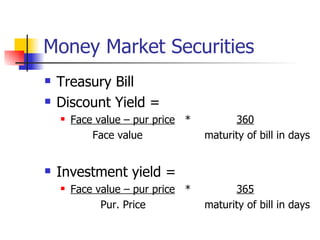

The document organizes various methods for investing financial assets into direct investing, indirect investing, and different asset classes. Direct investing involves individuals purchasing securities directly, while indirect investing involves purchasing shares of investment companies that hold portfolios of securities. The document further breaks down the different asset classes an investor may choose from, including money market securities, fixed income securities, equity securities, and derivative securities.