BHEL posts 42% rise in Q1 PAT on lower costs

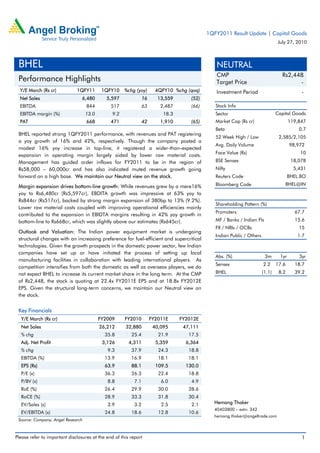

- 1. 1QFY2011 Result Update | Capital Goods July 27, 2010 BHEL NEUTRAL CMP Rs2,448 Performance Highlights Target Price - Y/E March (Rs cr) 1QFY11 1QFY10 %chg (yoy) 4QFY10 %chg (qoq) Investment Period - Net Sales 6,480 5,597 16 13,559 (52) EBITDA 844 517 63 2,487 (66) Stock Info EBITDA margin (%) 13.0 9.2 18.3 Sector Capital Goods PAT 668 471 42 1,910 (65) Market Cap (Rs cr) 119,847 Beta 0.7 BHEL reported strong 1QFY2011 performance, with revenues and PAT registering 52 Week High / Low 2,585/2,105 a yoy growth of 16% and 42%, respectively. Though the company posted a Avg. Daily Volume 98,972 modest 16% yoy increase in top-line, it registered a wider-than-expected Face Value (Rs) 10 expansion in operating margin largely aided by lower raw material costs. Management has guided order inflows for FY2011 to be in the region of BSE Sensex 18,078 Rs58,000 – 60,000cr and has also indicated muted revenue growth going Nifty 5,431 forward on a high base. We maintain our Neutral view on the stock. Reuters Code BHEL.BO Margin expansion drives bottom-line growth: While revenues grew by a mere16% Bloomberg Code BHEL@IN yoy to Rs6,480cr (Rs5,597cr), EBDITA growth was impressive at 63% yoy to Rs844cr (Rs517cr), backed by strong margin expansion of 380bp to 13% (9.2%). Shareholding Pattern (%) Lower raw material costs coupled with improving operational efficiencies mainly Promoters 67.7 contributed to the expansion in EBIDTA margins resulting in 42% yoy growth in bottom-line to Rs668cr, which was slightly above our estimates (Rs645cr). MF / Banks / Indian Fls 15.6 FII / NRIs / OCBs 15 Outlook and Valuation: The Indian power equipment market is undergoing Indian Public / Others 1.7 structural changes with an increasing preference for fuel-efficient and supercritical technologies. Given the growth prospects in the domestic power sector, few Indian companies have set up or have initiated the process of setting up local Abs. (%) 3m 1yr 3yr manufacturing facilities in collaboration with leading international players. As Sensex 2.2 17.6 18.7 competition intensifies from both the domestic as well as overseas players, we do not expect BHEL to increase its current market share in the long term. At the CMP BHEL (1.1) 8.2 39.2 of Rs2,448, the stock is quoting at 22.4x FY2011E EPS and at 18.8x FY2012E EPS. Given the structural long-term concerns, we maintain our Neutral view on the stock. Key Financials Y/E March (Rs cr) FY2009 FY2010 FY2011E FY2012E Net Sales 26,212 32,880 40,095 47,111 % chg 35.8 25.4 21.9 17.5 Adj. Net Profit 3,126 4,311 5,359 6,364 % chg 9.3 37.9 24.3 18.8 EBITDA (%) 13.9 16.9 18.1 18.1 EPS (Rs) 63.9 88.1 109.5 130.0 P/E (x) 36.3 26.3 22.4 18.8 P/BV (x) 8.8 7.1 6.0 4.9 RoE (%) 26.4 29.9 30.0 28.6 RoCE (%) 28.9 33.3 31.8 30.4 EV/Sales (x) 3.9 3.2 2.5 2.1 Hemang Thaker 40403800 – extn: 342 EV/EBITDA (x) 24.8 18.6 12.8 10.6 hemang.thaker@angeltrade.com Source: Company, Angel Research Please refer to important disclosures at the end of this report 1

