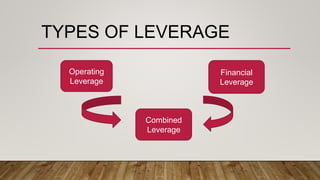

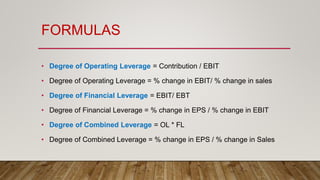

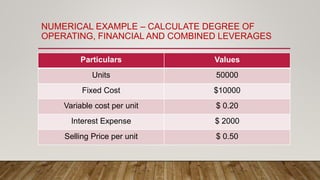

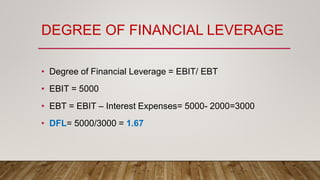

The document discusses various types of leverage in financial management, including operating leverage, financial leverage, and combined leverage, along with their formulas and calculations. It provides a numerical example to illustrate how to calculate these leverage degrees using specific values for sales, costs, and interest expenses, deriving insights on their implications for business leverage. Additionally, it explains the effects of changes in earnings before interest and tax (EBIT) and sales on earnings per share (EPS) using percentage increases.