct-09 Oct-10 Jan-08 Jan-09 Jan-10 Apr-07 Jul-07 Apr-08 Jul-08 Apr-09 Jul-09 Apr-10 Jul-10 Price 7x 9x 11x 13x 15x Source: Company, Angel Research Exhibit 9: RAIL v/s Peers – Relative performance 300 250 200 150 100 50 0 Dec-09 Apr-10 Apr-10 Jul-10 Aug-10 Aug-10 Oct-09 Mar-10 Oct-10 Feb-10 Sep-10 Nov-09 Nov-09 May-10 Jun-10 Jun-10 Jan-10 Jan-10 UPhos Rallis NACL Bayer Source: Company, Angel Research October 18, 2010 6

- 7. Rallis India | 2QFY2011 Result Update Exhibit 10: RAIL v/s Sensex – one year absolute returns 300 250 200 150 100 50 0 Dec-09 Apr-10 Apr-10 Jul-10 Mar-10 Aug-10 Aug-10 Oct-09 Oct-10 Feb-10 Sep-10 Nov-09 Nov-09 May-10 Jun-10 Jun-10 Jan-10 Jan-10 Rallis Sensex Source: Company, Angel Research October 18, 2010 7

- 8. Rallis India | 2QFY2011 Result Update Profit & Loss Statement (Consolidated) Y/E March (` cr) FY07 FY08 FY09 FY10 FY11E FY12E Gross sales 675 743 930 959 1,180 1,417 Less: Excise duty 58 69 74 58 77 93 Total operating income 617 675 856 901 1,103 1,324 % chg 4.2 9.4 26.9 5.2 22.5 20.0 Total Expenditure 603 615 719 726 892 1,080 Net Raw Materials 401 411 507 506 634 774 Other Mfg costs 138 134 134 137 154 168 Personnel 55 62 67 67 93 111 Other 9 9 11 15 11 26 EBITDA 13 59 137 175 211 244 % chg - 340.6 131.2 28.0 20.4 15.6 (% of Net Sales) 2.2 8.8 16.0 19.4 19.1 18.4 Depreciation& Amortisation 31 20 23 18 23 28 EBIT (18) 39 114 157 188 216 % chg - - 191.3 37.7 19.8 15.1 (% of Net Sales) - 5.8 13.3 17.4 17.0 16.3 Interest & other Charges 19 12 11 5 0 - Other Income 84 112 3 7 24 24 (% of PBT) 176 81 3 4 11 10 Recurring PBT 48 139 106 158 211 240 % chg 30.0 190.4 (23.6) 49.5 33.5 13.7 Extraordinary Expense/(Inc.) (57) (87) (6) (8) - - PBT (reported) (9) 52 100 150 211 240 Tax (3) 21 35 51 68 56 (% of PBT) (6.5) 15.2 33.3 32.3 32.2 23.4 PAT (reported) (6) 31 64 99 143 184 Add: Share of earnings of associate - - - - - - Less: Minority interest (MI) - - - - - - Prior period items - - - - - - PAT after MI (reported) (6) 31 64 99 143 184 ADJ. PAT (6) 31 64 99 143 184 % chg - - 110.2 53.8 44.9 28.5 (% of Net Sales) - 3.9 7.5 10.9 12.7 13.7 Basic EPS (`) (3) 17 36 51 73 94 Fully Diluted EPS (`) (3) 17 36 51 73 94 % chg - - 110.2 41.9 44.9 28.5 October 18, 2010 8

- 9. Rallis India | 2QFY2011 Result Update Balance Sheet (Consolidated) Y/E March (` cr) FY07 FY08 FY09 FY10 FY11E FY12E SOURCES OF FUNDS Equity Share Capital 18 18 18 20 20 20 Preference Capital 88 88 88 - - - Reserves & Surplus 106 202 244 405 498 611 Shareholders Funds 212 308 350 424 517 631 Minority Interest - - - - - - Total Loans 36 47 82 8 - - Deferred Tax Liability - - - - - 1 Total Liabilities 248 354 432 433 517 631 APPLICATION OF FUNDS Gross Block 285 296 338 309 421 442 Less: Acc. Depreciation 146 161 179 156 179 207 Net Block 139 135 159 153 242 235 Capital Work-in-Progress 5 13 29 112 18 18 Goodwill - - - - - - Investments 32 56 136 140 140 140 Current Assets 316 338 352 326 461 660 Cash 23 8 8 12 24 80 Loans & Advances 75 79 77 89 88 119 Other 218 250 266 226 349 461 Current liabilities 258 201 261 304 351 422 Net Current Assets 58 137 91 22 110 238 Mis. Exp. not written off 12 13 10 5 8 - Total Assets 248 354 432 433 517 631 October 18, 2010 9