- 2. 1QFY2011 Result Update |BHEL Exhibit 1: 1QFY2011 performance Y/E March (Rs cr) 1QFY11 1QFY10 % chg 4QFY10 % chg Net Sales 6,480 5,597 16 13,559 (52) Raw Material 3,809 3,545 7 8,027 (53) (% of Net Sales) 58.8 63.3 59.2 Employee Cost 1,338 1,114 20 1,743 (23) (% of Net Sales) 20.6 19.9 12.9 Other Expenses 489 421 16 1,301 (62) (% of Net Sales) 7.5 7.5 9.6 Total Expenditure 5,636 5,080 11 11,072 (49) EBITDA 844 517 63 2,487 (66) EBITDA (%) 13.0 9.2 18.3 Interest 4 4 18 (78) Depreciation 127 96 32 165 (23) Other Income 285 302 (6) 594 (52) Profit before Tax 998 719 39 2,898 (66) (% of Net Sales) 15.4 12.8 21.4 Total Tax 330 248 33 989 (67) (% of PBT) 33 34.5 34.1 Reported PAT 668 471 42 1,910 (65) Source: Company, Angel Research Operating efficiency drives bottom line; Net profit up 42%: BHEL posted moderate revenue growth of 16% for 1QFY2011. The bottom line grew mainly on account of lower raw-material costs. As a percentage of sales, raw-material costs declined sharply by 450bp yoy to 58.8% (63.3%) for 1QFY2011. Consequently, operating margin (EBIT) expanded sharply by 350bp yoy to 11% (7.5%) in 1QFY2011. (Notably, BHEL has managed raw-material costs at 55–59% of net sales, except for 3QFY2010 and 4QFY2010; however, an uptick in material prices for FY2011 will brew concerns regarding the company’s profitability). The bottom line grew by 42% yoy to Rs668cr (Rs471cr) in 1QFY2011, driven by better operating efficiencies and lower taxation. Exhibit 2: Raw-material cost as a percentage of net sales 66 64.0 64 63.3 62 59.5 59.2 60 58.5 58.2 58.8 57.3 58 (%) 55.5 56 54 52 50 1QFY09 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 Source: Company, Angel Research July 27, 2010 2

- 3. 1QFY2011 Result Update |BHEL Exhibit 3: Segment-wise performance Y/E March (Rs cr) 1QFY11 1QFY10 % chg 4QFY10 % chg Revenue Power 5,400 4,568 18.2 11,155 (52) Industry 1,476 1,333 10.7 3,149 (53) Total Revenue 6,876 5,901 16.5 14,304 (52) EBIT Power 1070 828 29.2 3,058 (65) Industry 170 162 4.9 805 (79) Total EBIT 1240 990 25.3 3,863 (68) Revenues mix (%) Power 78.5 77.4 Industry 21.5 22.6 EBIT Margin (%) Power 19.8 18.1 Industry 11.5 12.2 Source: Company, Angel Research During the quarter, the power division registered moderate 18.2% yoy top-line growth to Rs5,400cr (Rs4,568cr). BHEL’s industry division, on the other hand, continued to be under pressure and registered a sedate growth rate of 10.7% yoy, reaching Rs1,476cr (Rs1,333cr). OPM of the power division improved during the quarter, increasing by 170bp to 19.8% (18.1%). This was mainly due to lower raw-material costs during the quarter. However, the industry division’s OPM declined by 70bp yoy to 11.5% (12.2%) in 1QFY2011. Exhibit 4: Actual v/s Angel estimates Particulars (Rs cr) Actual Estimates Var. (%) Revenue 6,480 6,816 (4.9) Operating Profit 718 757 (5.2) PAT 668 645 3.6 EPS (Rs) 13.6 13.2 3.0 Source: Company, Angel Research Conference Call - Key highlights FY2011 order intake would amount between Rs58,000–60,000cr. The current delivery time for supercritical projects would be 46–52 months for 660MW capacity and 48–54 months for 800MW capacity. Capex for 1QFY2011 was about Rs400cr. Management has guided a capex of Rs1,600cr to augment from 15GW to 20GW of manufacturing capacity. Management expects to finalise the JV agreement with Toshiba by September 2010. For wind turbine generation, the company is in the final stages of signing a collaboration agreement. The company has identified the collaborator, which will be announced in 4–5 weeks. July 27, 2010 3

