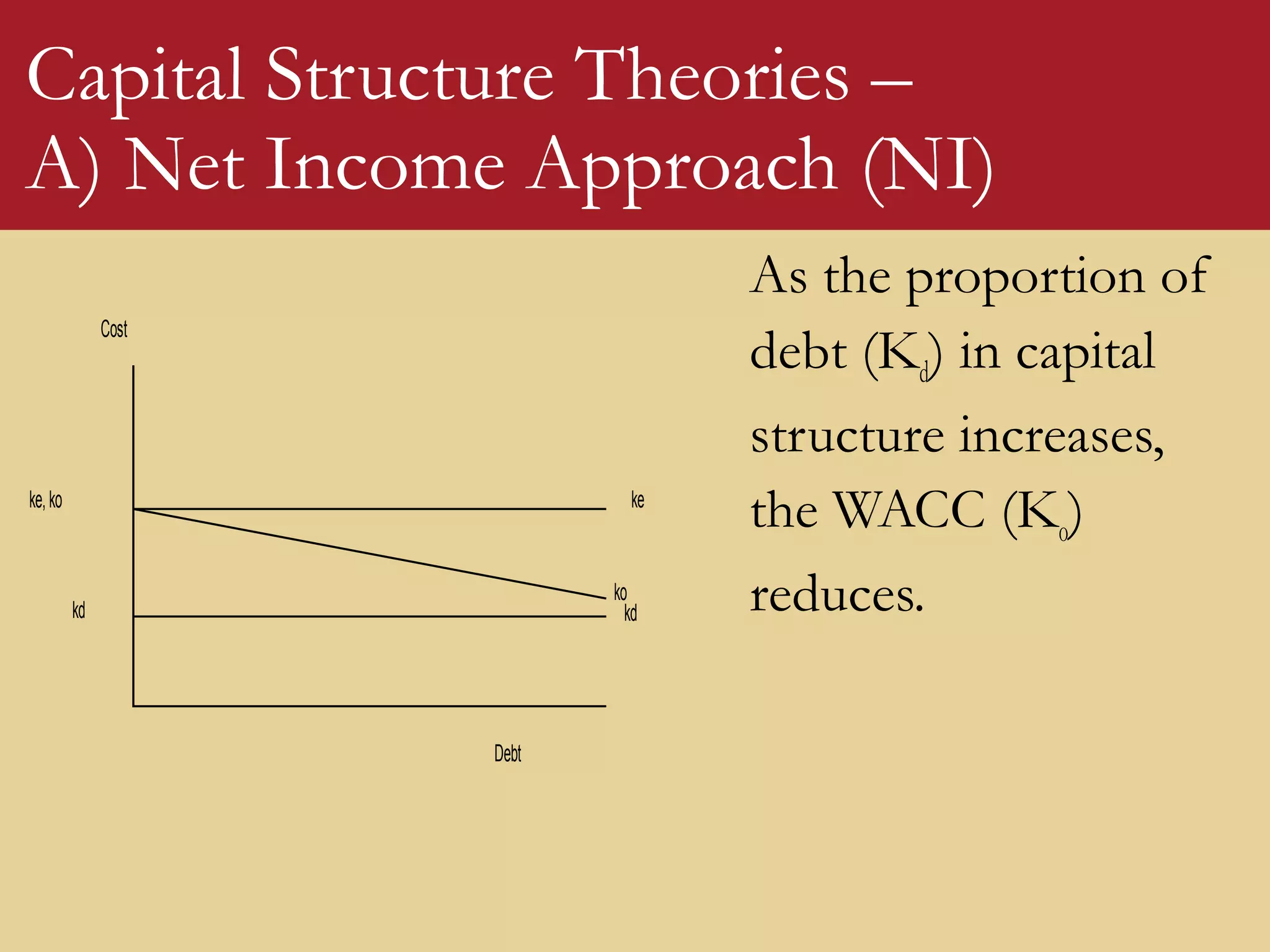

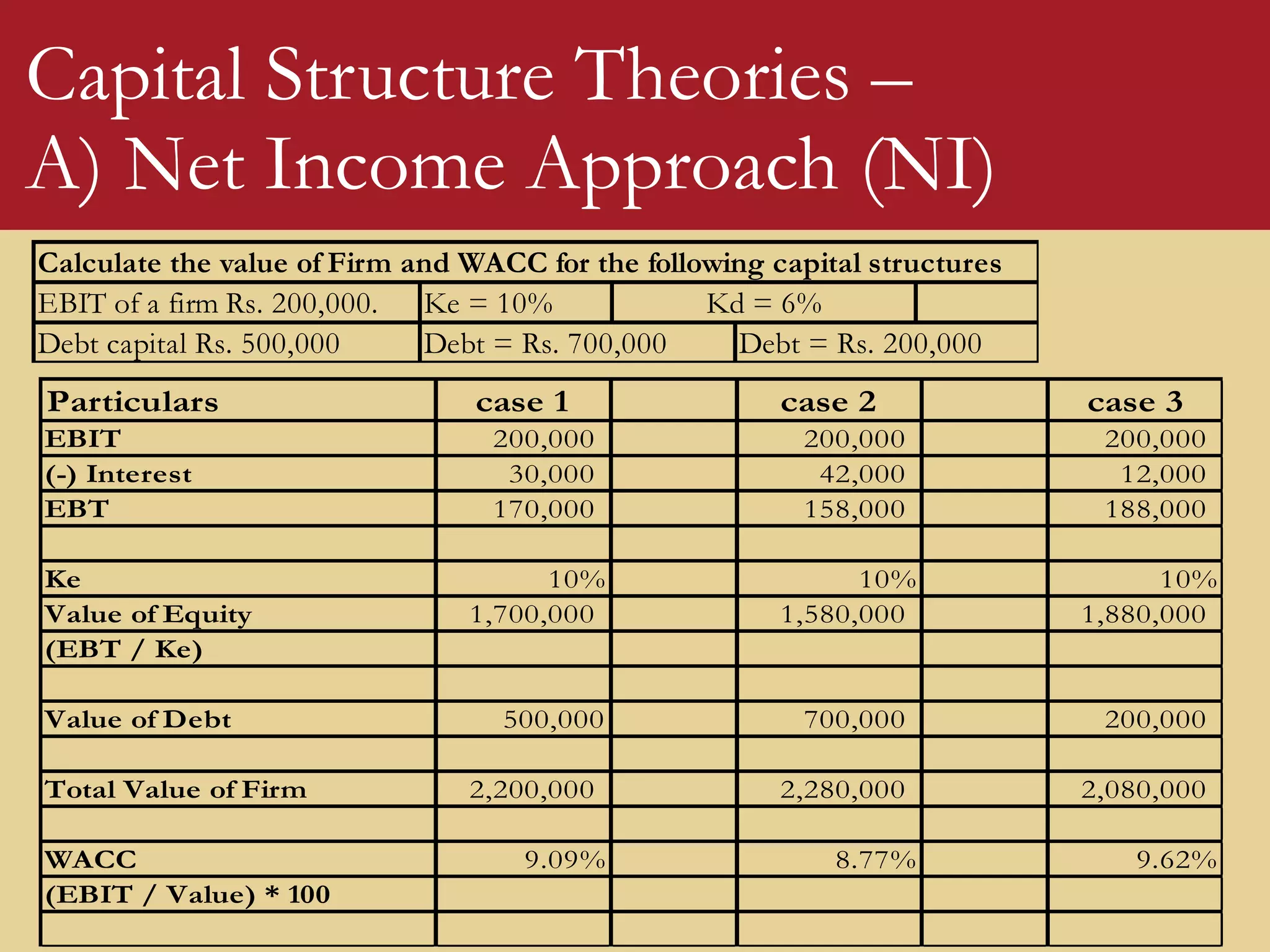

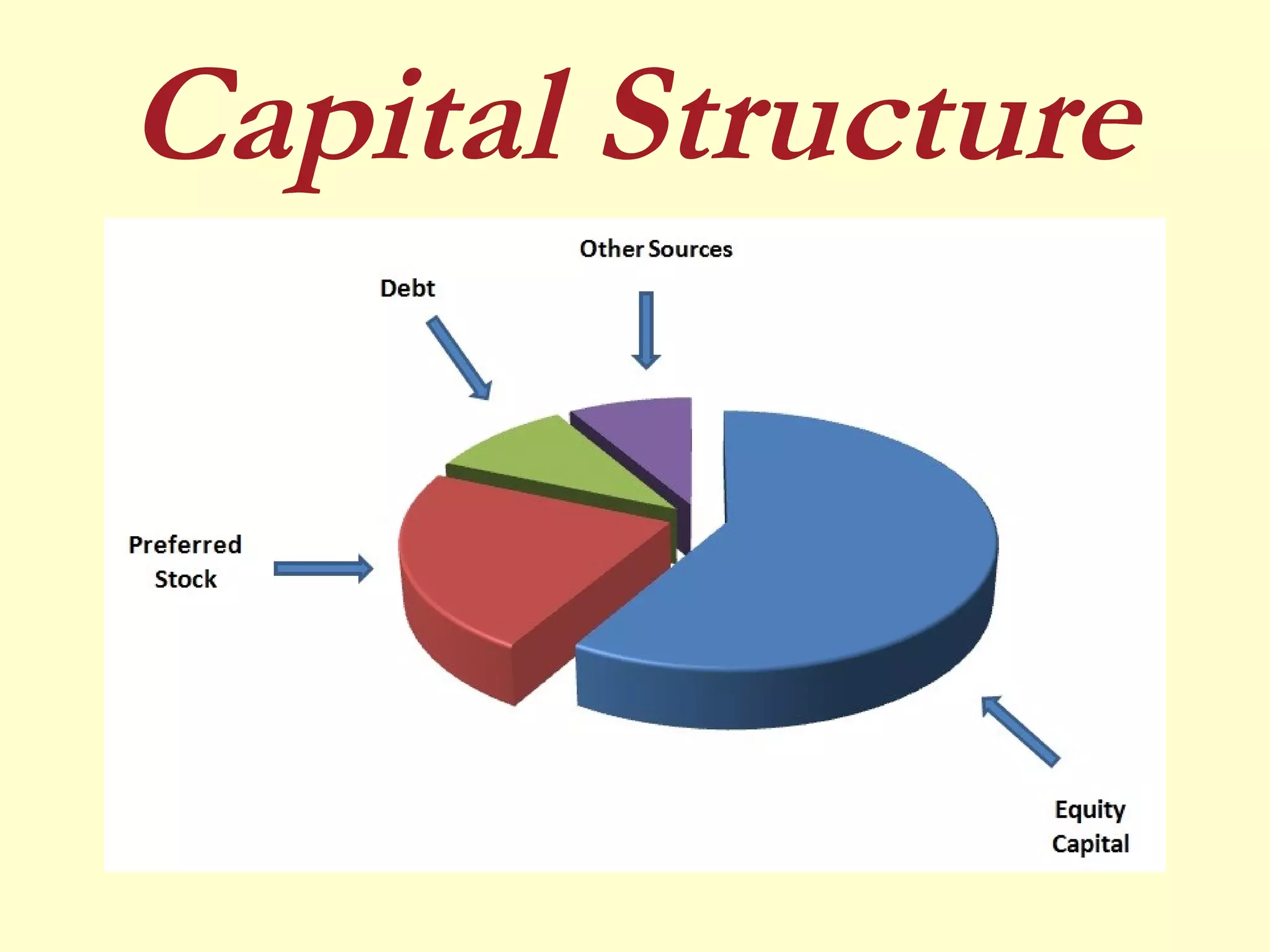

The document discusses capital structure, emphasizing its role in maximizing shareholders' wealth through the optimal mix of equity and debt, particularly focusing on concepts such as cost of capital (WACC), capital structure theories, and their implications on firm value. It outlines various approaches including the net income approach, net operating income approach, Modigliani-Miller model, and traditional approach, each presenting differing views on how capital structure influences value and cost of capital. Additionally, it provides examples illustrating the calculations of WACC and firm value under different capital structures.