- 10. Rallis India | 2QFY2011 Result Update Cash Flow Statement (Consolidated) Y/E March (` cr) FY07 FY08 FY09 FY10 FY11E FY12E Profit before tax 55 146 107 153 211 240 Depreciation 31 20 23 18 23 28 Change in Working Capital (26) (185) 40 110 (120) (84) Less: Other income - - - - - - Direct taxes paid (17) (26) (31) (67) (60) (49) Cash Flow from Operations 44 (45) 139 214 55 135 (Inc.)/ Dec. in Fixed Assets 47 63 (64) (95) (18) (21) (Inc.)/ Dec. in Investments 20 (21) (78) 3 - - Inc./ (Dec.) in loans and advances - - - - - - Other income - - - - - - Cash Flow from Investing 67 42 (142) (91) (18) (21) Issue of Equity - - - 1 - - Inc./(Dec.) in loans (78) 11 37 (74) (8) - Dividend Paid (Incl. Tax) (13) (19) (30) (44) (15) (57) Others (11) (4) (3) (3) (0) - Cash Flow from Financing (102) (13) 3 (120) (24) (57) Inc./(Dec.) in Cash 9 (15) (0) 3 14 57 Opening Cash balances 13 23 8 8 12 24 Closing Cash balances 22 8 8 11 25 80 October 18, 2010 10

- 11. Rallis India | 2QFY2011 Result Update Key Ratios Y/E March FY07 FY08 FY09 FY10 FY11E FY12E Valuation Ratio (x) P/E (on FDEPS) - 83.1 39.5 27.9 19.2 15.0 P/CEPS 102.5 50.2 29.1 23.5 16.6 13.0 P/BV 20.5 11.6 9.7 6.5 5.3 4.4 Dividend yield (%) 0.4 0.8 0.8 0.8 1.2 1.5 EV/Sales 4.1 3.8 2.9 2.9 2.4 1.9 EV/EBITDA 190.3 43.6 18.4 15.1 12.4 10.5 EV / Total Assets 10.3 7.3 5.8 6.1 5.1 4.1 Per Share Data (`) EPS (Basic) - 17.0 35.7 50.7 73.5 94.4 EPS (fully diluted) - 17.0 35.7 50.7 73.5 94.4 Cash EPS 13.8 28.1 48.5 60.1 85.3 108.6 DPS 5.3 10.7 10.7 12.0 16.7 20.7 Book Value 69.0 122.1 145.4 217.7 265.2 323.4 Dupont Analysis EBIT margin - 5.8 13.3 17.4 17.0 16.3 Tax retention ratio 106.5 84.8 66.7 67.7 67.8 76.6 Asset turnover (x) 5.5 2.4 2.6 2.9 3.2 3.2 ROIC (Post-tax) - 11.6 22.9 33.9 36.9 40.4 Cost of Debt (Post Tax) 15.3 8.9 3.2 5.4 5.4 - Leverage (x) 0.4 0.2 - - - - Operating ROE - 24.9 22.9 33.9 36.9 40.4 Returns (%) ROCE (Pre-tax) - 13.0 28.9 36.2 39.5 37.6 Angel ROIC (Pre-tax) - 11.7 39.4 79.9 51.7 51.3 ROE - 11.8 19.6 25.5 30.4 32.1 Turnover ratios (x) Asset Turnover (Gross Block) 2 2 3 3 3 3 Inventory / Sales (days) 80 74 63 60 57 62 Receivables (days) 52 52 46 39 37 47 Payables (days) 123 105 86 115 106 97 Working capital cycle (ex-cash) (days) 26 44 45 19 16 34 Solvency ratios (x) Net debt to equity 0.4 0.2 - - - - Net debt to EBITDA 3.4 0.8 - - - - Interest Coverage (EBIT / Interest) - 3.2 10.6 29.3 - - October 18, 2010 11

- 12. Rallis India | 2QFY2011 Result Update Research Team Tel: 022 - 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement Rallis India 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below Rs 1 lakh for Angel, its Group companies and Directors Ratings (Returns): Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%) Reduce (-5% to 15%) Sell (< -15%) October 18, 2010 12