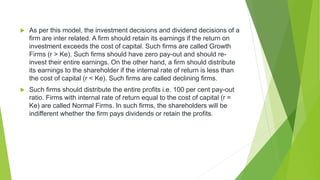

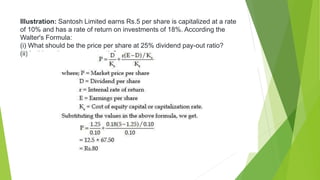

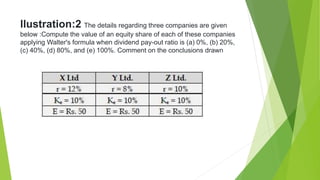

This document discusses dividend policy. It begins by defining dividends as the portion of a firm's profits distributed to shareholders. It then discusses factors that affect dividend policy, including earnings stability, financing needs, liquidity, competitive practices, past dividends, debt obligations, growth needs, and legal requirements. It also outlines different types of dividends such as cash, stock, bond, and property dividends. The document concludes by briefly introducing three dividend theories: Walter's model, Gordon's model, and Modigliani and Miller's hypothesis.

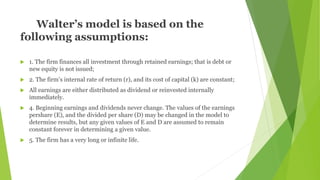

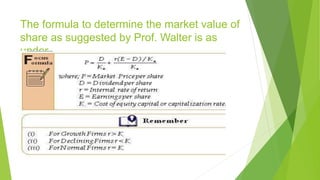

![Formula

P = [E (1-b)] / Ke-br

Where, P = price of a share

E = Earnings per share

b = retention ratio

1-b = proportion of earnings distributed as dividends

Ke = capitalization rate

Br = growth rate](https://image.slidesharecdn.com/dividendpolicy-210804060529/85/Dividend-policy-26-320.jpg)