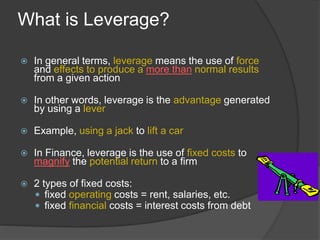

The document defines leverage as using fixed costs to magnify returns. There are two types of fixed costs: operating costs like rent and salaries, and financial costs like interest from debt. Leverage can increase risk but also returns. There are three types of leverage: operating, financial, and total. Operating leverage is the effect of fixed operating costs on income. Financial leverage is the effect of fixed financing costs like debt and preferred stock on earnings per share. Degree of operating leverage and degree of financial leverage measure the multiplier effect of each type of leverage. Examples using data from a levered company show that a 10% increase in sales would increase operating income by 17.14% due to operating leverage of 1.714, and operating income