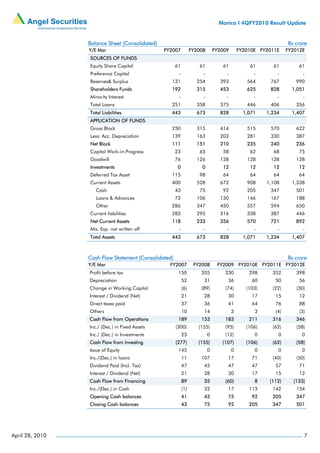

Marico reported disappointing quarterly results, with top-line growth of only 6% year-over-year and flat earnings growth, below estimates. However, a significant gross margin expansion of 644 basis points year-over-year was a positive surprise. While underlying volume growth remained strong at 14%, top-line growth was constrained by price cuts. The outlook remains neutral given concerns around value growth and slowing growth at Kaya.