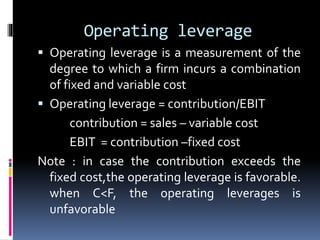

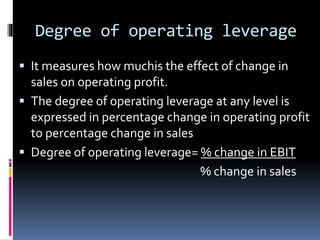

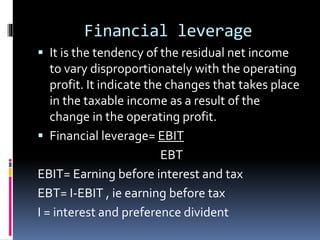

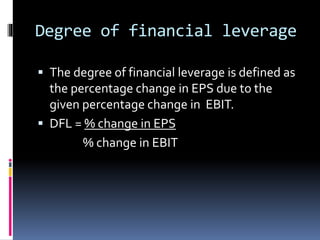

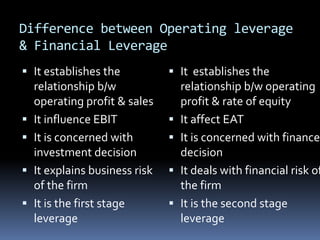

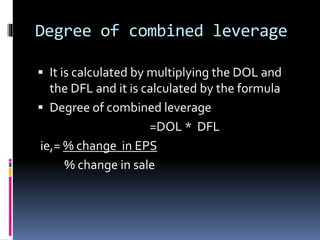

This document discusses different types of leverage used in business. There are three main types: operating leverage, financial leverage, and combined leverage. Operating leverage measures how fixed costs affect operating profit with changes in sales. Financial leverage shows how interest expenses affect net income. Combined leverage considers both operating and financial leverage and their combined impact on earnings per share with sales changes. The degree of each type of leverage can be calculated to understand the risk involved at different levels.