- 4. 1QFY2011 Result Update |BHEL Order inflow: The order inflow for 1QFY2011 was lower by 12.7% yoy to Rs10,824cr, as against Rs12,400cr for 1QFY2010. The power division accounted for an intake for Rs9,270cr, while the industrial and export segments accounted for the balance amount. The order book as of June 30, 2010, stood at Rs1,48,000cr. During 1QFY2011, BHEL secured the single largest Rs6,300cr mega contract for 1,600MW (2x800MW) supercritical thermal power project in Karnataka from Raichur Power Corporation (RPCL). RPCL is a joint venture (JV) company of Karnataka Power Corp (KPCL) and BHEL, which has been set up to build, own and operate thermal power plants with supercritical parameters in Karnataka. Significantly, this is the first order for a power project bagged by BHEL through a JV. Exhibit 5: Quarterly order inflow 25,000 22,614 20,000 15,580 16,000 14,500 14,500 15,107 15,000 (Rs cr) 12,400 10,824 10,000 8,017 5,000 - 1QFY09 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 Source: Company, Angel Research Exhibit 6: Quarterly order backlog 160,000 143,800 148,000 140,000 134,000 124,403 125,800 120,000 113,584 117,000 104,000 100,000 95,000 (Rs cr) 80,000 60,000 40,000 20,000 - 1QFY09 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 Source: Company, Angel Research Exhibit 7: Angel EPS forecast Year Angel forecast Bloomberg consensus Var. (%) FY2011E 109.5 113.0 (3.5) FY2012E 130.0 137.0 (5.1) Source: Company, Angel Research July 27, 2010 4

- 5. 1QFY2011 Result Update |BHEL Investment Arguments Stronghold in power equipment market: BHEL is the largest supplier of power equipment in India with a wide product portfolio consisting of boilers, gas turbines, fabric filters, steam generators, switch gears, among others. The company primarily caters to power-generating companies by offering steam turbines, generators, boilers and matching auxiliaries up to 800MW rating, including supercritical sets of 660/800MW. BHEL has facilities that can go up to 1,000MW of unit size. BHEL is the only Indian player manufacturing large-size, gas-based power plant equipment, comprising advanced-class gas turbines of up to 289MW (ISO) rating for open and combined-cycle operations. While competition is coming in from various players due to high prospects in the power sector, BHEL continues to be strong, especially in the boiler turbine generator (BTG) category, which forms a key part of the power plant. As a fully integrated power equipment player, BHEL enjoys a strong domestic presence in the power equipment market. Well positioned for future: The Indian power sector is likely to witness massive capacity additions of ~150,000MW over the next decade and BHEL, being the dominant domestic player, is expected to be the major beneficiary of the unfolding opportunities in the power equipment space. Of the 80,000MWs of BTG orders placed during the Eleventh Plan, BHEL’s market share had been ~55%. Approximately 62,500MW of BTG orders have been placed under the Twelfth Plan and BHEL has been able to garner ~53% of the same. Orders are yet to be placed for the balance portion of the Twelfth Plan capacity addition targets and we expect BHEL to maintain its existing market share going forward. Furthermore, the company is augmenting its manufacturing capacity from the current 15GW to 20GW, after having introduced new ratings of 150MW, 270MW, 525MW and 600MW in the sub-critical segment and 660MW and 800MW unit sizes in the supercritical segment. Strategic tie-ups to enhance competitive edge: The company is taking various initiatives, including strategic alliances through joint ventures (JV) in the supercritical technology and technology sourcing domains. To pursue inorganic growth, tie-ups are being identified in the areas of: a) transmission with a focus on 765kV and 1,200kV segments (JV with Toshiba for transmission products); b) photovoltaics (PV) with a focus on manufacturing silicon wafers, solar cells, modules and setting up a green-field PV project, c) nuclear, with a focus on building special nuclear reactors for which GE-Hitachi has signed an agreement with NPCIL and BHEL. Outlook and Valuation: The Indian power equipment market is undergoing structural changes with an increasing preference for fuel-efficient and supercritical technologies. Given the growth prospects in the domestic power sector, few Indian companies have set up or have initiated the process of setting up local manufacturing facilities in collaboration with leading international players. As competition intensifies from both the domestic as well as overseas players, we do not expect BHEL to increase its current market share in the long term. At the CMP of Rs2,448, the stock is quoting at 22.4x FY2011E EPS and at 18.8x FY2012E EPS. Given the structural long-term concerns, we maintain our Neutral view on the stock. July 27, 2010 5

