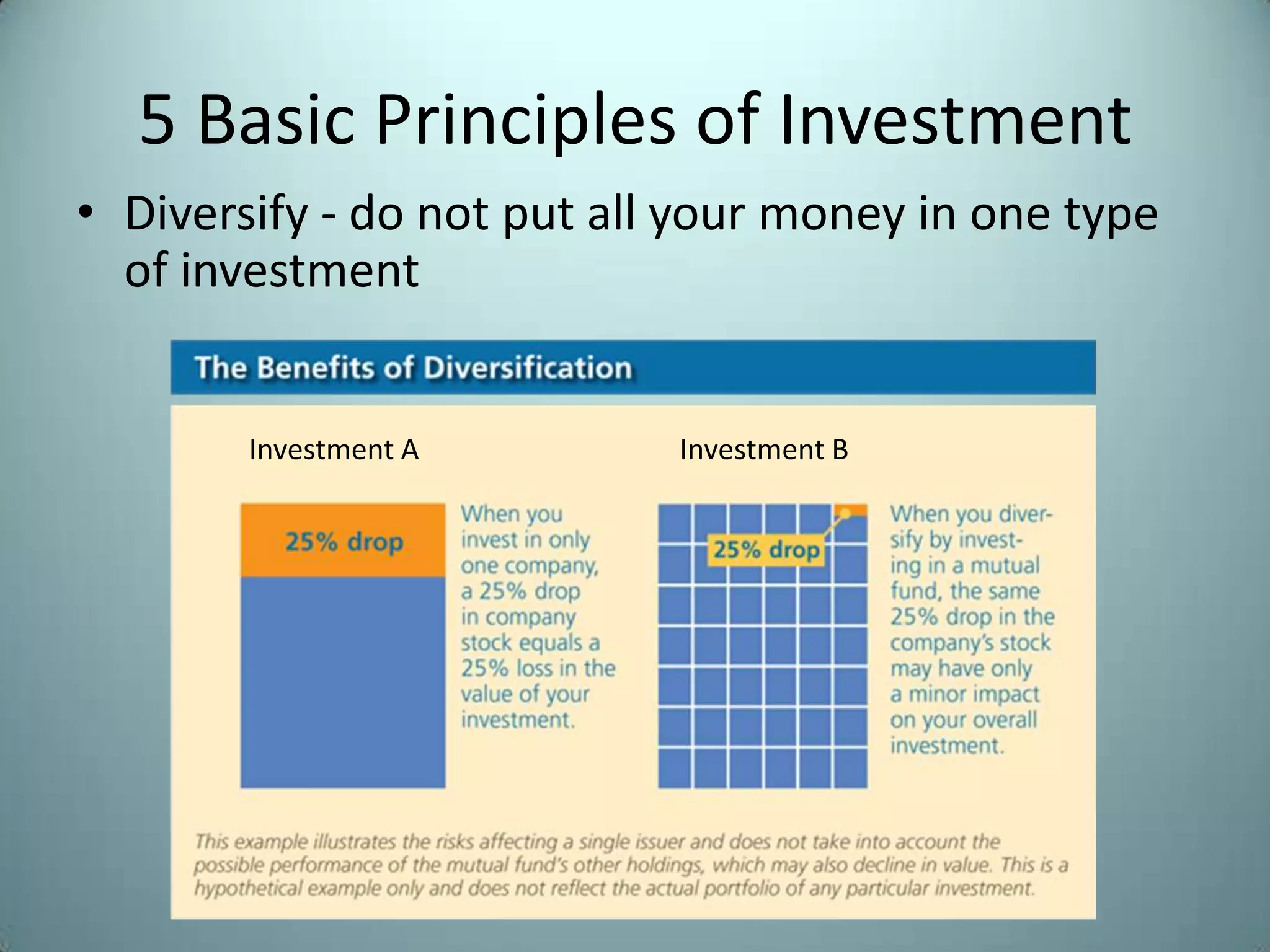

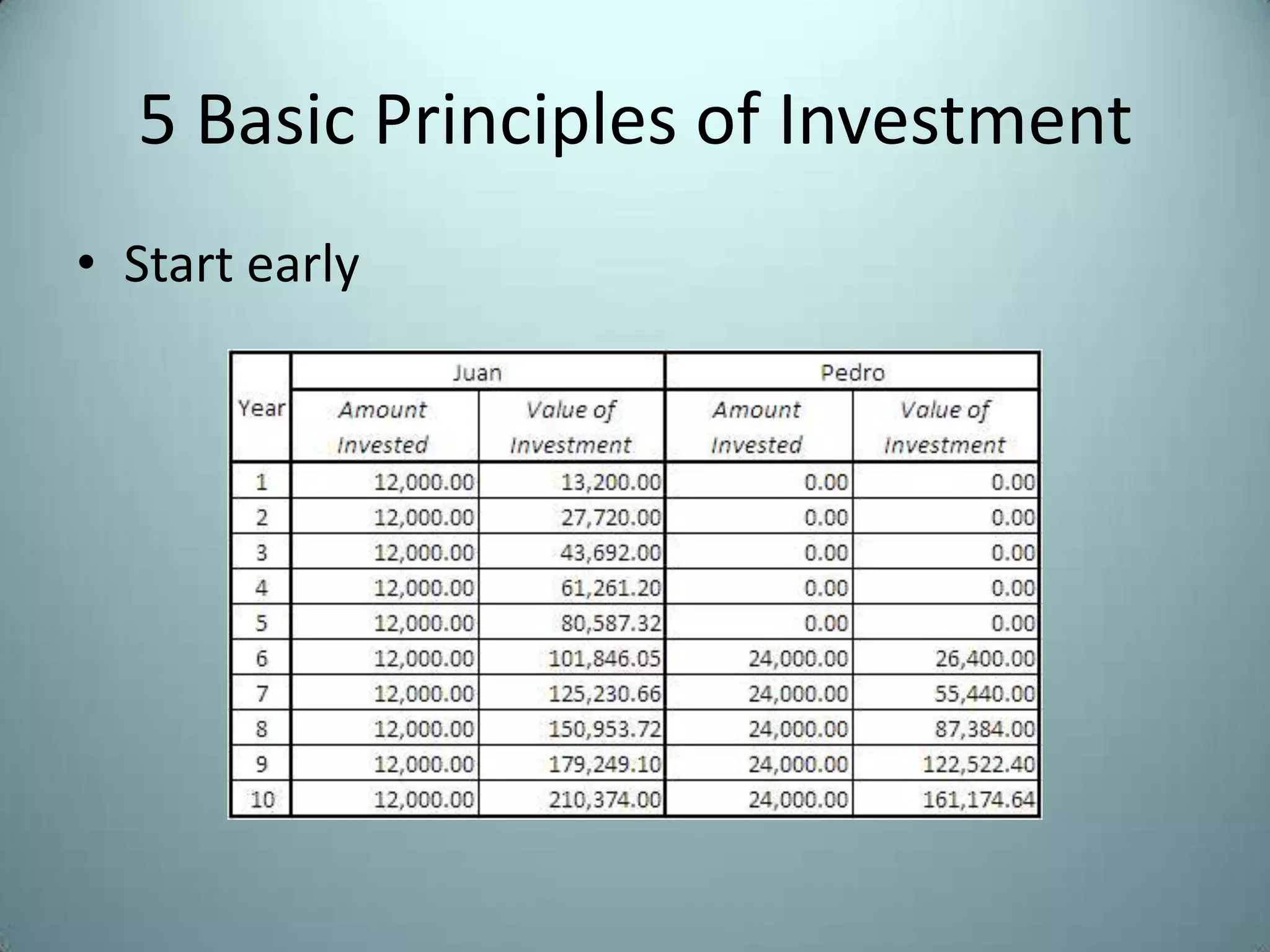

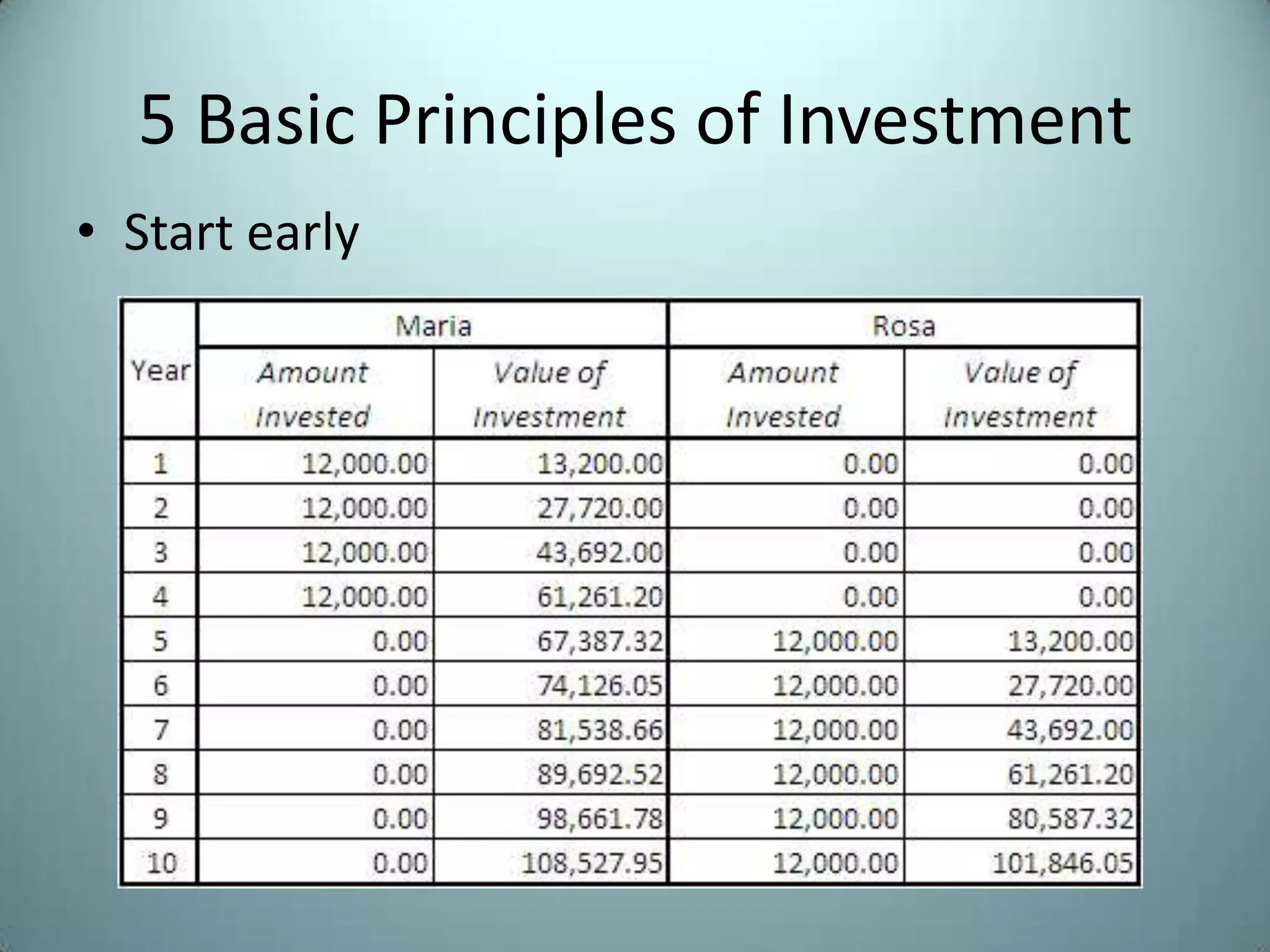

