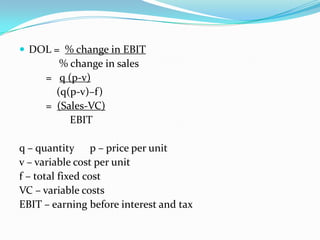

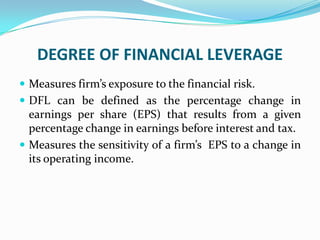

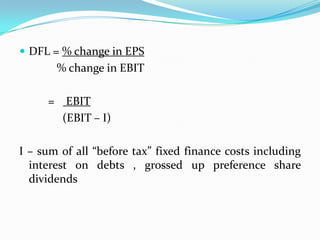

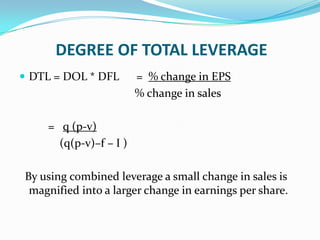

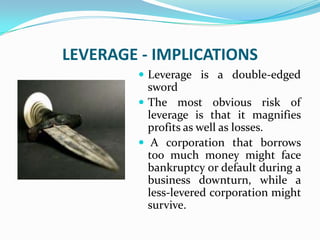

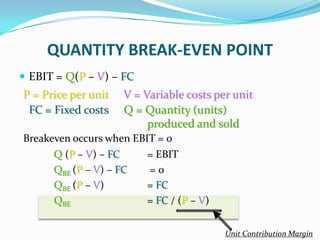

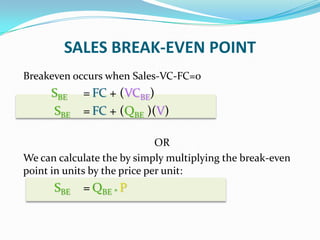

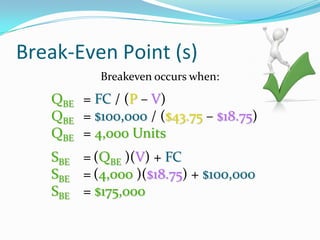

This document defines and explains various types of leverage including accounting, notional, economic, operating, and financial leverage. It also discusses degrees of operating leverage, financial leverage, and total leverage. Leverage involves using assets, equity, debt, or derivatives to multiply gains and losses. It allows firms to magnify returns but also increases risk. The document provides examples of calculating break-even points in units and sales. Operating leverage reflects the impact of revenue changes on profits while financial leverage depends on a firm's capital structure.