- 6. 1QFY2011 Result Update |BHEL Exhibit 8: Key assumptions Particulars (%) FY2011E FY2012E Order Inflow Growth - Power (18) (12) Order Inflow Growth - Industry 25 25 Order Inflow Growth - Exports 15 15 Order Inflow Growth - Combined (6.3) 1.3 Order Backlog Growth - Combined 9.5 4.5 Order Book Ratios Order Book/Sales 3.8 3.4 Order Book/Fwd Sales 3.2 3.1 Order Book to Sales (%) 29.0 31.1 Source: Company, Angel Research Exhibit 9: One-year forward P/E band 3,500 3,000 2,500 2,000 1,500 1,000 500 0 Aug-04 Aug-09 Jun-05 Jun-10 Jul-07 Dec-02 May-03 Jan-05 Dec-07 May-08 Jan-10 Apr-06 Oct-03 Oct-08 Mar-04 Sep-06 Feb-07 Mar-09 Nov-05 Share Price (Rs) 5x 10x 15x 20x Source: Company, Angel Research Exhibit 10: Premium/Discount to Sensex P/E 110.0 90.0 70.0 50.0 30.0 10.0 (10.0) (30.0) (50.0) Jul-05 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Oct-05 Oct-06 Oct-07 Oct-08 Oct-09 Premium/Discount to Sensex Avg. Historical Premium Source: Company, Angel Research July 27, 2010 6

- 7. 1QFY2011 Result Update |BHEL Exhibit 11: Recommendation summary Upside FY2012E FY2012E FY2010-12E FY2012E FY2012E Company Reco. CMP (Rs) Tgt Price (%) P/BV (x) P/E (x) EPS CAGR (%) RoCE (%) RoE (%) ABB* Neutral 814 - - 4.4 28.1 35.3 28.8 21.1 Areva T&D* Neutral 288 - - 4.9 29.2 11.3 26.9 22.8 BHEL Neutral 2,448 - - 4.9 18.8 21.5 30.4 28.6 Crompton Greaves Buy 275 307 11.6 4.4 16.4 7.2 34.0 27.3 Jyoti Structures Buy 163 215 31.9 1.9 9.1 21.4 27.6 20.6 KEC International Buy 495 648 30.9 2.4 9.5 22.3 27.7 26.2 Thermax Neutral 765 - - 5.5 20.9 30.9 39.4 29.7 Source: Company, Angel Research July 27, 2010 7