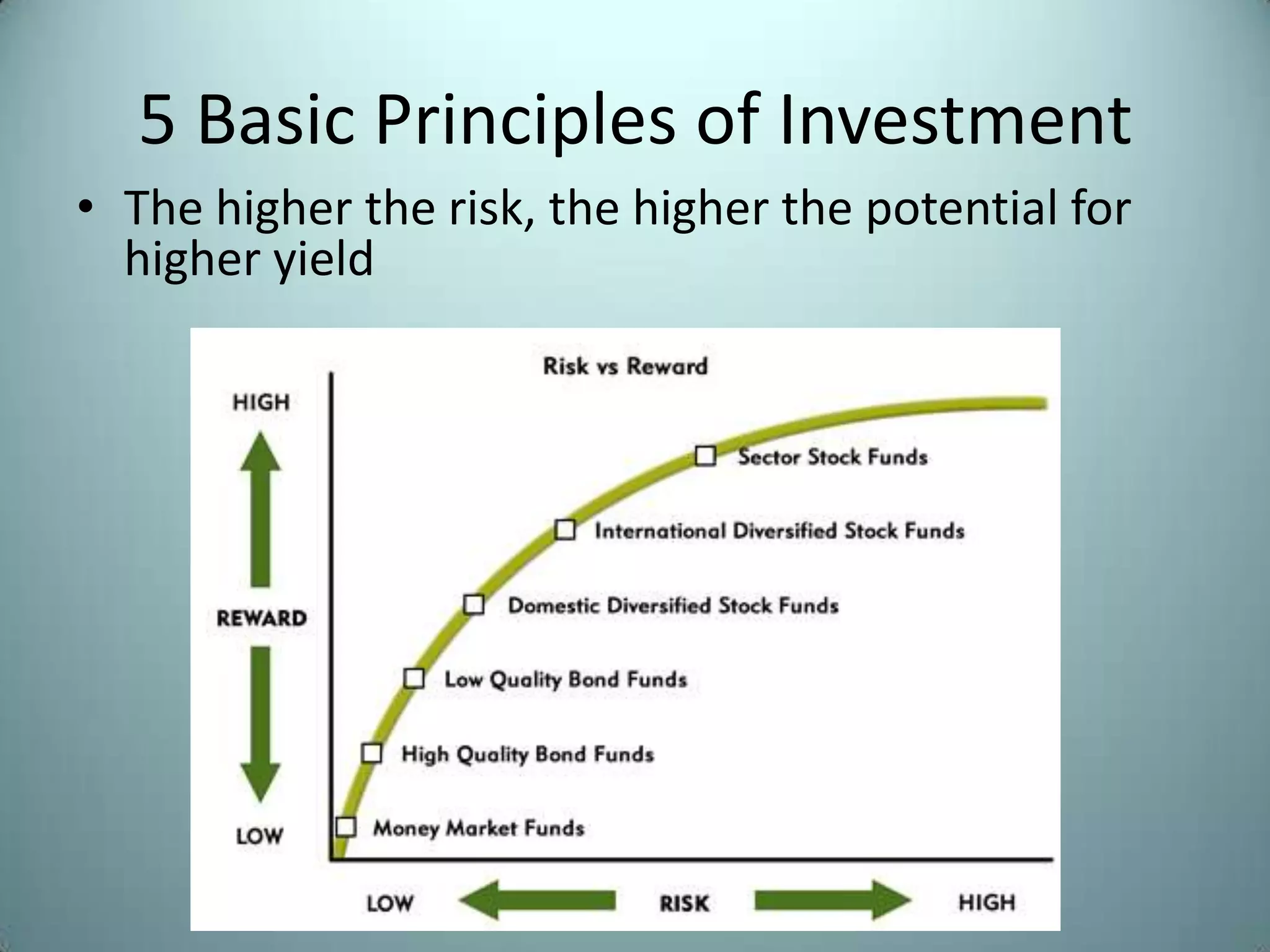

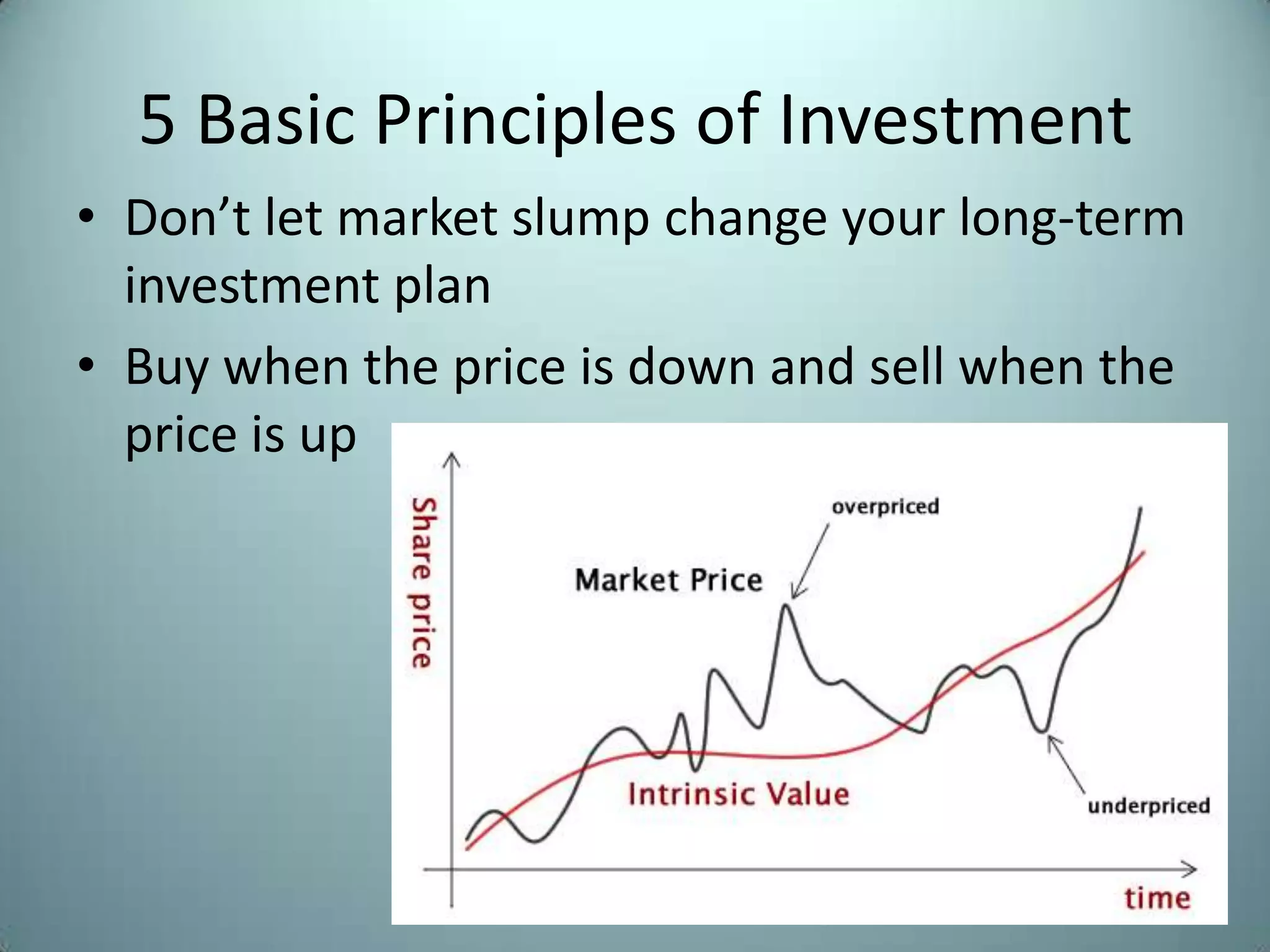

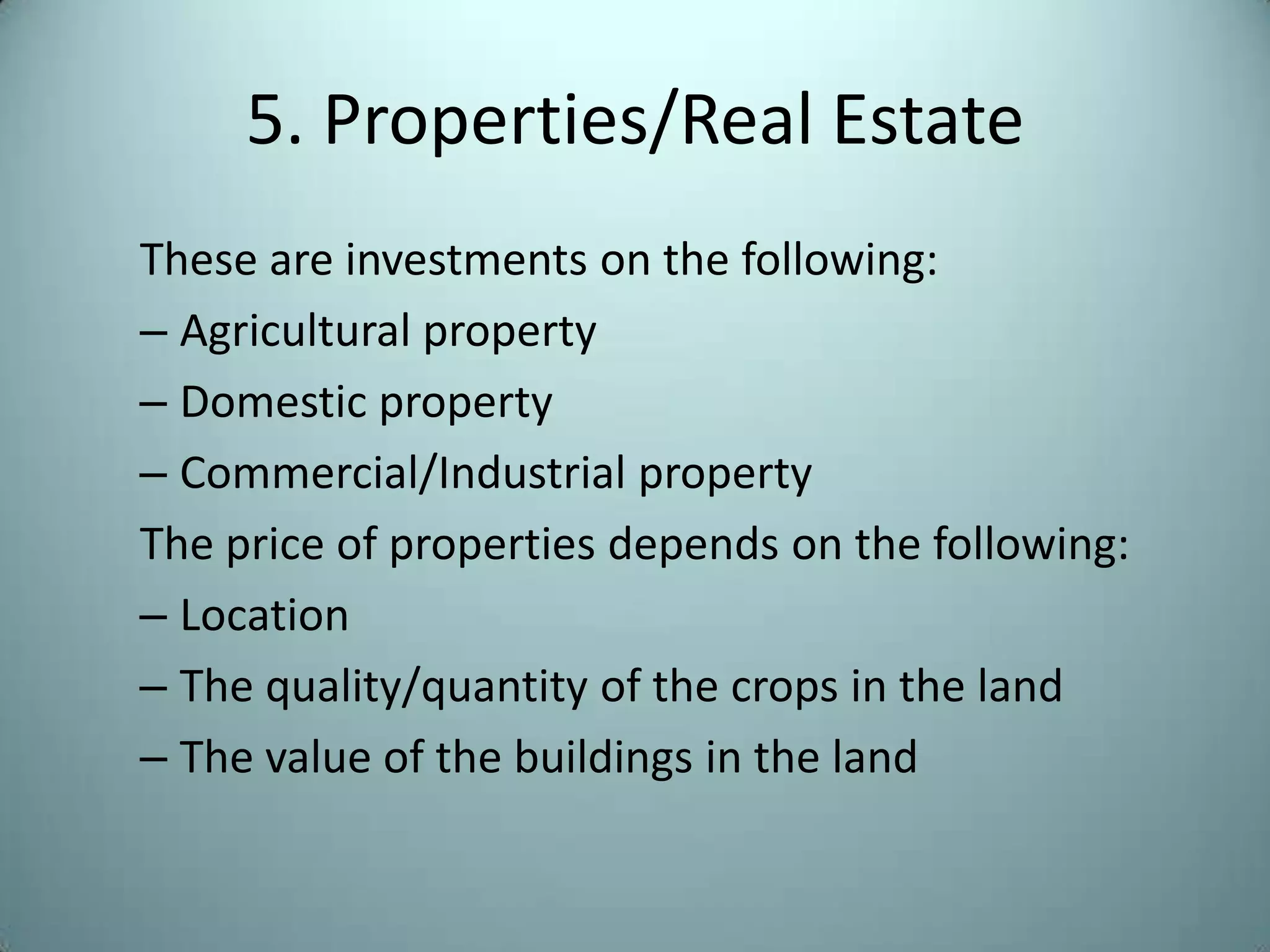

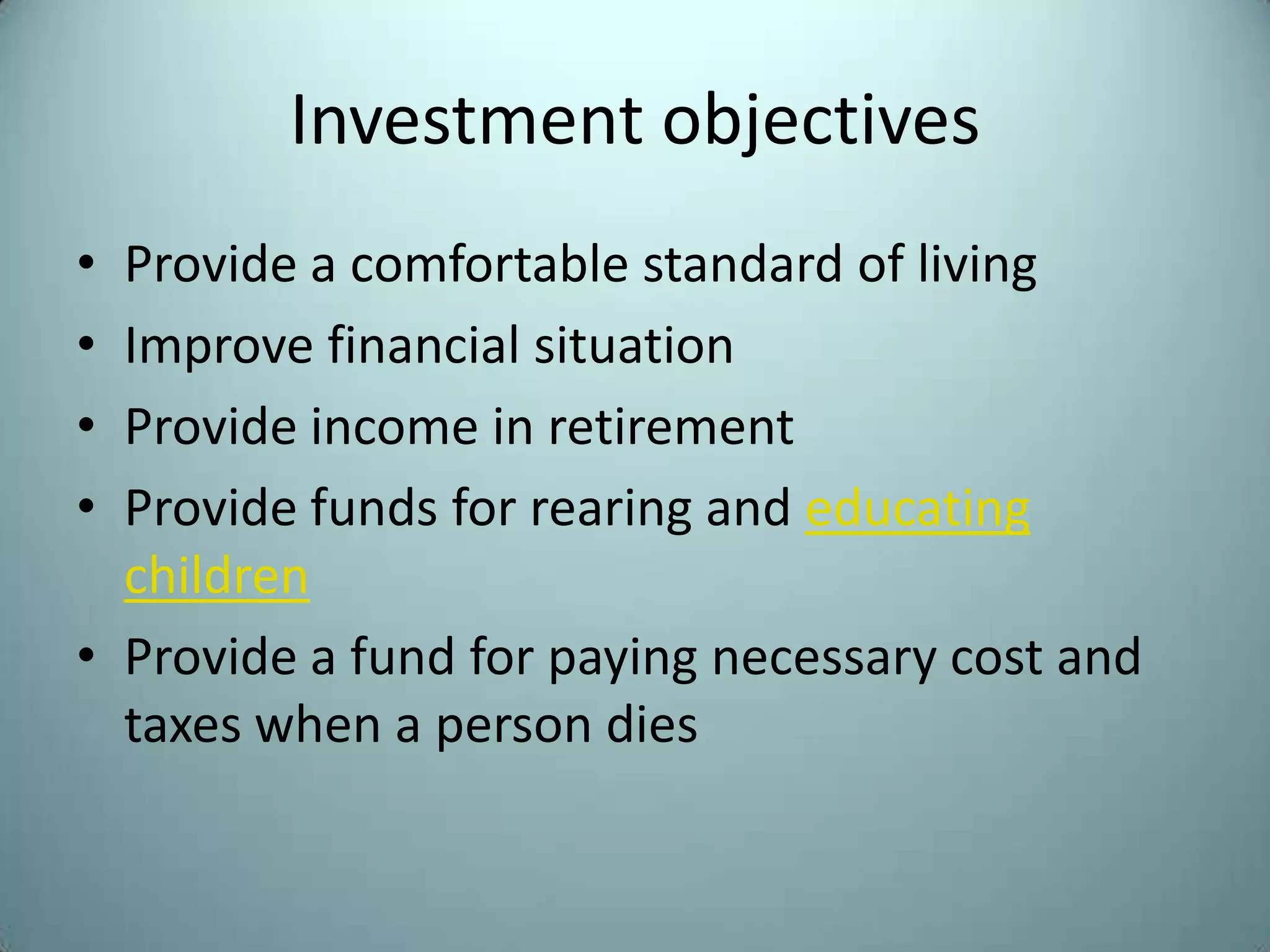

