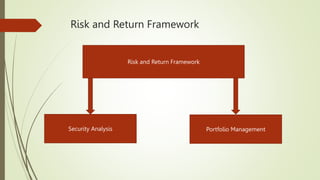

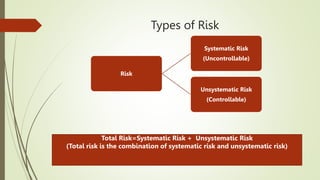

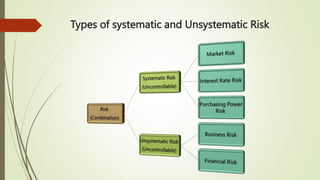

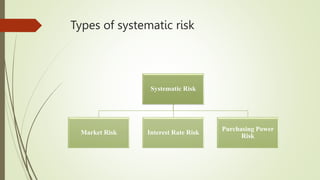

This document discusses risk and return from an investment perspective. It defines risk as the probability of getting a return less than expected, which can arise from unexpected changes in dividends, interest rates or stock prices. Risk is categorized as either systematic, stemming from broader economic and market forces outside an investor's control, or unsystematic, which is specific to a particular company. Systematic risk includes market risk, interest rate risk and purchasing power risk. Unsystematic risk includes business risk, related to company-specific operations, and financial risk, regarding a company's capital structure. Standard deviation is presented as a quantitative measure of risk, assessing the dispersion of returns around the expected mean return.