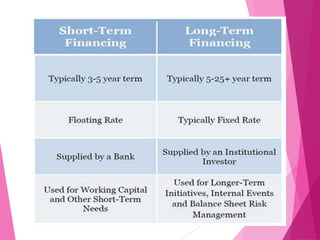

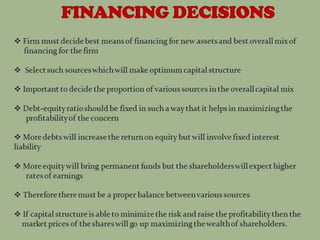

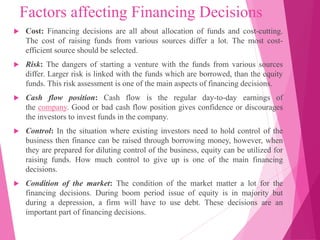

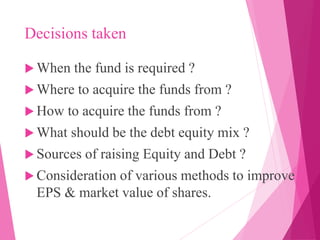

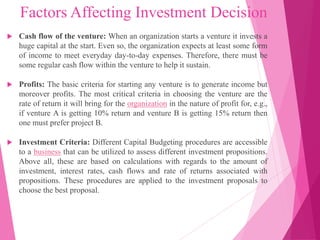

This document discusses four key finance decisions that businesses must make: funds required decision, financing decision, investment decision, and dividend decision. It provides details on each decision. The funds required decision involves estimating short-term and long-term capital needs. The financing decision is about acquiring funds and considers factors like cost, risk, and control. The investment decision relates to allocating funds raised and investing in assets. The dividend decision is about distributing profits to shareholders versus retaining earnings. Multiple factors influence each of these important financial decisions companies must undertake.