![Capital Structure Theories –

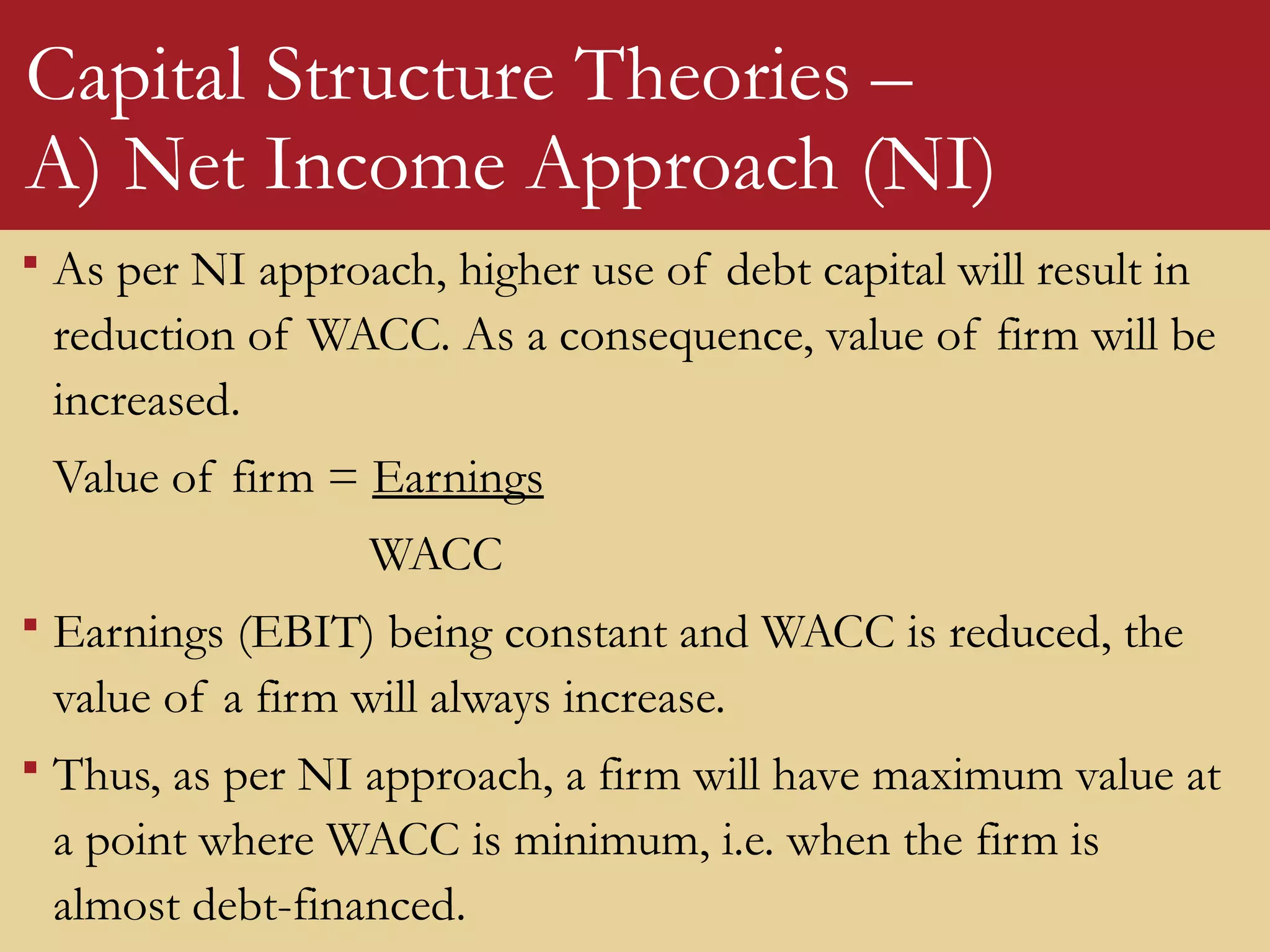

A) Net Income Approach (NI)

Net Income approach proposes that there is a definite

relationship between capital structure and value of the firm.

The capital structure of a firm influences its cost of capital

(WACC), and thus directly affects the value of the firm.

NI approach assumptions –

o NI approach assumes that a continuous increase in debt does

not affect the risk perception of investors.

o Cost of debt (Kd) is less than cost of equity (Ke) [i.e. Kd < Ke]

o Corporate income taxes do not exist.](https://image.slidesharecdn.com/capitalstructuretheories-160315053316/75/Capital-Structure-Theories-8-2048.jpg)