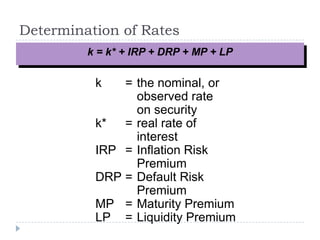

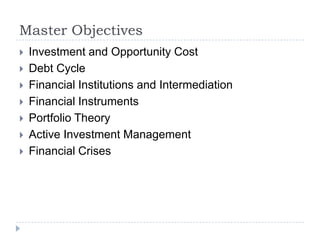

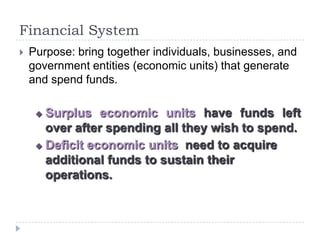

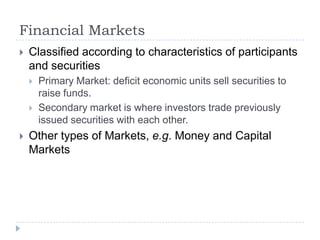

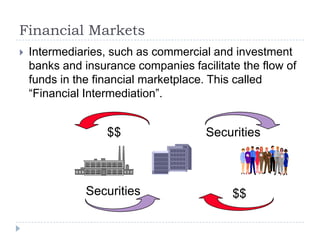

This document provides an overview of investments and financial markets. It discusses key concepts like financial intermediation, different types of financial markets and securities, interest rates, and the relationship between risk and return. The purpose of the financial system is to connect individuals and entities with surplus funds to those that need funds. Financial intermediaries like banks facilitate the flow of funds between these groups.

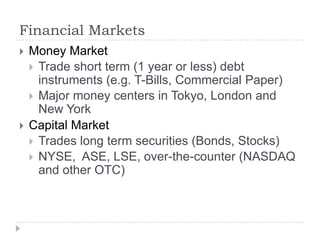

![Treasury Bills

T-Bills are short term securities issued by the

Federal Government [USA].

After initial sale, there is an active secondary market.

They are bought at discount and at maturity face

value is paid.](https://image.slidesharecdn.com/burkeinvestmentslecture1-130405015022-phpapp02/85/Burke-investments-lecture_1-10-320.jpg)

![Common Stock

Shareholders own a portion of the company and

have right to vote on major decisions

Return on investment: dividends [if paid by company]

and capital gain, if any.](https://image.slidesharecdn.com/burkeinvestmentslecture1-130405015022-phpapp02/85/Burke-investments-lecture_1-16-320.jpg)