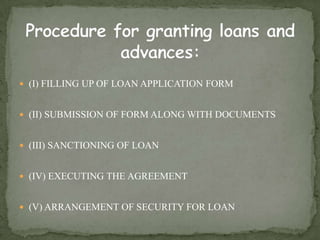

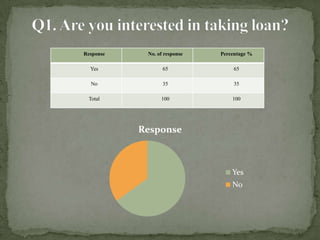

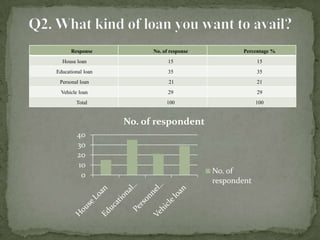

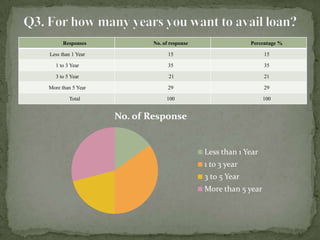

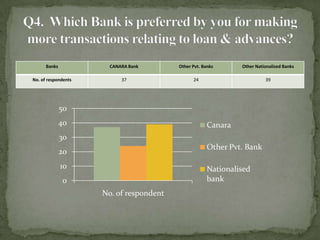

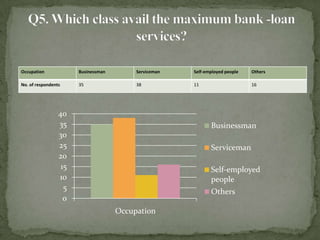

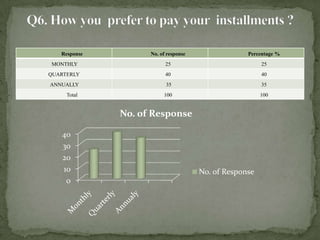

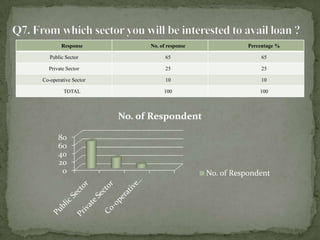

The document discusses various types of loans provided by banks including demand loans, term loans, secured loans, unsecured loans, overdrafts and bills discounted. It provides details on the process of obtaining a loan, including filling the application form, submitting documents, loan sanctioning, agreement execution and arranging security. Data from a survey on bank loans is presented, showing responses for loan type taken, loan amount, repayment period, bank chosen, occupation of borrowers and sector of lending banks. Common limitations of banks in lending and opportunities for improvement are also summarized.