The document provides an overview of operations research techniques. It discusses:

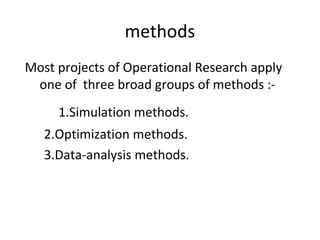

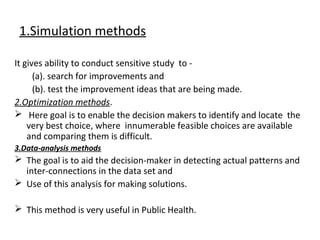

- Operations research aims to improve decision-making through methods like simulation, optimization, and data analysis.

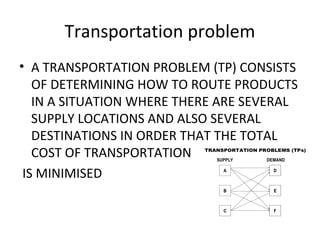

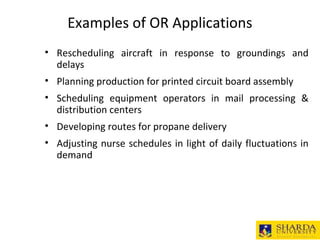

- Major applications include production scheduling, inventory control, transportation planning, and more.

- The techniques were developed in World War II and are now used widely in business for problems like resource allocation, forecasting, and process improvement.

![. IMPORTANT DEFINITIONS IN L.P.

Solution: A set of variables [X1,X2,...,Xn+m] is

called a solution to L.P. Problem if it satisfies its

constraints.

Feasible Solution: A set of variables

[X1,X2,...,Xn+m] is called a feasible solution to L.P.

Problem if it satisfies its constraints as well as non-

negativity restrictions

Optimal Feasible Solution: The basic feasible

solution that optimizes the objective function.

Unbounded Solution: If the value of the objective

function can be increased or decreased indefinitely,

the solution is called an unbounded solution](https://image.slidesharecdn.com/operationresearch-150115083732-conversion-gate01/85/Operation-research-complete-note-55-320.jpg)