- 8. 1QFY2011 Result Update |BHEL Profit & Loss Statement Y/E March (Rs cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Net Sales 17,238 19,305 26,212 32,880 40,095 47,111 % chg 28.9 12.0 35.8 25.4 21.9 17.5 Net Raw Materials 9,487 10,662 16,030 19,307 24,045 28,841 Other Mfg costs 2,181 2,754 3,555 2,854 3,308 3,891 Personnel 2,369 2,608 2,984 5,153 5,495 5,829 Other - - - - - - Total Expenditure 14,038 16,024 22,569 27,315 32,847 38,562 EBITDA 3,200 3,281 3,643 5,566 7,247 8,549 % chg 40.2 2.5 11.1 52.8 30.2 18.0 (% of Net Sales) 18.6 17.0 13.9 16.9 18.1 18.1 Depreciation& 273 297 334 458 579 686 Amortisation EBIT 2,927 2,984 3,309 5,108 6,668 7,863 % chg 43.7 1.9 10.9 54.4 30.5 17.9 (% of Net Sales) 17.0 15.5 12.6 15.5 16.6 16.7 Interest & other 43 35 31 34 35 35 Charges Other Income 824 1,445 1,497 1,516 1,612 1,956 (% of PBT) 22.2 32.9 31.4 23.0 19.5 20.0 Others - - - - - - Recurring PBT 3,707 4,393 4,776 6,591 8,245 9,784 % chg 46.9 18.5 8.7 38.0 25.1 18.7 Extraordinary (28.9) (37.4) (73.1) - - - Expense/(Inc.) PBT (reported) 3,736 4,430 4,849 6,591 8,245 9,784 Tax 1,321.4 1,571.1 1,710.6 2,280.0 2,885.7 3,424.5 (% of PBT) 35.4 35.5 35.3 34.6 35.0 35.0 PAT (reported) 2,415 2,859 3,138 4,311 5,359 6,360 Add: Share of earnings - - - - - - of associate Less: Minority interest - - - - - - (MI) Prior period items - - - - - - PAT after MI (reported) 2,415 2,859 3,138 4,311 5,359 6,360 ADJ. PAT 2,414 2,860 3,126 4,311 5,359 6,360 % chg 44.1 18.5 9.3 37.9 24.3 18.7 (% of Net Sales) 14.0 14.8 11.9 13.1 13.4 13.5 Basic EPS (Rs) 98.6 58.4 63.9 88.1 109.5 129.9 Fully Diluted EPS (Rs) 49.3 58.4 63.9 88.1 109.5 129.9 % chg 44.1 18.5 9.3 37.9 24.3 18.7 July 27, 2010 8

- 9. 1QFY2011 Result Update |BHEL Balance Sheet Y/E March (Rs cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E SOURCES OF FUNDS Equity Share Capital 245 490 490 490 490 490 Preference Capital - - - - - - Reserves& Surplus 8,544 10,285 12,449 15,426 19,353 24,166 Shareholders’ Funds 8,788 10,774 12,939 15,915 19,842 24,656 Minority Interest - - - - - - Total Loans 89 95 149 128 128 128 Deferred Tax Liability (935) (1,338) (1,840) (1,527) (1,527) (1,527) Total Liabilities 7,942 9,531 11,248 14,516 18,443 23,257 APPLICATION OF FUNDS Gross Block 4,135 4,443 5,225 7,827 8,722 10,877 Less: Acc. Depreciation 3,146 3,462 3,754 4,171 4,750 5,436 Net Block 989 981 1,470 3,656 3,971 5,440 Capital Work-in-Progress 303 658 1,157 289 895 239 Goodwill - - - - - - Investments 8 8 52 80 80 80 Current Assets 20,980 27,906 36,901 42,933 50,897 58,786 Cash 5,809 8,386 10,315 9,788 12,632 15,091 Loans & Advances 1,141 1,388 2,424 2,814 3,208 3,769 Other 200 421 350 407 392 505 Current liabilities 14,337 20,022 28,333 32,442 37,400 41,289 Net Current Assets 6,643 7,884 8,568 10,491 13,497 17,497 Mis. Exp. not written off - - - - - - Total Assets 7,942 9,531 11,248 14,516 18,443 23,257 July 27, 2010 9

