Leverage refers to the use of fixed costs by a firm to magnify the effects of changes in sales on profits. There are three types of leverage:

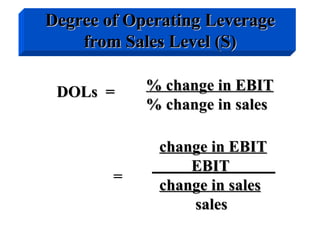

1) Operating leverage measures how changes in sales affect operating income (EBIT) due to fixed operating costs. A high degree of operating leverage means small sales changes have large effects on profits.

2) Financial leverage measures how changes in operating income (EBIT) affect earnings per share (EPS) due to fixed financing costs. A high degree of financial leverage means small profit changes significantly impact EPS.

3) Combined leverage considers how operating and financial leverage together magnify the effects of sales changes on EPS. The degree of combined leverage is the