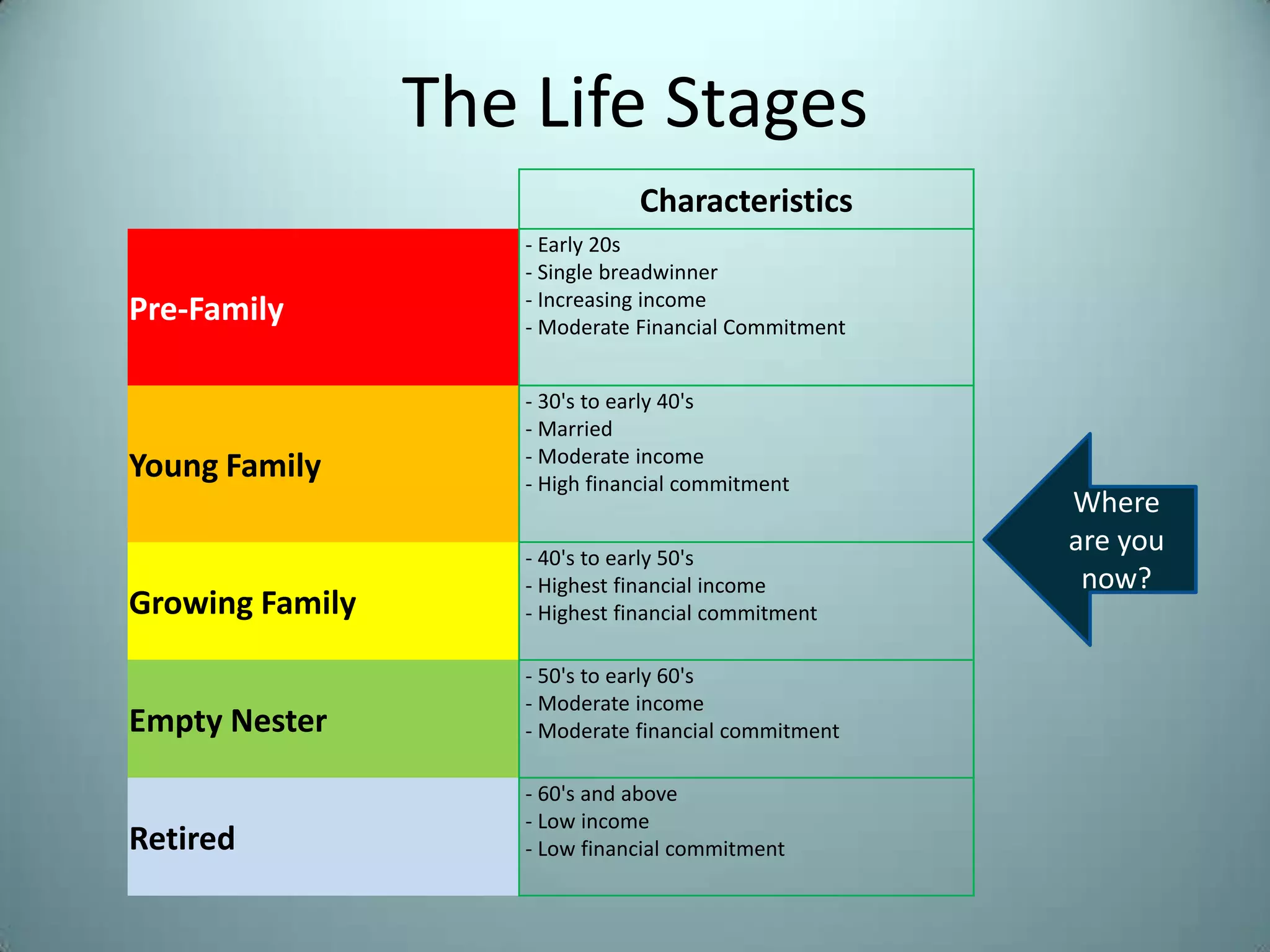

This document discusses the fundamentals of investment, including definitions, principles, asset types, and considerations. It defines investment as a monetary asset purchased to generate future income or appreciation. The 5 basic principles are to diversify investments, start early to benefit from compound interest, understand that higher risk means higher potential returns, maintain investments during market slumps, and buy low and sell high. Main asset types include fixed income securities, shares, unit investment trusts, mutual funds, and property. Key considerations for investment include objectives, life stage, funds availability, risk tolerance, investment horizon, taxes, performance, and diversification. It also introduces variable universal life insurance as a new alternative investment option.