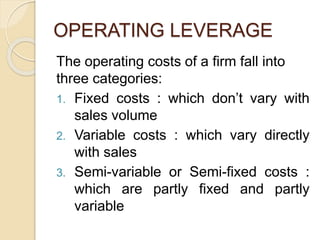

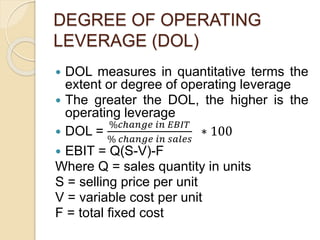

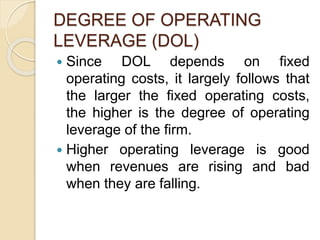

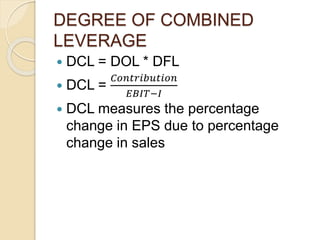

This document discusses different types of leverage used in business - operating, financial, and combined leverage. Operating leverage is related to fixed operating costs and how they magnify changes in sales on earnings. Financial leverage uses fixed financing costs to magnify the effect on earnings per share. Combined leverage is the product of operating and financial leverage. Degrees of leverage are defined to quantify the effects. Indifference points are discussed as the earnings level where leveraged vs unleveraged financing plans yield equal shareholder returns. Analysis of earnings-per-share for different financing options is based on expected earnings levels relative to the indifference point.

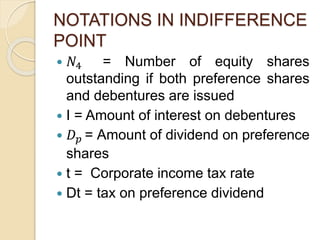

![DEGREE OF FINANCIAL

LEVERAGE (DFL)

DFL =

%𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝐸𝑃𝑆

% 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝐸𝐵𝐼𝑇

> 1

DFL =

𝐸𝐵𝐼𝑇

(𝐸𝐵𝐼𝑇−𝐼)

, when debt is used

DFL =

𝐸𝐵𝐼𝑇

(𝐸𝐵𝐼𝑇−𝐼−𝐷 𝑝) (1−𝑡)

, when debt

and preference capital is used

DFL =

𝐸𝐵𝐼𝑇

[𝐸𝐵𝐼𝑇−𝐼−(𝐷 𝑝+𝐷𝑡) (1−𝑡)]

, when

dividends paid on preference share

capital are subject to dividend tax](https://image.slidesharecdn.com/operatingfinancialcombinedleverage-170130081509/85/Operating-financial-and-combined-leverage-12-320.jpg)

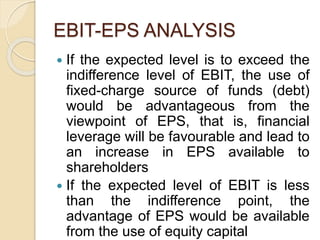

![EBIT-EPS ANALYSIS

On the basis of level of EBIT which

ensures identical market price for

alternative financial plans, the

indifference point can be symbolically

computed by

𝑃 𝐸1

𝑋 1−𝑡

𝑁1

= 𝑃 𝐸2[

𝑋−𝐼 1−𝑡 −𝐷 𝑝

𝑁2

]

Where

𝑃 𝐸1= 𝑃 𝐸 ratio of unlevered plan

𝑃 𝐸2 = 𝑃 𝐸 ratio of levered plan](https://image.slidesharecdn.com/operatingfinancialcombinedleverage-170130081509/85/Operating-financial-and-combined-leverage-23-320.jpg)