- 10. 1QFY2011 Result Update |BHEL Cash Flow Statement Y/E March (Rs cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Profit before tax 3,736 4,430 4,849 6,591 8,245 9,784 Depreciation 273 297 334 458 579 686 (Inc)/Dec in Working Capital 1,043 1,336 1,244 (2,450) (163) (1,540) Less: Other income 447 1,023 983 1,516 970 1,202 Direct taxes paid 1,484 1,974 2,213 2,280 2,886 3,425 Others 42 30 (18) (41) - - Cash Flow from Operations 3,163 3,097 3,214 762 4,805 4,303 (Inc.)/Dec.in Fixed Assets (431) (664) (1,280) (1,734) (1,500) (1,500) (Inc.)/Dec. in Investments - - (44) (27) - - Other income 447 1,023 983 1,516 970 1,202 Cash Flow from Investing 16 359 (341) (245) (530) (298) Issue of Equity - - - - - - Inc./(Dec.) in loans (469) 6 54 (22) - - Dividend Paid (Incl. Tax) 692 873 974 1,334 1,432 1,546 Others (343) (11) (24) 313 - - Cash Flow from Financing (1,161) (868) (919) (1,356) (1,432) (1,546) Inc./(Dec.) in Cash 1,675 2,577 1,929 (527) 2,844 2,459 Opening Cash balances 4,134 5,809 8,386 10,315 9,788 12,632 Closing Cash balances 5,809 8,386 10,315 9,788 12,632 15,091 July 27, 2010 10

- 11. 1QFY2011 Result Update |BHEL Key Ratios Y/E March FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Valuation Ratio (x) P/E (on FDEPS) 49.6 41.9 38.3 27.8 22.4 18.8 P/CEPS 44.6 38.0 34.6 25.1 20.2 17.0 P/BV 13.6 11.1 9.3 7.5 6.0 4.9 Dividend yield (%) 1.0 0.6 0.7 1.0 1.0 1.1 EV/Sales 6.6 5.8 4.2 3.3 2.5 2.1 EV/EBITDA 31.9 30.1 26.4 19.8 12.8 10.6 EV/Total Assets 12.9 10.3 8.4 6.9 5.1 4.0 Per Share Data (Rs) EPS (Basic) 98.6 58.4 63.9 88.1 109.5 129.9 EPS (fully diluted) 49.3 58.4 63.9 88.1 109.5 129.9 Cash EPS 54.9 64.5 70.7 97.4 121.3 143.9 DPS 24.5 15.3 17.0 23.3 25.0 27.0 Book Value 179.5 220.1 264.3 325.1 405.3 503.7 Dupont Analysis EBIT margin (%) 17.0 15.5 12.6 15.5 16.6 16.7 Tax retention ratio 0.6 0.6 0.6 0.7 0.7 0.7 Asset turnover (x) 5.1 7.0 10.1 7.4 6.0 5.6 ROIC (Post-tax) (%) 55.8 69.6 82.4 75.1 64.5 60.6 Cost of Debt (Post Tax) 8.6 24.8 16.3 15.8 17.8 17.8 (%) Leverage (x) (0.7) (0.8) (0.8) (0.6) (0.6) (0.6) Operating RoE (%) 25.1 35.1 30.2 38.8 34.9 34.5 Returns (%) RoCE (Pre-tax) 39.5 34.5 31.9 35.1 40.6 38.5 Angel RoIC (Pre-tax) 105.0 148.9 226.2 137.1 119.3 109.5 RoE 30.0 29.2 26.4 29.9 30.0 28.6 Turnover ratios (x) Asset Turnover (Gross 4.3 4.5 5.4 5.0 4.8 4.8 Block) Inventory / Sales (days) 84 94 95 95 94 92 Receivables (days) 178 204 195 204 200 195 Payables (days) 66 75 72 74 72 71 Working capital cycle 18 (9) (24) 8 8 19 (ex-cash) (days) Solvency ratios (x) Net debt to equity (0.7) (0.8) (0.8) (0.6) (0.6) (0.6) Net debt to EBITDA (1.6) (2.2) (2.5) (1.7) (1.6) (1.6) Interest Coverage (EBIT 76.2 96.2 124.5 152.5 208.8 246.2 / Interest) July 27, 2010 11

- 12. 1QFY2011 Result Update |BHEL Research Team Tel: 022 - 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement BHEL 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock Yes 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below Rs 1 lakh for Angel, its Group companies and Directors. Ratings (Returns) : Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%) Reduce (-5% to 15%) Sell (< -15%) July 27, 2010 12