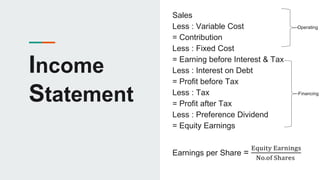

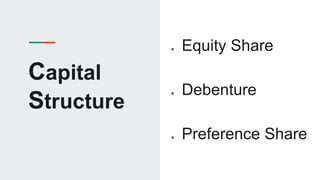

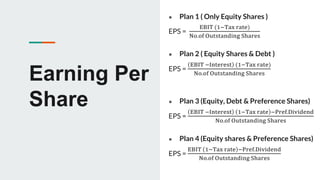

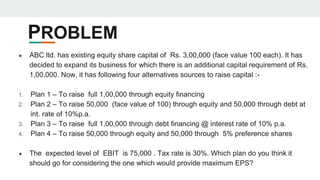

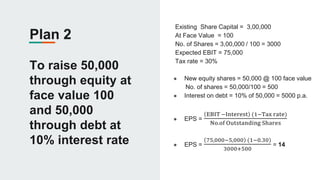

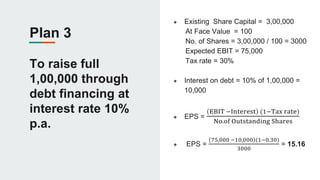

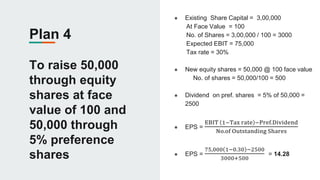

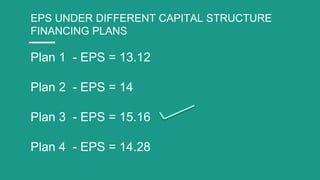

The document discusses ebit–eps analysis as a vital tool for optimizing capital structure to maximize shareholder earnings, detailing various capital financing options. It presents four plans for ABC Ltd. to raise an additional capital of Rs. 1,00,000, analyzing their respective earnings per share (EPS) under different financing structures. The findings suggest that raising all funds through debt financing yields the highest EPS at 15.16.