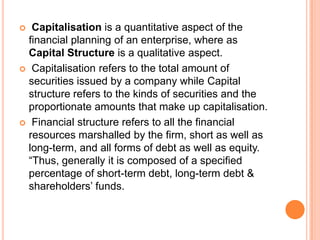

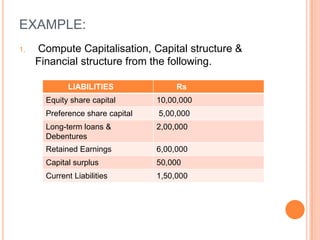

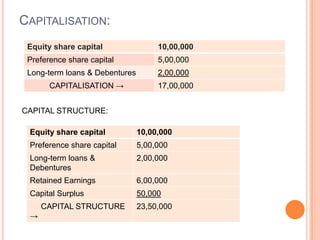

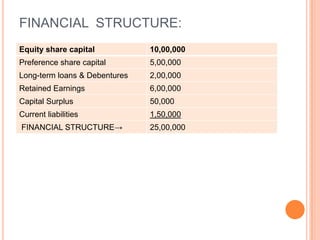

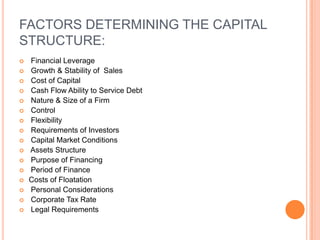

The document discusses capital structure, which refers to the proportion of debt, preferred stock, and common equity used to finance a company's assets. Capital structure includes long-term debt and stockholder equity. Capitalization refers to the total amount of securities issued, while capital structure refers to the types and proportions of securities. Financial structure includes all financial resources, both short- and long-term. An optimal capital structure maximizes share price and minimizes cost of capital. Factors that determine a company's capital structure include financial leverage, growth and stability of sales, cost of capital, cash flow ability, nature and size of the firm, control, flexibility, requirements of investors, and capital market conditions.

![Example of Trading on Equity

Able Company has an Equity capital of 1000

shares of Rs.100/- each fully paid & earns an

average profits of Rs.30,000 annually.

Now it wants to make an expansion & needs

another Rs.1,00,000. The company can either issue

new shares or raise loans @ 10%p.a{Assuming

same rate of profit}.

It is advisable to raise loans as by doing so

earnings per share will magnify.

The company shall pay only Rs.10,000 as interest

& profit expected shall be Rs.60,000[EBIT].

Profits left for shareholders[EBT] shall be

Rs.50,000. It is 50% return on the equity capital

against 30% return otherwise.

](https://image.slidesharecdn.com/capitalstructure-140125033108-phpapp02/85/Capital-structure-20-320.jpg)

![THEORIES:

Net Income Approach[NI]

Net Operating Income Approach[NOI]

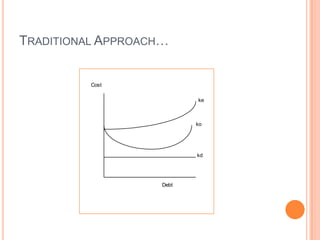

The Traditional Approach

Modiliani and Miller Approach

[MM Hypothesis]](https://image.slidesharecdn.com/capitalstructure-140125033108-phpapp02/85/Capital-structure-34-320.jpg)

![MM APPROACH WITHOUT TAX: PROPOSITION I

[THEORY OF IRRELEVANCE]

MM‟s Proposition I, states that the firm‟s value

is independent of its capital structure .The Total

value of firm must be constant irrespective of

the Degree of leverage(debt equity Ratio).

With personal leverage, shareholders can

receive exactly the same return, with the same

risk, from a levered firm and an unlevered firm.

Thus, they will sell shares of the over-priced

firm and buy shares of the under-priced firm.

This will continue till the market prices of

identical firms become identical. This is called

arbitrage.](https://image.slidesharecdn.com/capitalstructure-140125033108-phpapp02/85/Capital-structure-41-320.jpg)

![MM APPROACH [PROPOSITION I]

Cost

ko

Debt

MM's Proposition I](https://image.slidesharecdn.com/capitalstructure-140125033108-phpapp02/85/Capital-structure-42-320.jpg)

![MM APPROACH [PROPOSITION II]

Cost

ke

ko

kd

Debt

MM's Proposition II](https://image.slidesharecdn.com/capitalstructure-140125033108-phpapp02/85/Capital-structure-44-320.jpg)

![MM HYPOTHESIS WITH CORPORATE TAX

[THEORY OF RELEVANCE]

Under current laws in most countries, debt has an important

advantage over equity: interest payments on debt are tax

deductible, whereas dividend payments and retained

earnings are not. Investors in a levered firm receive in the

aggregate the unlevered cash flow plus an amount equal to

the tax deduction on interest. Capitalising the first

component of cash flow at the all-equity rate and the second

at the cost of debt shows that the value of the levered firm is

equal to the value of the unlevered firm plus the interest tax

shield which is tax rate times the debt.

It is assumed that the firm will borrow the same amount of

debt in perpetuity and will always be able to use the tax

shield. Also, it ignores bankruptcy and agency costs.](https://image.slidesharecdn.com/capitalstructure-140125033108-phpapp02/85/Capital-structure-45-320.jpg)