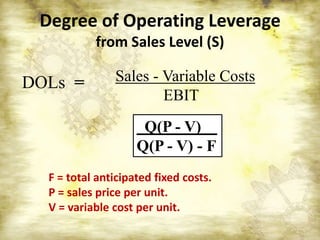

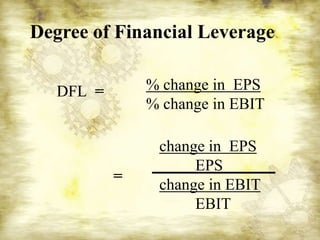

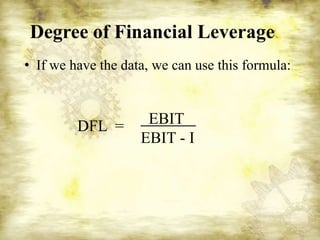

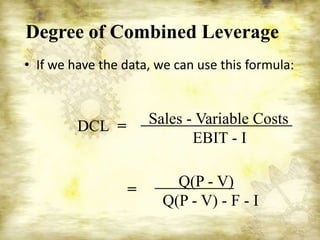

Leverage refers to using debt, borrowed money, or derivative instruments to amplify gains and losses from investments or business operations. There are two types of leverage: operating leverage, which is the use of fixed operating costs, and financial leverage, which is the use of fixed financing costs. The document defines various leverage metrics such as degree of operating leverage (DOL), degree of financial leverage (DFL), and degree of combined leverage (DCL) which measure how changes in sales, operating income, and earnings per share are amplified through the use of leverage.