This document discusses different types of leverage used in financial analysis:

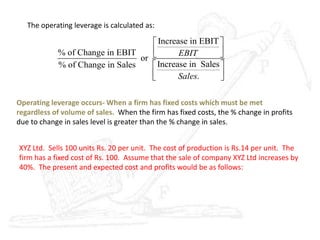

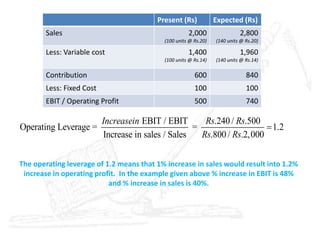

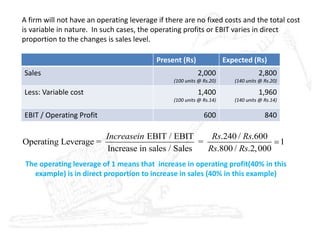

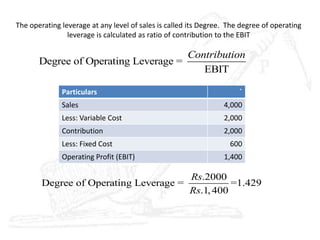

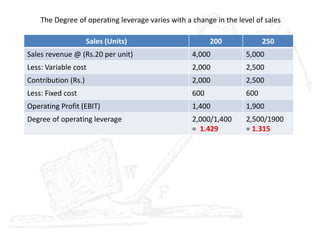

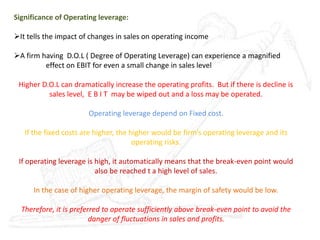

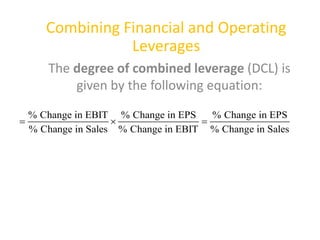

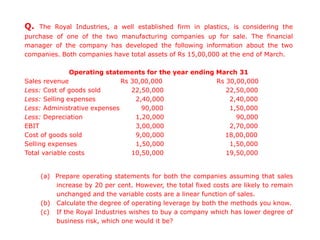

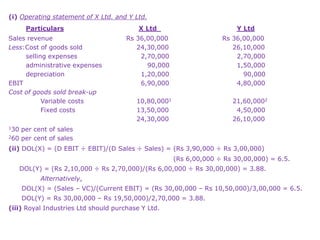

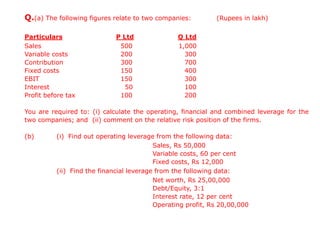

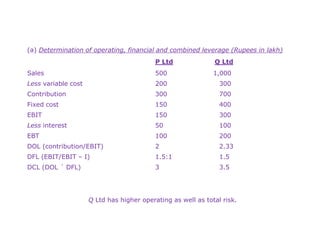

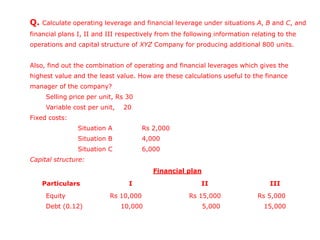

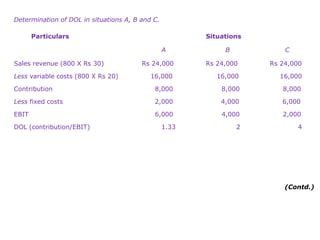

1. Operating leverage measures how fixed costs magnify changes in sales on earnings before interest and taxes (EBIT). It is calculated as the percentage change in EBIT divided by the percentage change in sales.

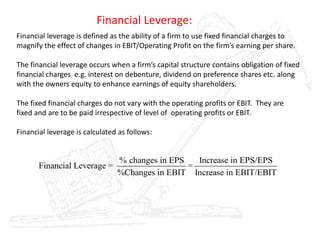

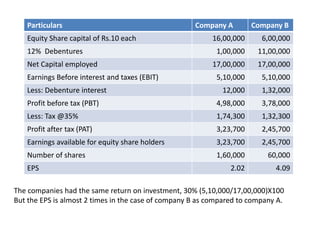

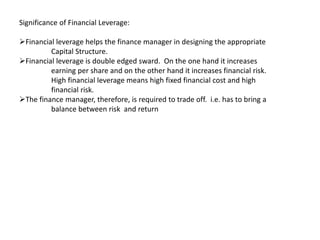

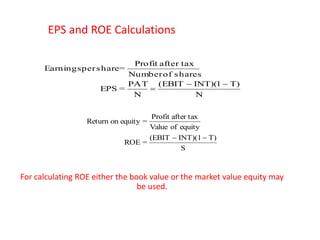

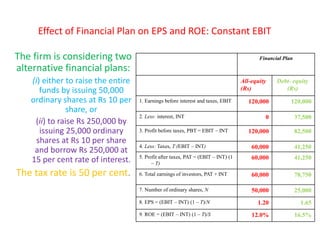

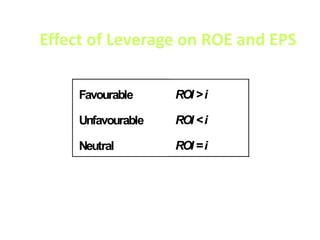

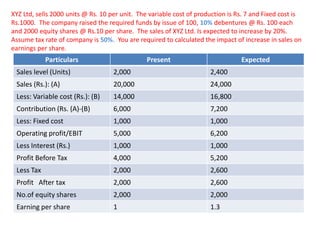

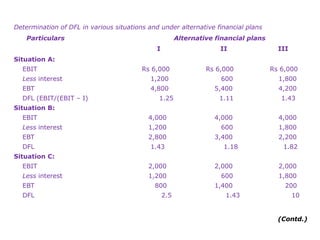

2. Financial leverage measures how fixed financial charges magnify the effect of changes in EBIT on earnings per share (EPS). It is calculated as the percentage change in EPS divided by the percentage change in EBIT.

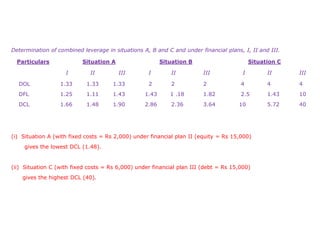

3. Combined leverage measures the combined effect of operating and financial leverage on EPS. It is calculated as the percentage change in EPS divided by the percentage change in sales.

The document provides examples and explanations of how to calculate